Después de veinticinco años de travesía por el desierto, la semana pasada el EURO STOXX 50 se unió al club de los principales índices bursátiles que han alcanzado un nuevo máximo. Algo habitual en el S&P 500, pero que al Nikkei 225 le tomó la friolera de treinta y cuatro años.

Cada vez que el mercado bate récords, la psicología del inversor cobra un protagonismo especial. La euforia por las ganancias conseguidas da paso al miedo a una súbita corrección que borre buena parte de lo acumulado.

Invertir en máximos genera incertidumbre. Sin referencias previas, el terreno se percibe como desconocido y, por tanto, más riesgoso. Nos cuesta poner a trabajar nuevo capital, pero también nos duele quedarnos al margen de la fiesta. La teoría del cerebro reptiliano explica en parte esta aversión: la evolución ha favorecido avances incrementales y una sensibilidad mayor a las pérdidas que a las oportunidades desaprovechadas. De ahí que la tentación de realizar beneficios se intensifique conforme crecen las ganancias.

Por fortuna, contamos con el neocórtex, que nos permite razonar y planificar a largo plazo. Evaluar si es prudente invertir en máximos requiere mirar más allá de la geopolítica, los ciclos económicos y la política monetaria. A largo plazo, las acciones suben si los beneficios por acción lo hacen, y actualmente las ganancias empresariales también se encuentran en niveles récord.

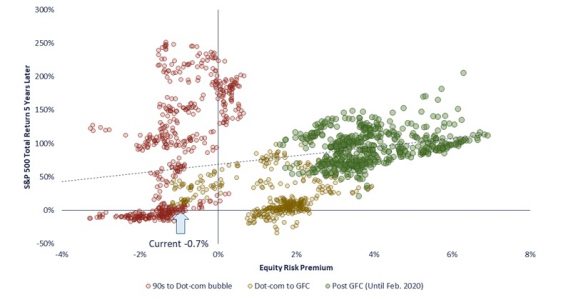

Sin embargo, los precios han crecido más rápido que los beneficios, lo que ha elevado las valoraciones. Si bien el ratio P/E sugiere que el mercado está caro, lo realmente relevante es la comparación con otras alternativas de inversión. La prima de riesgo bursátil —la diferencia entre la rentabilidad por beneficio y el rendimiento del bono del Tesoro— ha caído a niveles no vistos desde la burbuja de las puntocom.

En aquel entonces, la prima de riesgo llegó a situarse por debajo del -3%. Hoy nos acercamos al -1%, tras haber promediado más del 3% en las últimas dos décadas. Esto podría sugerir prudencia en la exposición a renta variable. Sin embargo, las valoraciones son solo una parte de la ecuación. A diferencia de los bonos, los beneficios de las acciones pueden crecer con el tiempo. La prima de riesgo es una métrica estática que asume beneficios constantes, pero valoraciones elevadas pueden estar justificadas por expectativas de crecimiento robustas.

El siguiente gráfico ilustra esta idea: en el eje horizontal, la prima de riesgo del S&P 500 en un momento dado; en el vertical, el retorno del índice cinco años después. La dispersión de los datos sugiere que no existe una correlación clara entre la prima de riesgo y las rentabilidades futuras, lo que refuerza la hipótesis de que los mercados son eficientes y reflejan la información disponible en cada momento.

En este sentido, las valoraciones se asemejan al principio de indeterminación de la mecánica cuántica, según el cual dos variables complementarias no pueden conocerse con precisión simultáneamente. Los inversores pagan primas más altas cuando las perspectivas de crecimiento son elevadas y viceversa. Determinar si la prima pagada es excesiva o insuficiente en relación con las expectativas es imposible ex-ante, pues solo observamos el agregado.

Históricamente, una prima de riesgo elevada (bolsa barata) ha sido, en el mejor de los casos, condición suficiente pero no necesaria para obtener buenos retornos. En cambio, cuando el mercado ha estado caro, los resultados han sido muy dispares, con rentabilidades tanto mediocres como extraordinarias.

