“Resiliencia puesta a prueba” ha sido el título con el que State Street Global Advisors (SSGA) ha ofrecido una actualización de sus previsiones macro para 2024 a inversores españoles en un evento celebrado recientemente en Madrid. En él, Desmond Lawrence, estratega sénior de inversión en State Street Global Advisors, ofreció una visión panorámica sobre las distintas clases de activos y aportó tres claves sobre el posicionamiento de la firma en renta fija y renta variable para este año.

Lawrence comenzó hablando de la innegable ralentización del crecimiento económico mundial si se analizan las cifras dejando la sorprendente resistencia de EE.UU. a un lado. Para reforzar su argumento, el experto se fijó en la ralentización de datos macro como el comercio global o la producción industrial, que ha entrado en territorio negativo. Al mismo tiempo, el estratega constató el aumento de la presión sobre los costes, resultado del agresivo ciclo de subidas de tipos de interés emprendido por la Reserva Federal, pero también por otros bancos centrales de referencia, como el BCE.

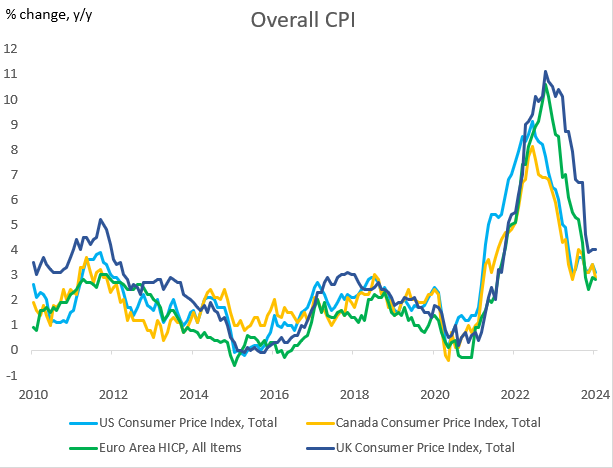

La visión de la firma es que un soft landing parece viable en EE.UU., pero el experto apunta que la economía real aún no ha recogido plenamente el impacto de la fuerte subida de tipos, como se puede observar en la evolución de la inflación. En la firma constatan que la trayectoria es descendente, pero las lecturas de las distintas regiones desarrolladas revelan una caída a distintas velocidades, en la que China juega un papel muy importante al estar actuando como exportador de deflación.

Japón supone la única excepción en el mundo desarrollado, al haber entrado en una dinámica positiva de inflación moderadamente al alza que lleva a Lawrence a anunciar lo nunca visto en las últimas décadas: “El Banco de Japón buscará una subida en los tipos de interés en los próximos meses”.

Como reflexión, el estratega observa que “los bancos centrales han conseguido mucho de su mandato de control de la inflación en los últimos meses, pero sería ingenuo por parte de los inversores creer que los bancos centrales reaccionan a un solo dato. Sin embargo, los mercados lo están haciendo”. Estas elevadas expectativas son las que están provocando reacciones como la corrección vista en las primeras semanas de enero, pero para el estratega la situación no se detiene aquí: “La caída de la inflación se está empezando a filtrar hacia la economía, pero prevalecerán los desafíos”.

Fuente: Bloomberg Finance L.P., datos a 27 de febrero de 2024

Su consejo para lidiar con este entorno es buscar un posicionamiento en duración. Es más, Lawrence constata que actualmente la curva de distintos emisores gubernamentales está mostrando una alta correlación en el tramo a diez años, por lo que ve oportunidades de inversión en deuda soberana, particularmente en los treasuries. “Dadas las rentabilidades actuales, la ralentización del crecimiento y la desinflación continuada, la renta fija se encuentra entre las clases de activos mejor posicionadas desde un punto de vista de rentabilidad/riesgo”, concluye el experto. Éste anticipa más valor en la deuda soberana que en el crédito, y advierte a los inversores que deberán esperar en los últimos rendimientos más bajos en la parte corta de la curva, curvas más inclinadas y que los diferenciales se ensanchen, de aquí en adelante.

Otra de las razones para apostar por un posicionamiento en duración este año tiene que ver con los riesgos geopolíticos, añade el estratega: “Este año vamos a tener una ralentización de la economía y un aumento de los riesgos, con el incremento de los conflictos internacionales, que se traducirá en un repunte de la volatilidad en todas las clases de activos”. Esto llevará a los inversores a emprender un vuelo hacia la calidad, como constatan en la firma al analizar los flujos de inversión hacia treasuries americanos. Lawrence añadió que en el nuevo escenario geopolítico la alineación de intereses será más crucial si cabe, dado que muchos países buscarán forjar relaciones comerciales con EE.UU. para evitar conflictos en otras partes, lo que en su opinión también es positivo para el posicionamiento en duración.

