Cycle Shift: The Fed Resumes Rate Cuts

| By Amaya Uriarte | 0 Comentarios

After a nine-month pause, the Federal Reserve cut rates again at its latest meeting—a widely expected decision, though not without implications. Jerome Powell made it clear that the balance between inflation and employment—the core of the Fed’s mandate—has shifted, with growing concern over the deterioration of the labor market.

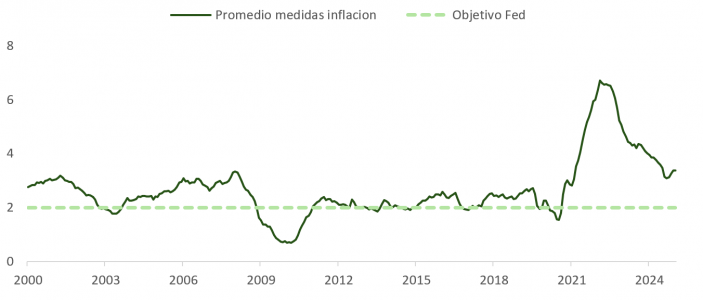

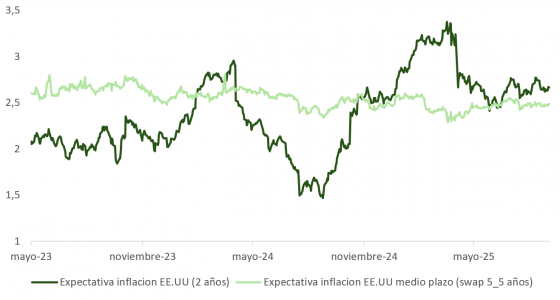

In line with his message at Jackson Hole, Powell emphasized that inflationary risks have moderated. The uncertainty generated by the Trump administration’s tariff policy remains, but the data points to contained inflation in both the short and long term. Metrics such as the “trimmed” CPI (Cleveland Fed) or the “sticky” CPI (Atlanta Fed) have risen since April, although two-year swaps indicate that the peak is already behind us.

The 5y5y swaps, meanwhile, remain stable and very close to the Fed’s long-term target, reinforcing the thesis that the monetary authority is comfortable with the projected level of inflation.

Labor Market: Tensions Beneath the Surface

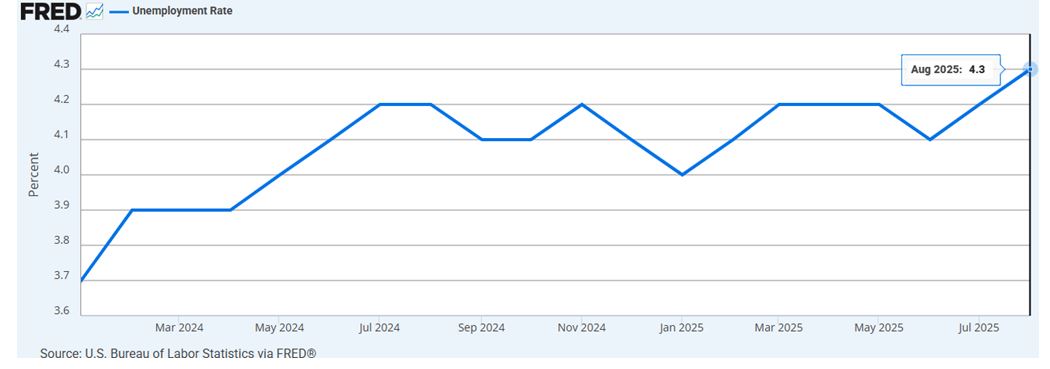

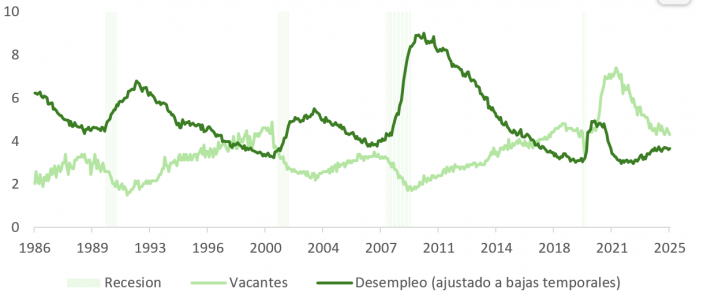

The labor market is now at the center of attention. The sharp decline in immigration has reduced the supply of workers. And although demand has also moderated, the participation rate continues to decline, which keeps unemployment within the Fed’s comfort range… for now.

Revised forecasts for 2026 and 2027 anticipate lower unemployment, but the context remains fragile. The BLS revision placed job creation between March 2024 and March 2025 at 900,000 fewer workers than originally reported. The average number of new jobs created has fallen to just 29,000 per month over the past three months—well below the 70,000 to 100,000 needed to maintain equilibrium. This keeps the Fed on alert, with a high probability of further 25-basis-point cuts in October (87%) and December (92%), according to the futures market and the dot plot. Even so, only half of the FOMC members support this double cut.

Powell was clear: “Labor demand has weakened, and the recent pace of job creation appears to be below the equilibrium rate needed to keep the unemployment rate constant.”

Monetary Policy: The Path Toward Neutrality

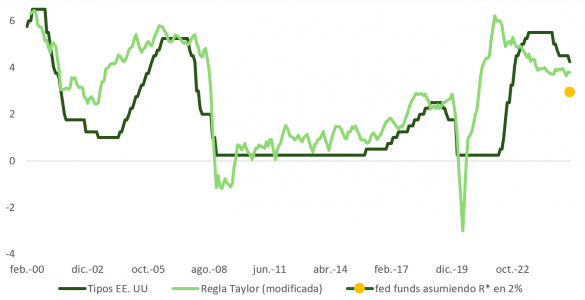

Powell emphasized that there is no predefined plan: each decision will be made meeting by meeting. However, the new balance—less inflationary pressure and greater weakness in employment—suggests that rates should move toward neutral levels.

The Taylor Rule confirms that Fed Funds are still in restrictive territory. The projections implied in the futures and swaps curves appear reasonable, although the margin of error remains high due to macro uncertainty. Powell was unequivocal: “There is no risk-free path.”

Political Tensions and Mixed Signals

During the press conference, questions arose about the apparent disconnect between the economic projections—higher inflation and lower unemployment—and the moderate pace of monetary adjustment. Some interpret this as a sign of political pressure, particularly from President Trump.

The contrast between those favoring a moderate adjustment (Waller and Bowman, with 0.25%) and the more aggressive camp (Miran, proposing 0.5%) could be seen as a statement of independence in the face of external pressure. The Fed appears determined to distance itself from any partisan narrative.

Market Implications: Duration, Dollar, and Positioning

With the curve pricing in up to five additional cuts between now and December 2026, the risk now falls on those holding short dollar positions and long duration.

The OBBA fiscal plan, which balances stimulus with spending cuts, is favorable to growth in 2026. Monetary policy is easing while companies continue to report growth in earnings per share—an unusual combination at this stage of the cycle.

The normalization of the labor market following post-pandemic distortions reinforces the thesis that there will not be a demand-induced recession. The Atlanta Fed’s GDP model for the current quarter, in fact, anticipates an acceleration in growth.

Business confidence data in Europe, such as the ZEW or Sentix, deteriorated in September. This increases the likelihood of positive macroeconomic surprises in the United States, which could attract flows toward dollar-denominated assets.

From a technical standpoint, the positive divergence between price and the RSI (Relative Strength Index) reinforces this view of short-term support for the dollar.