Llegados a este punto, ¿está el mercado correctamente valorado? Con una economía estadounidense que sigue alejándose del riesgo de recesión gracias a políticas procrecimiento y con la IA liderando una nueva revolución digital, las actuales valoraciones podrían estar justificadas. Solo el tiempo dirá si la realidad superará las expectativas o si hemos caído en un exceso de optimismo.

Legal Disclaimer Boreal Capital Management LLC, Boreal Capital Securities LLC and Boreal Capital Holdings LLC

Investment advisory products and services, are provided by Boreal Capital Management LLC, an investment adviser regulated by the Securities and Exchange Commission; investment products, trade execution and other services may be offered by Boreal Capital Securities LLC, a member of the FINRA and SIPC. Boreal Capital Management LLC and Boreal Capital Securities LLC are subsidiaries of Boreal Capital Holdings LLC.

Boreal Capital Holdings LLC, Boreal Capital Management LLC and Boreal Capital Securities LLC, their affiliates, and the directors, officers, employees and agents (collectively, “Boreal”) are not permitted to give legal or tax advice. While Boreal can assist clients in the areas of estate and financial planning, only an attorney can draft legal documents and provide legal services and advice. Clients of Boreal should consult with their legal and tax advisors prior to entering into any financial transaction or estate plan. The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but Boreal makes no representation or guarantee as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. The information contained herein does not purport to be a complete analysis of any security, company, or industry involved. This material is not to be construed as an offer to sell or a solicitation of an offer to buy any security. Opinions and information expressed herein are subject to change without notice. Boreal and/or its affiliates may have issued materials that are inconsistent with, or may reach different conclusions than, those represented in this document, and all opinions and information are believed to be reflective of judgments and opinions as of the date that material was originally published. Boreal is under no obligation to ensure that other materials are brought to the attention of any recipient of this document.

The information and material presented herein are for general information only and do not specifically address individual investment objectives, financial situations or the particular needs of any specific person who may receive this presentation. Investing in any security or investment strategies discussed herein may not be suitable for you, and you may want to consult a financial advisor. Nothing in this material constitutes individual investment, legal or tax advice. Investments involve risk and any investment may incur either profits or losses. Past performance does not guarantee future results. Unless otherwise stated, the portfolios and its performances herein do not account for costs, fees and / or charges, have no track record and have not been independently audited. Boreal shall accept no liability for any loss arising from the use of this material, nor shall Boreal treat any recipient of this material as a customer or client simply by virtue of its receipt. The information herein is not intended for any person residing in any jurisdiction in which it is unlawful to distribute this material.

Securities investments, products and services:

- Are not FDIC or Government Agency Insured

- Are not Bank Guaranteed • May Lose Value

- The information and materials presented here are not intended for persons in jurisdictions where it is unlawful to distribute such information and materials. For further information, please consult your legal advisor.

Legal Disclaimer Boreal Capital Management AG

Investment advisory products and financial services are provided by Boreal Capital Management Ltd (“Boreal”), a Swiss external asset manager regulated by the SRO AOOS.

Boreal Capital Management Ltd is not permitted to give legal or tax advice. Only an attorney can draft legal documents and provide legal services and advice. Clients of Boreal should consult with their legal and tax advisors prior to entering into any financial transaction or estate plan.

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but Boreal makes no representation or guarantee as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. The information contained herein does not purport to be a complete analysis of any security, company, or industry involved. Opinions and information expressed herein are subject to change without notice. Boreal and/or its affiliates may have issued materials that are inconsistent with or may reach different conclusions than those represented in this document, and all opinions and information are believed to be reflective of judgments and opinions as of the date that material was originally published. Boreal is under no obligation to ensure that other materials are brought to the attention of any recipient of this document. Boreal accepts no liability whatsoever and makes no representation, warranty or undertaking, express or implied, for any information, projections or any of the opinions contained herein or for any errors, omissions or misstatements in the document. Boreal does not undertake to update this document or to correct any inaccuracies which may have become apparent after its publication.