SSGA muestra una postura más cauta con la inversión en renta variable. El estratega destaca la relación que guardan los PMI frente al crecimiento del BPA, que debería ser el principal impulsor de los retornos en la renta variable. “La restricción del crédito y una actividad en torno a la neutralidad no dan luz verde a los beneficios, pero las condiciones están mejorando”, indica Lawrence, en referencia por ejemplo a que no se han visto afectadas por el endurecimiento de los costes de financiación ni tantas compañías ni tantos consumidores como se esperaba: las primeras, por haber refinanciado sus vencimientos de deuda y haberlos extendido; los segundos, por haber suscrito hipotecas a tipo fijo. “El mecanismo de transmisión de la política monetaria no ha funcionado”, resume el experto.

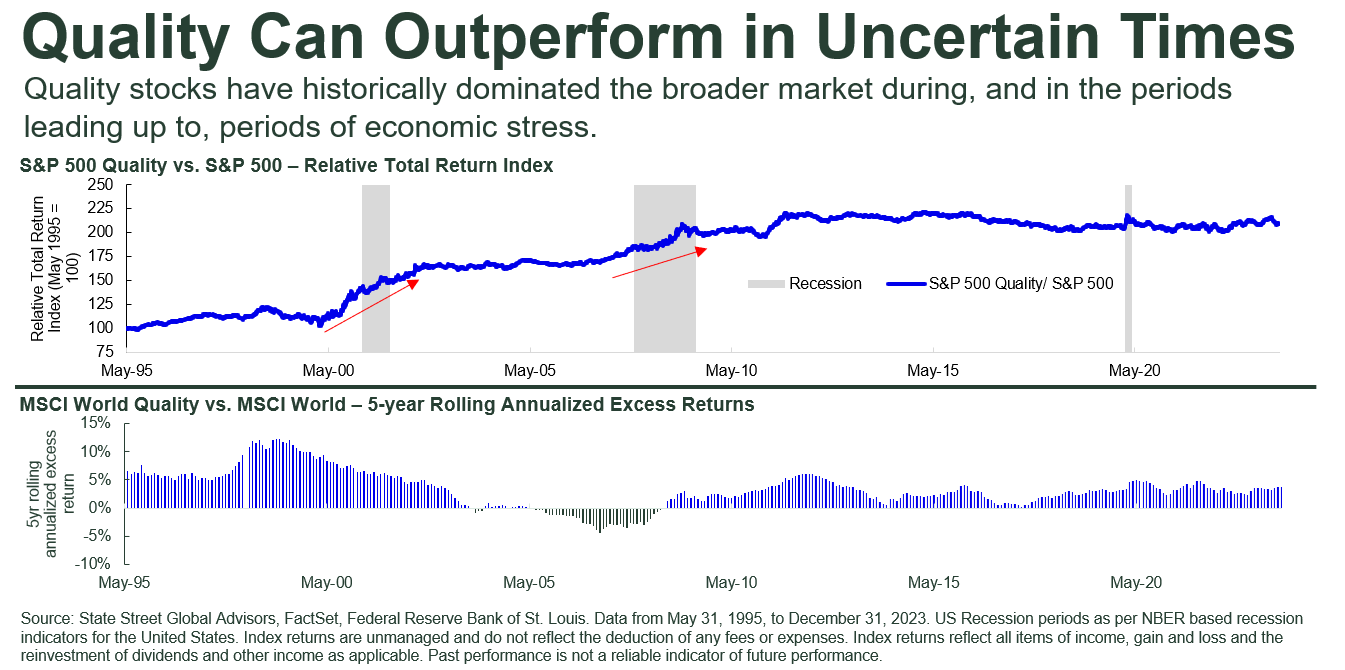

Debido a esta visión, el experto explica que la firma prefiere posicionarse actualmente en grandes capitalizadas con beneficios resistentes, por lo que prefieren enfocarse en compañías de calidad, particularmente en EE.UU.

Finalmente, Lawrence comentó que “los mercados emergentes siguen siendo más vulnerables, dado el contexto mundial”. Sin embargo, en el lado de la renta fija, sí ven oportunidades en divisa fuerte, «que preferimos ligeramente frente a la moneda local, dada nuestra opinión sobre los tipos y rendimientos estadounidenses». En cuanto a la renta variable de los mercados emergentes, la firma ve ventajas en la exposición más amplia que ofrece la pequeña capitalización de los mercados emergentes y también recomienda adoptar un enfoque activo con respecto a China y seleccionar oportunidades en determinados países emergentes, excluida China.

Lea aquí el informe de SSGA Global Market Outlook 2024.

Marketing Communication.

Information Classification: General Access.

For professional clients use only.

For Investors in Spain: State Street Global Advisors SPDR ETFs Europe I and II plc have been authorised for public distribution in Spain and are registered with the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores) under no.1244 and no.1242. Before investing, investors may obtain a copy of the Prospectus and Key Investor Information Documents, the Marketing Memoranda, the fund rules or instruments of incorporation as well as the annual and semi-annual reports of State Street Global Advisors SPDR ETFs Europe I and II plc from Cecabank, S.A. Alcalá 27, 28014 Madrid (Spain) who is the Spanish Representative, Paying Agent and distributor in Spain or at spdrs.com. The authorised Spanish distributor of State Street Global Advisors SPDR ETFs is available on the website of the Securities Market Commission (Comisión Nacional del Mercado de Valores).

Important Information

This document has been issued by State Street Global Advisors Limited (“SSGA”). Authorized and regulated by the Financial Conduct Authority, Registered No.2509928. VAT No. 5776591 81. Registered office: 20 Churchill Place, Canary Wharf, London, E14 5HJ. Telephone: 020 3395 6000. Facsimile: 020 3395 6350 Web: ssga.com.

SPDR ETFs is the exchange traded funds (“ETF”) platform of State Street Global Advisors and is comprised of funds that have been authorised by Central Bank of Ireland as open-ended UCITS investment companies.

This document has been issued by State Street Global Advisors Europe Limited (“SSGAEL”), regulated by the Central Bank of Ireland. Registered office address 78 Sir John Rogerson’s Quay, Dublin 2. Registered number 49934. T: +353 (0)1 776 3000. Fax: +353 (0)1 776 3300. Web: www.ssga.com

State Street Global Advisors SPDR ETFs Europe I & II plc issue SPDR ETFs, and is an open-ended investment company with variable capital having segregated liability between its sub-funds. The Company is organised as an Undertaking for Collective Investments in Transferable Securities (UCITS) under the laws of Ireland and authorised as a UCITS by the Central Bank of Ireland.

The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional advisor.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

ETFs trade like stocks, are subject to investment risk and will fluctuate in market value. The investment return and principal value of an investment will fluctuate in value, so that when shares are sold or redeemed, they may be worth more or less than when they were purchased. Although shares may be bought or sold on an exchange through any brokerage account, shares are not individually redeemable from the fund. Investors may acquire shares and tender them for redemption through the fund in large aggregations known as “creation units.” Please see the fund’s prospectus for more details.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

The views expressed in this material are the views of SPDR EMEA Strategy & Research through the period ending 30 September 2023 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

The Fund/share class may use financial derivatives instruments for currency hedging and to manage the portfolio efficiently. The Fund may purchase securities that are not denominated in the share class currency. Hedging should mitigate the impact of exchange rate fluctuations however hedges are sometimes subject to imperfect matching which could generate losses.

Investing in foreign domiciled securities may involve risk of capital loss from unfavorable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Investments in emerging or developing markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that are generally less diverse and mature and to political systems which have less stability than those of more developed countries.

Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

The returns on a portfolio of securities which exclude companies that do not meet the portfolio’s specified

ESG criteria may trail the returns on a portfolio of securities which include such companies. A portfolio’s

ESG criteria may result in the portfolio investing in industry sectors or securities which underperform the

market as a whole.

Assets may be considered «»safe havens»» based on investor perception that an asset’s value will hold steady or climb even as the value of other investments drops during times of economic stress. Perceived safe-haven assets are not guaranteed to maintain value at any time.

Standard & Poor’s, S&P and SPDR are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss Regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

Companies with large market capitalizations go in and out of favor based on market and economic conditions. Larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the value of the security may not rise as much as companies with smaller market capitalizations

Please refer to the Fund’s latest Key Information Document (KID)/Key Investor Information Document (KIID) and Prospectus before making any final investment decision. The latest English version of the prospectus and the KID/KIID can be found at www.ssga.com. A summary of investor rights can be found here: https://www.ssga.com/library-content/products/fund-docs/summary-of-investor-rights/ssga-spdr-investors-rights-summary.pdf

Note that the Management Company may decide to terminate the arrangements made for marketing and proceed with de-notification in compliance with Article 93a of Directive 2009/65/EC

© 2024 State Street Corporation.

All Rights Reserved.

Expiry: 31/05/2024