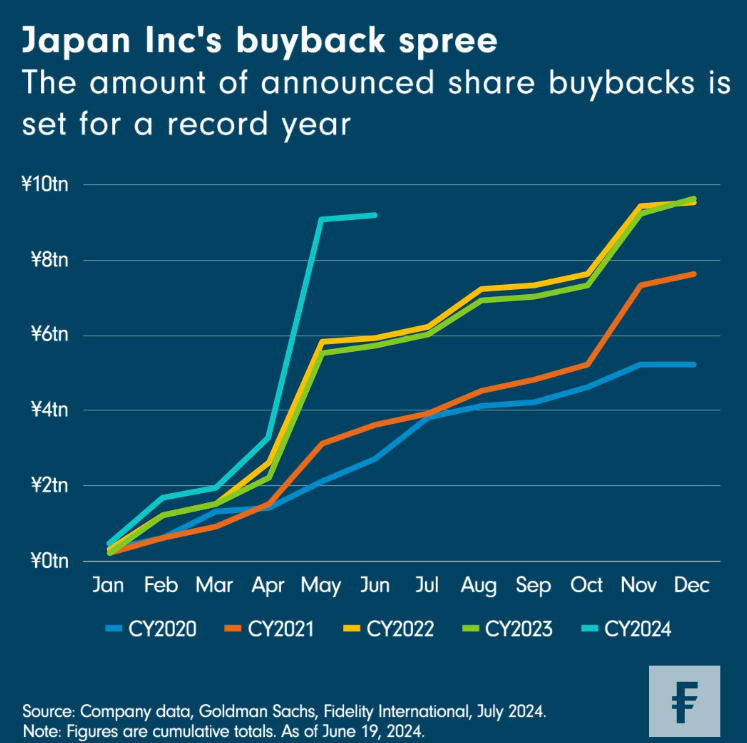

Las reformas del gobierno corporativo de Japón siguen dando sus frutos, y las recompras de acciones anunciadas por las empresas japonesas van camino de batir un récord anual. Como muestra el gráfico, el importe acumulado ha alcanzado los 9,3 billones de yenes (57.500 millones de dólares) en 2024, frente a los 9,6 billones de yenes de todo 2023, el mayor total anual registrado.

Y hay más buenas noticias para los accionistas. El número de empresas que anunciaron un aumento del reparto de dividendos se disparó a algo más de mil en los cinco primeros meses de este año, frente a las cerca de 800 del mismo periodo de 2023. A finales de mayo, el 72% de las empresas cotizadas en la sección principal de la Bolsa de Tokio (TSE) habían hecho públicos sus planes para optimizar la gestión del capital, deshacer las participaciones cruzadas o reforzar la rentabilidad para los accionistas.

Se trata de un progreso notable para Japan Inc, que se había forjado una reputación de acaparar efectivo en lugar de compartir los beneficios con los inversores. Y es evidente que aún hay margen de mejora. En el Topix, el 59% de las empresas no financieras tienen saldos netos de caja positivos, frente al 16% de las empresas similares del S&P 500 y el 19% del Stoxx 600 europeo[1]. Con la vuelta de una inflación suave, los beneficios empresariales tienen unas perspectivas prometedoras, lo que apoyará a las empresas que quieran recompensar a los inversores. También se espera que el último plan de la TSE para renovar el Topix empuje a hacer más a las empresas más pequeñas en particular.

La reforma estructural ha sido uno de los principales motores del repunte bursátil en Japón. Pero no podemos ignorar la otra cara de la historia. Una excesiva debilidad del yen podría hacer subir la inflación importada, perjudicando el crecimiento de los salarios reales y el consumo. Y la renta variable japonesa se enfrenta a una competencia cada vez mayor dentro de la región. El sólido crecimiento de la India está atrayendo a los inversores extranjeros y China ha puesto en marcha reformas empresariales similares a las de Japón en un esfuerzo por impulsar las valoraciones de las acciones. Pero si la iniciativa japonesa sigue dando resultados en términos de eficiencia del capital y rentabilidad, su nueva cultura favorable a los accionistas, junto con un cambio hacia una inflación moderada, debería impulsar la confianza a largo plazo en la renta variable japonesa.

Tribuna de Jeremy Osborne, director de renta variable japonesa de Fidelity International.

[1] Según Goldman Sachs.

Important Information

This document is for Investment Professionals only and should not be relied on by private investors.

This document is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior permission of Fidelity.

This document does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, or an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties.

This communication is not directed at, and must not be acted on by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. In China, Fidelity China refers to FIL Fund Management (China) Company Limited. Investment involves risks. Business separation mechanism is conducted between Fidelity China and the shareholders. The shareholders do not directly participate in investment and operation of fund property. Past performance is not a reliable indicator of future results, nor the guarantee for the performance of the portfolio managed by Fidelity China. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers.

Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Investors should also note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this documentation is gathered by Fidelity for its use as an investment manager and may have already been acted upon for its own purposes. This material was created by Fidelity International.

Past performance is not a reliable indicator of future results.

This document may contain materials from third-parties which are supplied by companies that are not affiliated with any Fidelity entity (Third-Party Content). Fidelity has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content.

Fidelity International refers to the group of companies which form the global investment management organization that provides products and services in designated jurisdictions outside of North America Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances.