Las complicadas condiciones económicas están preparando el terreno para que sea interesante el año que está por delante. A medida que se desacelera la economía y el ciclo envejece, es probable que las empresas afronten obstáculos financieros. Aunque las empresas están empezando el año con balances sólidos, ¿pueden los emisores de high yield capear una recesión?

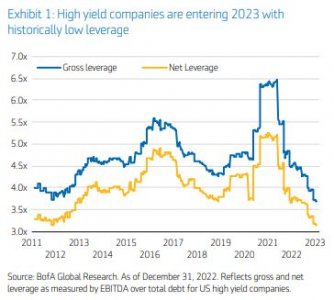

Aunque la precaución está garantizada, pensamos que muchas compañías high yield están bien posicionadas para navegar una desaceleración, dado que el punto de partida es de fundamentales sólidos. En los últimos años, las compañías high yield fueron diligentes en la mejora de sus balances, dando como resultado los niveles de apalancamiento más bajos en más de una década (gráfico 1) y las ratios de cobertura de interés más elevadas de la historia reciente. Esta mejora de los fundamentales también se evidencia por el momento de mejora de ratings actual, en el que las estrellas emergentes están superando a los ángeles caídos. Además, la composición por calidad del crédito ha mejorado en el mercado, habiendo ahora más de un 50% de BBs y alrededor de un 10% de CCCs o inferior. Por dar contexto, antes de la gran crisis financiera, el mercado de high yield tenía más de un 20% de CCCs e inferior.

A medida que entramos en 2023, el entorno macroeconómico global se mantiene extremadamente incierto. Unos tipos de interés más altos y potencialmente al alza, inflación persistente, un riesgo geopolítico elevado, unos mercados de la energía tensos y los efectos de la incierta reapertura de China son solo algunas de las principales preocupaciones.

Estos riesgos bien pueden llevar a una mayor desaceleración de EE.UU. y las economías desarrolladas y crear obstáculos financieros a muchas compañías de high yield. Con el riesgo de una potencial recesión apareciendo en el horizonte, es probable que las compañías high yield afronten una demanda ralentizada del consumidor y recortes en las inversiones corporativas—y ambos podrían llevar a una caída en los ingresos. Es posible que se contraigan los márgenes al estar los ingresos bajo presión en este contexto de desaceleración económica. Además, es probable que las ratios de cobertura por tipo de interés caigan, al ajustarse los rendimientos por cupón al alza e incrementarse los costes por intereses, especialmente para los emisores de bonos flotantes. Como resultado, creemos que la mejora de los fundamentales ya ha tocado techo para muchas compañías de high yield.

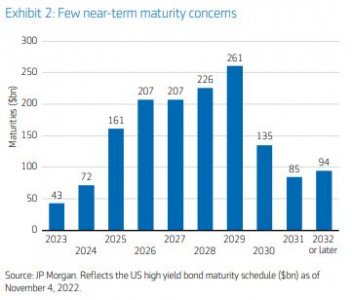

A pesar de la nublada previsión macro, creemos que muchas compañías están bien posicionadas para navegar una desaceleración. En general, los balances están en buena forma y las métricas de crédito no están ajustadas para muchas empresas. Adicionalmente, no existe un muro de vencimientos inmediato que suponga un desafío financiero para las empresas (gráfico 2) y los niveles de liquidez en general son buenos. Durante el año que está por delante, esperamos que el mercado del high yield presentará oportunidades convincentes para invertir en empresas con un perfil de rentabilidad riesgo atractivo.

Tribuna de Kevin Bakker, CFA, y Ben Miller, CFA, co responsables de high yield estadounidense en Aegon Asset Management.

Lea más claves de los expertos en Aegon Asset Management.

Unless otherwise noted, the information in this document has been derived from sources believed to be accurate at the time of publication. This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies.

References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains «forward-looking statements» which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

Investments in high yield bonds may be subject to greater volatility than fixed income alternatives, including loss of principal and interest, as a result of the higher likelihood of default. The value of these securities may also decline when interest rates increase. The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only.

©2023 Aegon Asset Management or its affiliates. All rights reserved.

Adtrax: 5425390.1GBL