U.S.: Uncertainty Reaches Highest Level in Three Years Among Current Homeowners and Prospective Buyers

Uncertainty among current homeowners and prospective buyers has reached its highest level in three years, with 60% saying they cannot determine whether now is a good time to buy a home, compared to 48% two years ago. This is according to the latest Bank of America Homebuyer Insights Report, published in coordination with the most recent On the Move analysis from the Bank of America Institute.

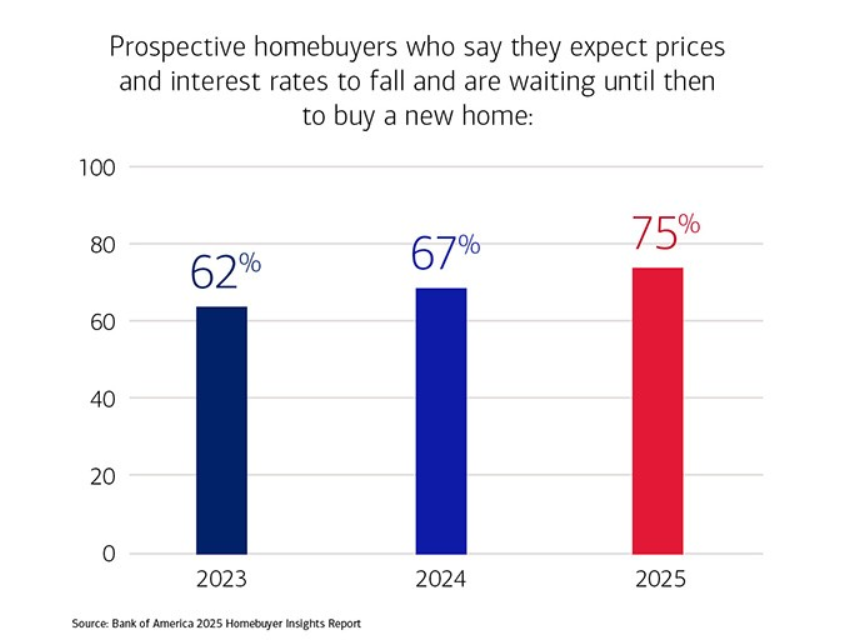

Despite this figure, 52% of prospective buyers remain optimistic about the current state of the housing market, stating it is better now than it was a year ago. On the other hand, 75% expect home prices and interest rates to decline, and are waiting for that moment to purchase a new home—up from 62% in 2023.

“With so many factors affecting the housing market, potential buyers and current homeowners are wondering what it all means for them,” said Matt Vernon, Head of Consumer Lending at Bank of America. “As our research shows, most buyers feel the market is headed in the right direction, but many still plan to wait for more favorable conditions before making a decision,” he added.

Generation Z: Making Trade-Offs to Achieve Homeownership

The new research also reveals that despite financial obstacles, the dream of homeownership remains a powerful motivator for both Generation Z and Millennials. This drives them to make sacrifices now and prioritize the long-term financial security that owning a home can provide. For both generations, three out of four current homeowners consider owning a home to be a major accomplishment. The 2025 data shows:

30% of Gen Z homeowners said they made their down payment by working an additional job, compared to 28% in 2024 and 24% in 2023.

22% of Gen Z homeowners purchased their home jointly with siblings, up from 12% in 2024 and 4% in 2023.

34% of prospective Gen Z buyers would consider living with family or friends while they wait to buy a home.

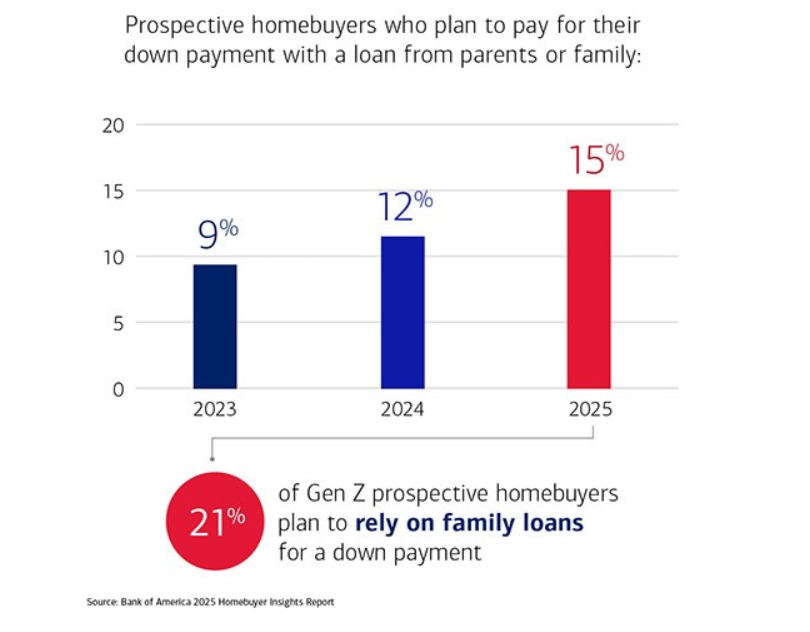

21% of Gen Z prospective buyers say they plan to fund their down payment with a loan from parents or relatives, compared to just 15% of the general population. Among all prospective buyers, this figure rose from 9% in 2023 to 12% in 2024.

“Even with the challenges they face, younger generations understand the long-term value of homeownership, and many are doing what it takes to achieve it,” commented Vernon. “They’re finding creative ways to afford down payments and working hard to improve their financial future,” he added.

Extreme Weather Concerns Homebuyers

62% of current homeowners and prospective buyers are concerned about the impact of extreme weather events and natural disasters on homeownership, and 73% consider it important to buy in areas at lower risk for such events.

38% have changed their preferred home-buying location due to the risk of extreme weather in that area.

Among current homeowners, nearly a quarter (23%) have personally experienced property damage or loss due to severe weather over the past five years.

65% of current homeowners are taking steps to prepare their homes for the risk of extreme weather events.

The national online survey was conducted by Sparks Research on behalf of Bank of America between March 20 and April 22, 2025. A total of 2,000 surveys were completed (1,000 homeowners / 1,000 renters) with adults aged 18 and over who make or share financial decisions in the household, and who currently own, previously owned, or plan to own a home in the future.