Central and Eastern Europe, India, and LatAm: Why Do International Asset Managers Like These Regions?

| By Amaya Uriarte | 0 Comentarios

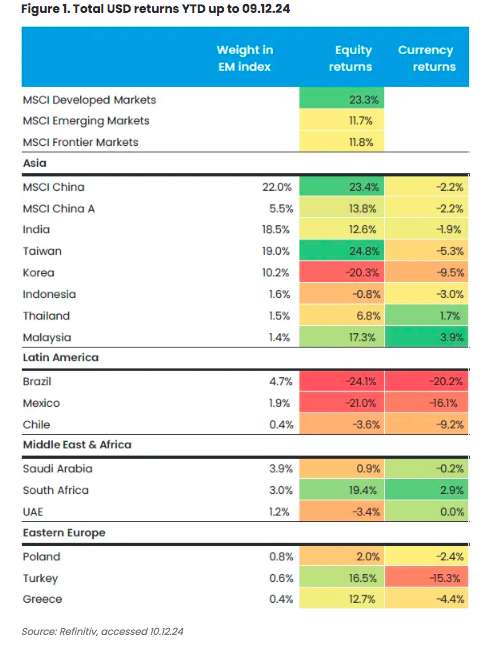

The performance balance of emerging and frontier markets in 2024 is clear: they have reflected the heterogeneity of the countries comprising this category, showcasing different points in their cycles and diverse market drivers. Assets in these markets ended the year offering attractive returns, though not always outperforming their counterparts in developed markets.

“Both emerging market equities and local currency emerging market sovereign bonds are comfortably above their average annual returns over the past decade. It has been much more challenging for local emerging market assets due to the impact of exchange rates, although relatively low hedging costs have led to significantly better returns with currency hedging, surpassing those of U.S. Treasury bonds,” explain experts from Deutsche Bank.

According to the bank, the performance of emerging markets, to varying degrees, is driven by a combination of factors: growth and policy betas (often defining central bank decisions); correlations between bonds and equities in major markets (emerging markets perform better in a regime of higher equities/lower rates and worse in a regime of lower equities/higher rates); risk-adjusted returns; dollar liquidity conditions; and idiosyncratic factors such as fiscal dominance and political cycles.

For East Capital, “the standout market in 2024 was Taiwan, driven by the artificial intelligence theme, as it produces all the advanced AI chips for Nvidia, benefiting the largest position in our global emerging markets strategy, TSMC, as well as its suppliers. It may surprise many that China’s offshore market outperformed developed markets, with a return of 23.4%.”

Looking ahead to 2025

As we approach the new year, Deutsche Bank’s outlook suggests that 2025 will be less challenging but likely much more uncertain. “We anticipate a more negative tilt in the distribution of expected returns for emerging market assets, driven primarily by spillover effects from a regime change in U.S. policy, but also potentially by thicker tails based on the sequencing and speed of that change,” they warn.

They also acknowledge that emerging economies face negative exposure to threats such as disruptions or changes in global trade due to increased tariff use (more so in Asia, Central and Eastern Europe, and Mexico than in others), possible delays in their easing cycles as U.S. monetary conditions tighten, weaker local institutional dynamics (e.g., government-central bank relations), and shifts in U.S. geopolitical commitments to key emerging market regions.

