Biden Gives Up for Reelection but Policy Proposals Will Remain Key, Experts Say

| By Amaya Uriarte | 0 Comentarios

The day starts digesting the big news of the weekend, Joe Biden’s withdrawal as a candidate for the U.S. presidential election in November, with the dollar slightly falling and Treasury bonds rising, while European stocks recover from their worst week of the year. From a political perspective, experts point out that the upcoming Democratic Party convention in August will be decisive in determining who will replace Biden. From a market and economic policy perspective, they suggest that few changes are expected.

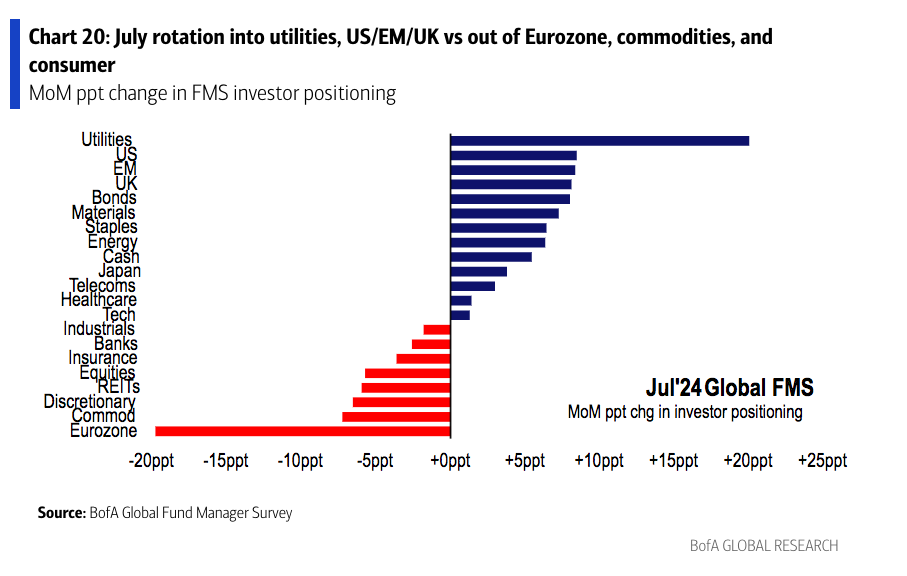

In the opinion of Matt Britzman, Senior Equity Analyst at Hargreaves Lansdown, operators around the world will try to figure out what Biden’s withdrawal from the U.S. election campaign means for the markets. “U.S. stock futures will open higher, but with just three months to go before the election, this is uncharted territory, and markets usually don’t like uncertainty. Besides the general nervousness, investors might expect the sectors that have received a boost from the so-called Trump trade to pull back a bit now that he faces an unknown opponent. This includes sectors like energy, banks, and bitcoin, as they are expected to receive support from a Trump administration. A prudent pullback wouldn’t be a surprise, but Trump remains a clear favorite, so don’t expect significant changes for now,” says Britzman.

Currency markets, for example, have ignored the political events in the U.S., and the news of Joe Biden’s withdrawal from the presidential race and his support for Vice President Kamala Harris is having little impact on the market in the early hours of the Asian session. According to Eurizon, currency markets are usually calm in the summer months, and this week there will be few important data releases or political meetings to stir them. Attention will be on the dynamics of intervention and stop loss in the Japanese yen, as well as any details that may arise regarding monetary policy in a hypothetical second Trump term. In terms of data, Wednesday will bring the July PMI business activity index, an updated reading of the main economic trends (especially the apparent slowdown of the U.S. economy). U.S. GDP growth in the second quarter (Thursday) and PCE inflation (Friday) will complete the week.

Candidate Question

Gilles Moëc, Chief Economist at AXA IM, argues that it doesn’t matter who the candidate is because the problems are the same. “Beyond the name of Biden’s replacement, the key issue for us is how different the rival’s economic platform will be from Biden’s. With limited time to produce a new agenda and, in any case, a decent level of consensus throughout the Democratic Party on economic issues, we wouldn’t expect many changes. We note that Kamala Harris herself and most of the natural alternatives are closely associated with the Biden administration or the mainstream Democrats,” he explains.

