The US Offshore Industry on Alert Over H-1B Work Visa Fees

| By Amaya Uriarte | 0 Comentarios

The Trump administration’s decision to impose a $100,000 fee for each new H-1B work visa has put the US Offshore investment industry on alert. While the measure primarily affects technology companies, it also impacts the financial sector—especially the one centered in Miami—which employs a large number of highly skilled foreign workers.

Sources consulted by Funds Society did not rule out potential legal challenges to the recent measure, which they described as “widely counterproductive” for talent acquisition, innovation, and economic growth.

The H-1B visa category allows employers to petition for highly educated foreign professionals to temporarily work in “specialty occupations,” the NGO The American Immigration Council explained in a note. These jobs require at least a bachelor’s degree or its equivalent. Generally, the initial duration of an H-1B visa is three years, but it can be extended up to six, it added.

An analysis published by Business Insider, based on public data from the U.S. Department of Labor and the U.S. Citizenship and Immigration Services (USCIS), determined that the financial entities most affected by this measure will be the largest ones—including JPMorgan Chase, Goldman Sachs, BlackRock, Fidelity, and Vanguard, among others—based on the number of such visas requested in previous years. However, smaller companies will also be impacted by the change, as they lack the financial capacity of large corporations to absorb high upfront costs.

Initial Shock and Consequences

“This policy change is widely seen as counterproductive for attracting top-tier STEM talent (Science, Technology, Engineering, and Mathematics) and supporting economic growth,” stated Ignacio Pakciarz, co-founder & co-CEO of the global multi-family office BigSur Partners, headquartered in Miami.

Pakciarz emphasized that China responded quickly with the launch of the K visa program, aimed at young STEM professionals. This visa is explicitly designed to attract recent graduates and professionals in scientific and technological fields. “Unlike the H-1B, it does not require employer sponsorship, covers a wide range of academic, scientific, cultural, and business activities, and offers multiple entries with longer validity and extended stays,” he explained. “The policy shift signals China’s intention to lower barriers for foreign talent as part of its innovation strategy,” he added.

“Although Trump’s previous policies and executive orders have been favorable to the tech, AI, and crypto sectors—offering regulatory clarity, supporting innovation in digital assets, and positioning the U.S. as a global leader in crypto—this new visa fee proposal runs counter to those goals,” he added.

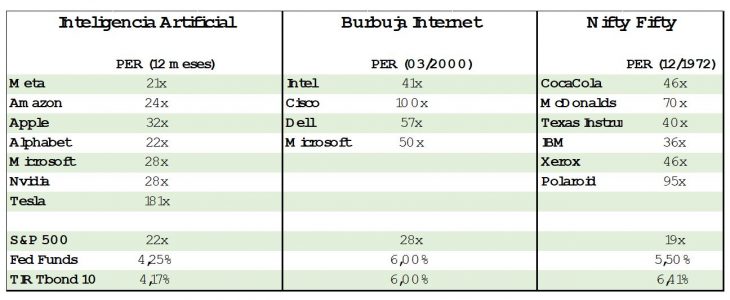

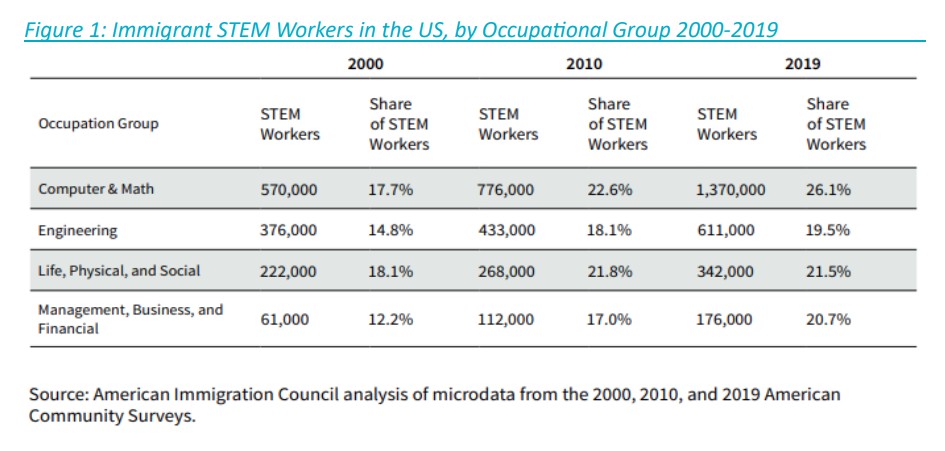

Studies and expert committees in both the United States and the United Kingdom have shown that high visa costs are a major deterrent for highly skilled migrants in STEM. According to the MFO, empirical research has found a positive relationship between international STEM migration and innovation output: “The greater the number of H-1B visas issued, the higher the number of patents, startups, and tech jobs in the host economy. Conversely, policies that restrict access through excessive fees reduce the inflow of highly skilled workers, thereby decreasing overall innovation and long-term economic growth.”

From Boreal Capital Management Miami, its CEO Joaquín Frances indicated that although the decision did not catch the firm by surprise—given the Trump administration’s increasingly restrictive approach to immigration—“we believe the measure could have been implemented with more nuance, for example, applying the fee only to applicants from countries with a higher concentration of H-1B visas. It remains to be seen whether this order will be challenged in court in the coming months, something that seems likely given its magnitude and consequences.”

In Response to the Economic Impact

Faced with the economic impact of the new fee, companies could explore various strategies to mitigate its effects. “One option is to strengthen internal training programs, investing in the development of local talent to fill highly specialized positions,” explained the CEO of Boreal, a company of Mora Banc Group.

Alternatives to the H-1B Visa

“Likewise, there is the possibility of relocating certain teams or functions to other countries, thus avoiding the need to move foreign personnel to the U.S. Lastly, in some cases, it may be possible to apply for an O-1 visa instead of the H-1B,” he added.

The O-1 visa is intended for individuals with extraordinary abilities in fields such as science, education, business, arts, or sports, and requires clear evidence of nationally or internationally recognized achievements.

For its part, the BigSur Partners paper outlines a series of alternative policy measures, notably the need to expand the Optional Practical Training (OPT) program for STEM graduates, allowing several years of post-degree work experience to facilitate the transition from studies to a professional career and help employers assess candidates’ suitability “without lottery barriers or fees”; waiving residency requirements for such graduates; and also calls for “comprehensive immigration reform,” focusing on reducing costs, increasing efficiency, and aligning policy with labor market needs, “with the goal of making the U.S. a more attractive destination for world-class talent.”

The MFO’s position is made clear in the report’s closing statement: “Overall, the evidence and policy guidance conclude that reducing bureaucracy, lowering costs, and increasing long-term residency pathways are much stronger incentives for global STEM talent than imposing or raising high visa fees.”