UCITS Equity Funds vs. Their ETF Version: How to Properly Compare Returns?

| By Amaya Uriarte | 0 Comentarios

The growth of the ETF segment in the European fund market has raised a new question: Is a simple average sufficient to compare the sectoral performance of active versus passive UCITS equity funds? This is the question that the European Fund and Asset Management Association (EFAMA) has sought to answer in its latest edition of Market Insights, titled “The Sectoral Performance of Active and Passive UCITS: Is a Simple Measure Enough?”

Although past performance does not guarantee future returns, recent literature has shown that funds with better historical performance attract more capital inflows. In recent years, passive funds have gained popularity due to their lower costs and their tendency to report higher average net returns than active funds. “However, the debate over which group of funds delivers better performance is more complex than it seems,” EFAMA acknowledges.

According to EFAMA, fund performance is typically reported by showing a simple or weighted average of the gross or net returns of all funds within a given category. “This is generally measured within a broad fund category, such as all active or passive funds, or the total universe of funds. This approach does not take into account the diversity of funds in terms of issuers, types of securities, geographical exposure, currency, and industry sectors, and consequently, the diversity in fund performance,” EFAMA explains.

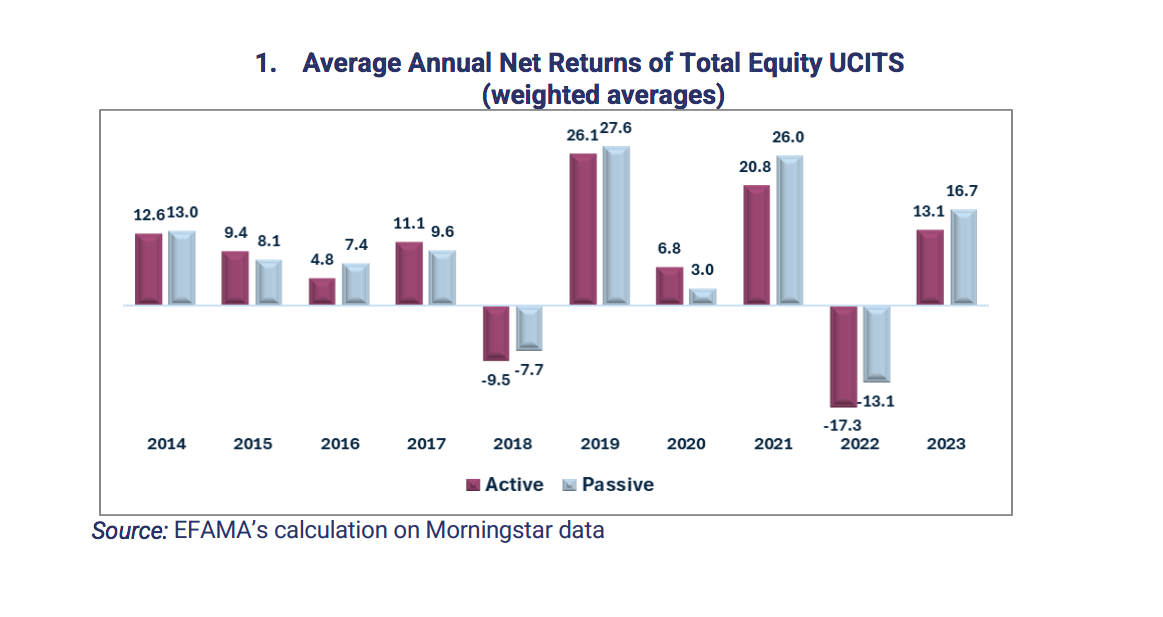

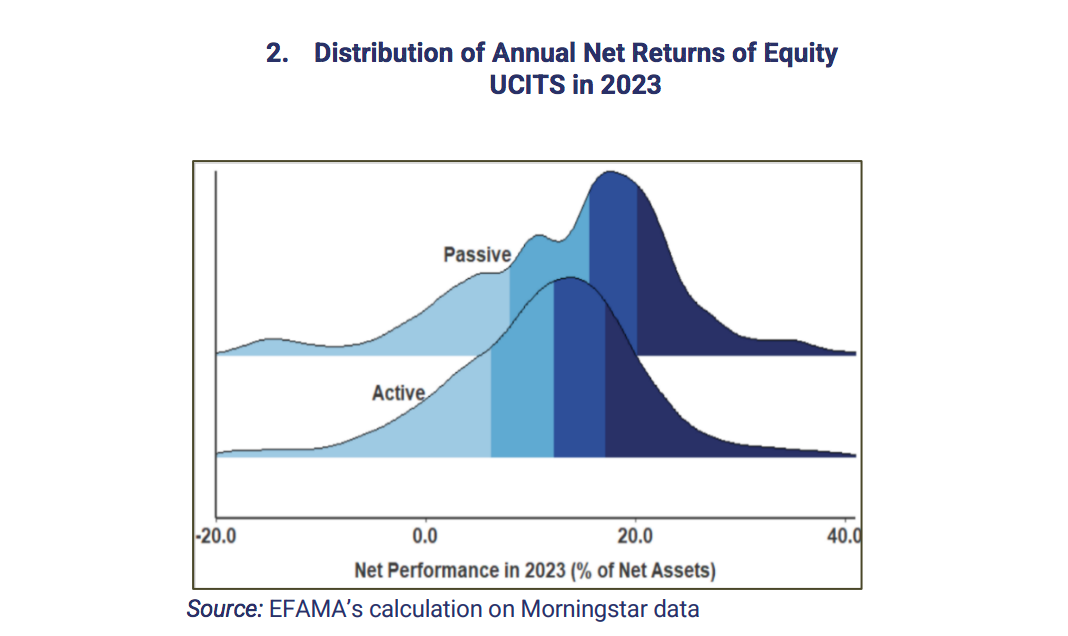

To address this, EFAMA analysts have compared the net performance of different categories of UCITS equity funds over the past ten years (2014–2023). The analysis shows that in 2023, the average net return of active UCITS equity funds was 13.1%, while that of passive UCITS equity funds reached 16.7%, “suggesting that passive UCITS outperformed,” EFAMA states in its report.

When analyzing the distribution of average annual net returns of active and passive UCITS equity funds in 2023, it is observed that two years ago, in 2023, many active funds achieved returns as strong as passive funds, while many passive funds had lower returns than active ones. According to EFAMA, “the observed returns depend on various fund characteristics, such as the industry sector or geographical exposure, regardless of whether a fund is active or passive.”

Key Findings

“Our analysis reveals significant differences in the average net performance of sectoral equity funds, with neither active nor passive funds consistently outperforming the other,” says Vera Jotanovic, Senior Economist at EFAMA.

Meanwhile, Bernard Delbecque, Senior Director at EFAMA, explains that given the high diversity among investment funds, “retail investors should seek professional advice before allocating their savings to specific equity funds, ensuring that their choices align with their individual investment goals and preferences.”

In this regard, one of the main conclusions reached is that “significant differences in net performance are observed among UCITS equity funds across various industry sectors, for both active and passive funds.”

Additionally, it is concluded that while passive equity funds generally outperform active equity funds when comparing net returns across the entire universe of equity funds, this pattern does not consistently hold across all sectors.

It is also extrapolated that some active funds outperform passive funds, and vice versa, depending on the industry sector, the year, and the time horizon, “demonstrating that no category consistently delivers superior performance,” EFAMA notes. Finally, the report warns that its findings remain robust even after accounting for return volatility.