Why 2025 Could Be Another Record Year for Global Dividends

| By Amaya Uriarte | 0 Comentarios

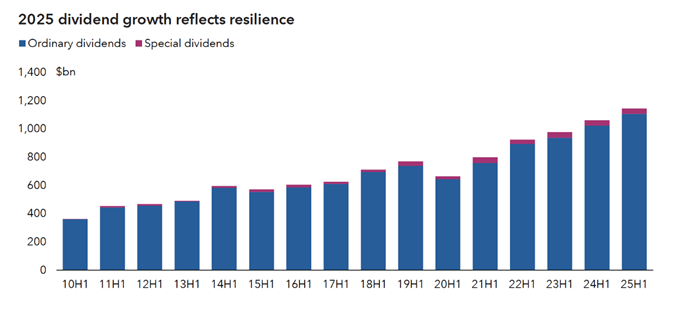

Global dividends recorded a strong increase in the first half of 2025, with a year-over-year rise of 7.7% in gross terms, reaching a record figure of 1.14 trillion U.S. dollars—almost matching the total for the entire year of 2017—according to Dividend Watch, part of the Capital Group Global Equity Study.

As explained in its conclusions, the total income figure for the first half was boosted by the weakness of the U.S. dollar, as dividends from Japan and Europe, in particular, were converted at much more favorable exchange rates. However, the growth of “core” dividends—which adjusts for factors such as special dividends, exchange rates, and other minor elements—was an encouraging 6.2%.

“2025 is shaping up to be another strong year for global dividends, with a solid first half and balanced growth across all regions and sectors. We remain optimistic and believe that the second half of 2025 will continue to show strong global dividend growth,” says Alexandra Haggard, Head of Asset Class Services for Europe and Asia-Pacific at Capital Group.

In her view, dividend flows can be a strong indicator of a company’s financial health and stability. “Companies that consistently pay and increase dividends typically demonstrate solid earnings, healthy cash flow, and disciplined management. By tracking dividend trends, investors can better understand company performance and their resilience to economic challenges,” she explains.

Finances Will Be Key Factors in 2025

In examining sector trends, the report identifies that the combination of the financial sector’s large size and favorable economic conditions led it to contribute two-fifths of global dividend growth in the first half of the year. The sector recorded a 9.2% year-over-year increase in core payments, reaching a record 299 billion U.S. dollars. In this regard, banks accounted for just under half of the total increase in the financial sector, and the 13 banks that contributed most to dividend growth in the first half came from various markets, indicating widespread global strength.

Other sectors that experienced robust growth included transportation—particularly shipping and airports—machinery, especially aerospace and defense groups, and software. Globally, 86% of companies increased or maintained their dividends in the first half, with an average corporate-level “core” dividend growth of 6.1% year-over-year.

Regional View: Japan, the Leader

Total income in the first half reached record levels in the United States, Canada, Japan, much of Europe, and some emerging and Pacific markets, although there was notable weakness in Australia, Brazil, Italy, China, and the United Kingdom.

Growth was strongest in Japan, where core payments rose 13.8% year-over-year, more than double the rate of the rest of the world. The record payments of 54.9 billion U.S. dollars reflect unprecedented profits and a shift in corporate culture that is returning more capital to shareholders.

The United States was the largest contributor to the year-over-year increase of 71.3 billion U.S. dollars in global payments in the first half, due to its massive size. Its core dividend growth rate of 6.1% was in line with the global average, although lower extraordinary income tempered the increase in gross income.

The second quarter is the key dividend season in Europe, and growth this year was slower compared to the past four years. Core dividend growth for the first half was 5.6% year-over-year, a rate lower than the rest of the world. Cuts by European car manufacturers, in particular, caused the region’s dividend growth to fall by a third in the first half of the year.

As highlighted by Mario González, Head of Capital Group in Iberia, US offshore, and Latam, Spanish dividends reached a record 16.7 billion U.S. dollars in the first half of 2025, representing a 12.7% increase in the core figure. “Companies that pay dividends have long served as a safe harbor in the storm, offering investors a cushion when markets turn volatile. Their ability to generate income even in times of recession makes them an attractive anchor for clients in Spain seeking resilience and reliability,” he comments.