In the opinion of Paul Donovan, Chief Economist at UBS GWM, “politicians matter less for economies than they think.” Instead, he believes markets react if the probabilities of policies change. “What matters is who the Democrats choose as their candidate; if that choice significantly changes policy proposals; if the probabilities for the presidential and congressional elections change. It will take time to get information on any of these points,” says Donovan.

For Marisa Calderon, President and CEO of Prosperity Now, so far, Biden’s economic policies have not been bad. “President Biden came into office at a time of deep economic insecurity for many Americans. The pandemic had caused incalculable damage to the nation’s labor market and created the threat of greater systemic inequality and a potentially larger wealth gap between different communities. However, his track record to date tells a different story. With the highest job growth ever seen in the United States, his policies have helped the country get back to work. We are inspired by his track record of successes in the White House, and we look forward to continuing to work with his administration for the rest of his term to drive sound and equitable economic policy that works for all Americans,” says Calderon.

Political Proposals

In this regard, what policies are relevant? In Moëc’s opinion, regarding international trade, any Democratic candidate would likely pursue a fairly strong “anti-China” policy anyway. “Biden did not repeal the special tariffs imposed by Trump, and with public opinion harboring negative feelings about China—the Pew Center polls suggest that more than 80% of U.S. citizens have a negative view of the country—rolling back the Chinese export machine has become uncontroversial in Washington,” he says.

According to him, “the key difference with Trump would still be the treatment of imports from other suppliers, which in the event of a Democratic victory in November would spare European exporters from a smaller but still painful version of the trade war against Beijing.”

He also argues that any Democratic candidate would likely maintain Biden’s focus on industrial policy, with a continuation of the CHIPS Act and the IRA, with sustained support for the U.S. transition to net zero. “In fiscal matters, much of the savings any Democratic candidate would consider would come from allowing some of the tax cuts implemented by Trump in 2017 to expire, at least those that benefit the highest-paid individuals,” he adds.

Another relevant policy is immigration. According to Moëc, “any Democratic candidate would probably commit to reducing entry flows, but in any case, the impact on the working-age population dynamics would be less than if Trump’s hardline agenda prevails.”

The Chief Economist of AXA IM believes the situation remains fluid, but his thesis is that even with Joe Biden out of the race, it is Donald Trump who would still present the agenda with the most tangible impact on the markets, given its inflationary aspects (brutal repression of immigration, widespread increases in customs tariffs, accommodative fiscal policy). “In any case, the likelihood of any Democratic president also enjoying a majority in Congress is small, which would reduce their ability to direct the economy. The ‘Trump Trade,’ which has recently supported the dollar and put a floor under long-term interest rates despite rate cut expectations, is likely to remain active,” he concludes.

On the other hand, analysts at Edmond de Rothschild AM highlight that markets were buoyed by the Trump-Vance campaign’s promises to provide budgetary and regulatory aid to the U.S. economy. “However, the current economic conditions are very different from those that existed when Donald Trump came to the presidency in 2016. Interest rates and the public deficit are now much higher, so the winning candidate will have less room to maneuver. The economy rebounded in 2017 after slowing down in 2015-16, but the next president will face a slowdown,” they explain.

Focusing on the implications of a second Trump presidency, Elliot Hentov, Head of Macro Policy Research at SSGA, highlights that it would be logical to expect a considerable fiscal expansion in the event of a Republican sweep, with a more modest fiscal boost in the case of a divided Congress. In his opinion, there are three relevant focuses: energy, trade, and security.

“In trade, almost certainly there would be tariff increases, with a disproportionate share being imposed on Chinese imports, but other countries would also be affected. In energy, Trump is likely to amplify U.S. efforts to increase energy exports, which could increase global supply and help contain prices, benefiting net energy importers. And in foreign/security policy, a Trump presidency would likely continue extracting greater security commitments from U.S. allies, notably in Europe,” adds Hentov.