This material is not to be construed as an offer to sell or a solicitation of an offer to buy any security nor a solicitation to buy, subscribe or sell any currency or product or financial instrument, make any investment or participate in any particular trading strategy in any jurisdiction where such an offer or solicitation would not be authorized or to any person to whom it would be unlawful to make such an offer or invitation. The information and material presented herein are for general information only and do not specifically address individual investment objectives, financial situations or the particular needs of any specific person who may receive this presentation. It does not replace a prospectus or any other legal document relating to any specific financial instrument which may be obtained upon request from the issuer of the financial product. In this document Boreal makes no representation as to the suitability or appropriateness of the described financial instruments or services for any recipient of this document nor to their future performance. Each investor must make their own independent decision regarding any securities or financial instruments mentioned in this document and should independently determine the merits or suitability of any investment. Before entering into any transaction, investors are invited to read carefully the risk warnings and the regulations set out in the prospectus or other legal documents and are urged to seek professional advice from their financial, legal, accounting and tax advisors with regard to their investment objectives, financial situation and specific needs. The tax treatment of any investment depends on your individual circumstances and may be subject to change in the future. Boreal does not provide any tax advice within this document and the investor’s individual circumstances were not taken into account when providing this document.

Investing in any security or investment strategies discussed herein may not be suitable for you, and you may want to consult a financial advisor. Nothing in this material constitutes individual investment, legal or tax advice. Investments involve risk and any investment may incur either profits or losses. The investments mentioned herein may be subject to risks that are difficult to quantify and to integrate into the valuation of investments. In general, products with a high degree of risk such as derivatives, structured products or alternative/non-traditional investments (such as hedge funds, private equity, real estate funds etc.) are suitable only for investors who are capable of understanding and assuming the risks involved. The value of any capital investment may be at risk and some or all of the original capital may be lost. The investments are exposed to currency fluctuations and may increase or decrease in value. Fluctuations in exchange rates may cause increases or decreases in your returns and/or in the value of the portfolio. The investments may be exposed to currency risks because a financial instrument or the underlying investment of a financial instrument is dominated in a currency different from the reference currency from the portfolio or other than the one of the investor’s country of residence.

This document may refer to the past performance of financial instruments. Past performance does not guarantee future results. The value of financial instruments may fall or rise. All statements in this document other than statements of past performances and historical facts are “forward-looking statements” which do not guarantee the future performance. Financial projections included in this document do not represent forecasts or budgets but are purely illustrative examples based on series of current expectations and assumptions which may not eventuate. The actual performance, results, market value and prospects of a financial instrument may differ materially from those expressed or implied by the forward-looking statements in this document. Boreal disclaims any obligation to update any forward-looking statement as a result of new information, future events or otherwise. The information contained in this document is neither the result of financial analysis within the meaning of the Swiss Banking Association “Directive on the Independence of Financial Research” nor of independent investment research as per EU regulation on MiFID provisions.

Unless otherwise stated, the portfolios and its performances herein do not account for costs, fees, commissions, expenses charged on issuance and redemption of securities or other, nor any taxes that may be levied and / or charges, have no track record and have not been independently audited. Boreal shall accept no liability for any loss arising from the use of this material, nor shall Boreal treat any recipient of this material as a customer or client simply by virtue of its receipt. The information herein is not intended for any person residing in any jurisdiction in which it is unlawful to distribute this material.

This document is confidential and is intended only for the use of the person to whom it was delivered. This document may not be reproduced in whole or in part or delivered to any other person without the prior written approval of Boreal.

Por Carlos Ruiz de Antequera

Por Carlos Ruiz de Antequera