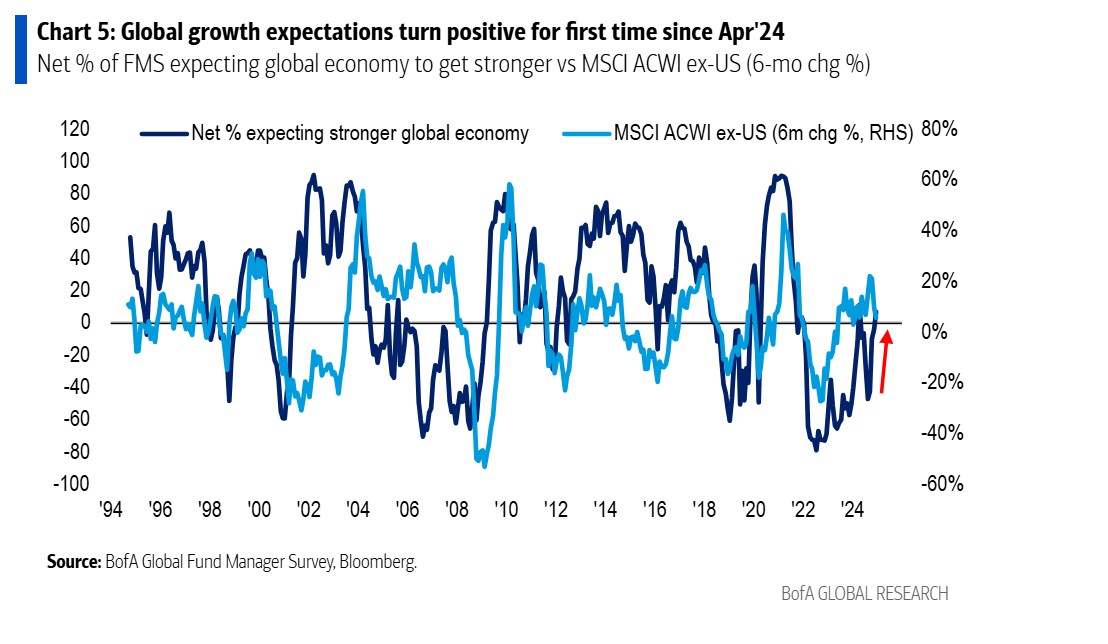

Guillaume Tresca, Senior Emerging Markets Strategist at Generali AM, acknowledges their vulnerabilities but maintains that emerging markets will remain attractive in 2025, despite the risks posed by Trump. “Emerging markets are in better shape than in 2016-2017, with resilient growth, limited external vulnerabilities, larger foreign exchange reserves, and central banks ahead of the economic cycle,” he asserts.

Tresca adds that U.S. exceptionalism and robust growth are not necessarily negative for emerging markets. He notes that while tariff risks will affect these markets, their impact will be heterogeneous and likely delayed until the second half of 2025. “Moreover, it is crucial to separate the impact at the asset class level from the country level. We have a strong preference for external debt over local debt, expecting returns of about 7% in 2025,” he clarifies.

Daniel Graña, Portfolio Manager at Janus Henderson, emphasizes that the growth drivers of emerging markets have evolved. As a result, the adverse effects of tariffs and rising U.S. bond yields on these markets are less pronounced than in the past, thanks to their growing role in the global innovation revolution. “Innovation in emerging markets has a unique flavor, where entrepreneurs modify innovative products and business models to address the frictions specific to their regions,” Graña adds.

Positioning and Investment Ideas

When discussing investment preferences and opportunities, Tresca highlights, “We prefer interest rates in Central and Eastern Europe (CEE), which will benefit from lower base euro rates. Latin American rates will carry higher risk premiums, while in Asia, central banks have room to cut rates if needed. Emerging market currencies will weaken against the dollar but can hold up well against G9 currencies. We favor the South African rand, Turkish lira, and Brazilian real over the Mexican peso.”

From Federated Hermes, they argue that the external macroeconomic context in 2025 will be favorable for emerging market debt. They expect global moderation in growth and inflation, along with continued monetary policy easing by the U.S. Federal Reserve and other major central banks, to support the attractive yields offered by emerging markets. Despite heightened geopolitical risks, the unpredictability of the new U.S. administration, and China’s weak growth, they believe a combination of core and frontier emerging market assets is likely to perform well in 2025.

“Within frontier markets, we continue to like Sub-Saharan African credits such as Côte d’Ivoire and Kenya. Backed by improved credit profiles and attractive valuations, these also provide diversification benefits against potential macroeconomic headwinds,” say Mohammed Elmi and Jason DeVito, Senior Portfolio Managers of Emerging Market Debt at Federated Hermes.

In Latin America, the firm sees some compelling narratives. “In Argentina, significant inflation reduction and GDP growth resumption have caught the attention of foreign investors, amidst improvements in governance and regulatory frameworks. El Salvador has enjoyed healthy market access and could benefit as Trump seeks to increase investment in Western Hemisphere countries tough on drug-related crimes. More broadly, any boost to U.S. economic growth could benefit commodity exporters, many of which are in Latin America.”

At Janus Henderson, Graña focuses on India: “India’s favorable demographics are complemented by a reformist government agenda that understands the role of a thriving private sector. The country is also improving its infrastructure to boost growth and investing in innovation. India stands alone with medium-high single-digit growth potential over the next decade.”

“India’s market is highly valued relative to historical levels, with elevated margins and profit expectations. Increasing equity supply has increasingly countered strong domestic fund flows. Recently, nominal growth (not adjusted for inflation) has slowed, driven by tighter fiscal and monetary conditions, while market expectations of profits have come into question. This could present an opportunity,” adds Tom Wilson, Head of Emerging Market Equities at Schroders.

In fixed income, Jeremy Cunningham, Investment Director at Capital Group, sees opportunities in sovereign and corporate investment-grade debt issuers in dollars, despite narrow spreads. He believes limited exposure to distressed sovereign credits continues to offer attractive yield opportunities in their portfolios.

“The fundamental context for emerging market debt remains favorable. Growth is positive among major economies. Fiscal deficits have mostly stabilized and are nearing levels seen in developed markets. Foreign exchange reserves have also increased, partly due to rising commodity prices. Real yields remain positive in many markets,” Cunningham concludes.