“The Offshore Client Is More Sophisticated Today Than in Years Past; They Seek Institutional-Level Reporting and Want More Transparent Structures”

| By Amaya Uriarte | 0 Comentarios

“The Offshore Client Is More Sophisticated Today Than in Years Past; They Seek Institutional-Level Reporting and Want More Transparent Structures, but Still Require Access to Unique Opportunities in the United States,” said Jerry García in an exclusive interview with Funds Society. He is the co-founder, alongside Chris Gatsch, of Alta Vera Global Capital Advisors, a new independent wealth management firm based in the United States that targets UHNW profiles.

García worked for nearly two decades at J.P. Morgan, where he met his current partner, who at the time already had 10 years of experience at Merrill Lynch.

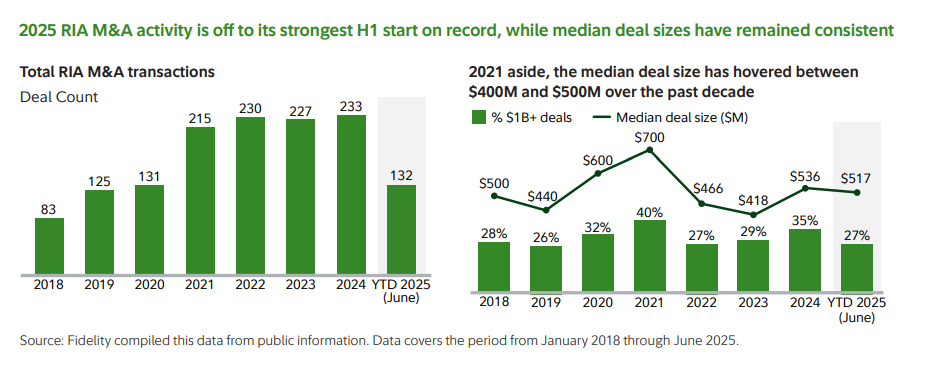

During the conversation, he also reflected on a trend that is clearly visible in the market: “We are at an interesting inflection point. I am convinced that there is a structural shift toward independence in the advisor community.”

And he outlined, almost like a manifesto, how he feels about his own venture: “I always envied those who loved what they did and didn’t see it as a job. Today, I no longer see it as employment, but as a passion. Supporting our clients is a lifelong ambition, and I truly enjoy my day-to-day,” he stated.

More Than a RIA

Alta Vera “is not simply a RIA,” said the interviewee, who was born in Puerto Rico. The company offers wealth management services, capital raising, and strategic advisory. It was founded under the motto of delivering institutional capabilities with personalized execution, helping clients “make complex capital and wealth decisions—whether managing generational wealth, raising capital for a new venture, or hedging strategic risks—with clarity, consistency, and confidence,” according to García’s LinkedIn profile.

The new firm partnered with OneSeven to leverage its marketing, compliance, and operations platform and is part of the Merchant Investment Management ecosystem. Alta Vera works with high- and ultra-high-net-worth families, often with assets in multiple countries; as well as with entrepreneurs and business owners; and with institutions and family offices seeking unique private transactions, sophisticated hedging strategies, or co-investment opportunities. It serves both onshore and offshore clients.

“Large firms continue to consolidate and get bigger. At the same time, clients want more independence and flexible global access. But at the end of the day, what matters most is still trust and relationships. The firms that manage to combine independence, innovation, and scale will be the ones that thrive, and we hope to be at the forefront of that,” predicted García.

The idea of founding an independent firm began during his days at J.P. Morgan, where he led teams in both the United States and Latin America and witnessed the market’s demand for global, sophisticated, and tailored solutions for such families. “Given the conflicts of interest I observed in the business,” he continued, “I wanted to create an environment where this could be done in a much more independent and personalized way—truly sitting on the same side of the table as our clients.”

“My firm and our advisors do not represent a brand: we represent the client and their interests. We have no pressure to push a product or fit into someone else’s box. We can look at the entire market—from large banks and custodians to niche private equity and hedge fund opportunities—and choose what is truly best for the client, not what’s best for a brand,” he reflected. “That freedom makes the advice much more objective and, honestly, also more personal,” he added.

The new firm was launched this summer. García confirmed he is “in conversations with multiple advisors and teams representing billions of dollars in AUMs, even at this early stage.”

The Offshore Client: Increasingly Sophisticated

“In Latin America, the demand to move capital offshore continues to grow,” stated García. “Chile, after the political instability of recent years, is a clear example. But in general, capital always flows to where the opportunities are, and the United States remains a major destination for Latin Americans.”

Regarding offshore client profiles, they “tend to be more sophisticated than in previous years,” he asserted. “They seek institutional-level reporting, more transparent structures, but still want access to unique opportunities in the United States.”

According to Jerry García, clients today are looking for real diversification (not just stocks and bonds, but also private credit, hedge funds, and unique transactions); stronger risk management (hedging strategies to address volatility); and access to exclusive, curated opportunities that don’t feel generic.

When it comes to alternative investments, he sees “strong demand,” especially for U.S. real estate, although they are also looking into sectors such as “data centers, artificial intelligence, technology, and energy, seeking interesting private transactions for our clients.”

In October 2007, García joined J.P. Morgan as a financial advisor to UHNW individuals and families and remained at the bank for nearly 16 years. He served as Managing Director & Market Manager, leading various teams serving the same client profile—first in the United States, then in Central America, the Caribbean, and South America.

From 2023 to 2025, he was Partner & Head of Latin America Wealth Management at Azura, based in Miami. Chris Gatsch, his current partner at Alta Vera, began his career in 2009 at Merrill Lynch, where he worked for 10 years, providing wealth services to HNW clients through the structuring and approval of secured lending. At the end of 2019, he transitioned to J.P. Morgan, where he continued building his business until, in 2022, he launched his own wealth management firm: Lake House Private Wealth Management.