Middle East: How Are Markets Digesting Another Conflict?

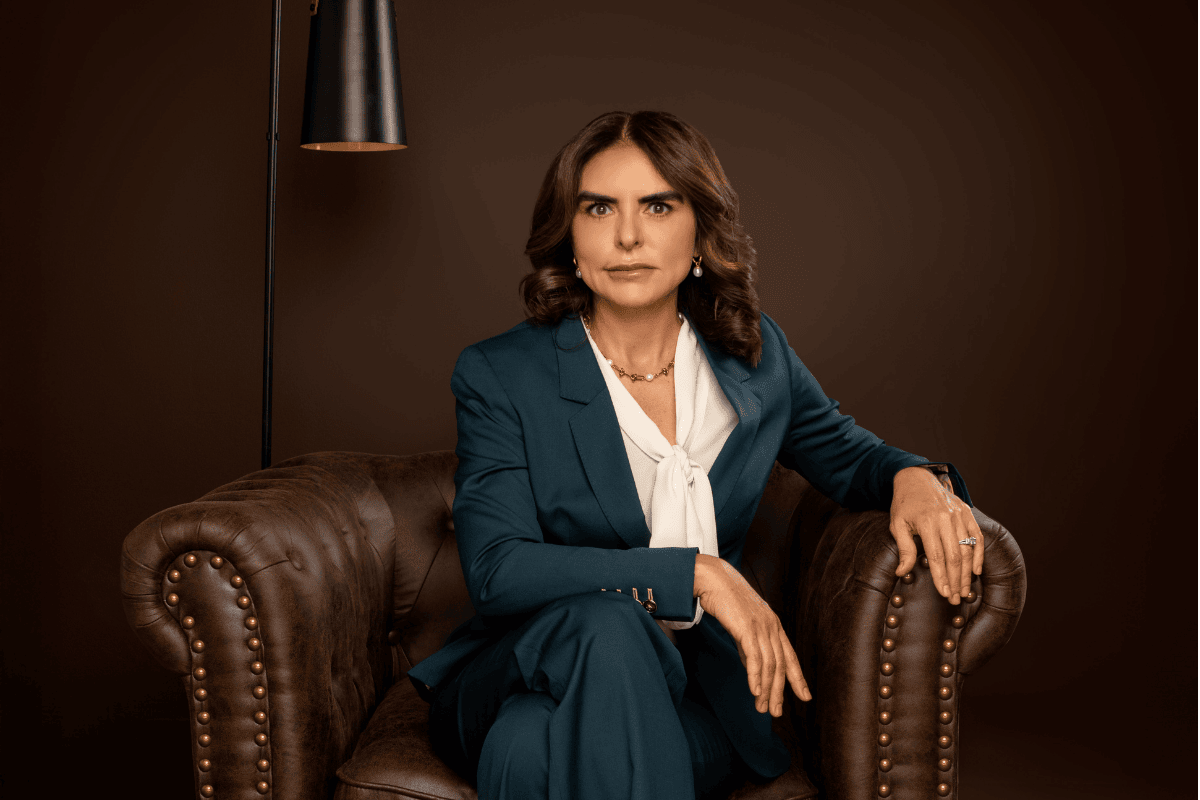

| By Marta Rodriguez | 0 Comentarios

Tensions in the Middle East finally erupted this weekend after the United States and Israel launched attacks against Iranian military targets and the conflict began to escalate and spread across the region. As a result, oil rose to a seven-month high and markets opened the session with losses.

In the view of Christian Schulz, chief economist at AllianzGI, markets are facing a significant shock, but one that is not yet destabilizing. “The immediate implication is a repricing of tail risks, with a potential rise in oil prices, a decline in risk assets, and a rally in safe-haven assets. However, much will depend on whether the conflict expands into broader regional or domestic instability,” the expert explains.

According to Adam Hetts, global head of multi-asset at Janus Henderson, there are other key market transmission channels to monitor if the uncertainty generated by this conflict persists. In his view, greater uncertainty dampens investor sentiment, which may broadly affect risk assets globally. “This would likely make developed market sovereign bonds, including U.S. Treasuries, and safe-haven currencies more attractive. In a prolonged period of uncertainty, rising oil prices could generate global inflation fears, which in turn could reduce the likelihood of the U.S. Federal Reserve cutting interest rates, something currently expected for later this year,” he notes.

Impact on markets

According to Schulz’s forecast, markets will demand a higher risk premium, at least temporarily, until there is greater clarity about Iran’s internal stability and the intentions of its geopolitical partners. “In broader financial markets, U.S. Treasuries, the U.S. dollar, and gold could appreciate, while equities could experience a sharp correction, although potentially short-lived,” he adds.

Looking, for example, at the gold and silver markets, the performance of perpetual futures over the weekend showed a very typical upward reaction. “This further reinforces the bullish tone in markets, but restraint by indirectly involved countries and the limited risk of an oil crisis should cap price increases. Although they provide stability to a portfolio during periods of heightened financial market volatility, the geopolitical playbook suggests that buying gold and silver on the day of a geopolitical escalation is unlikely to be a profitable strategy,” notes Carsten Menke, Head of Next Generation Research at Julius Baer.

By contrast, Jeffrey Cleveland, chief economist at Payden & Rygel, reminds that despite the severity of the geopolitical backdrop, it is advisable to avoid hasty conclusions: not every political escalation necessarily translates into a lasting macroeconomic crisis. In fact, he points out that, historically, geopolitical crises tend to trigger immediate, but often short-lived, reactions in markets. “Initial uncertainty fuels volatility and corrections, but once the situation stabilizes, even without a full resolution of the conflict, investors tend to absorb the event and refocus on economic fundamentals. In this sense, periods of weakness can become buying opportunities, especially for those with a medium- to long-term horizon,” Cleveland notes.

In his view, the true macroeconomic transmission channel would be energy, and in particular potential prolonged disruptions to oil flows through the Strait of Hormuz, a strategic hub for global crude trade. In addition, for this expert, another factor to consider is the differing sensitivity of asset classes: “Geopolitical tensions tend to affect equities more intensely, increasing volatility and temporarily compressing valuations, while fixed income, especially high-quality bonds, tends to benefit from safe-haven flows.”

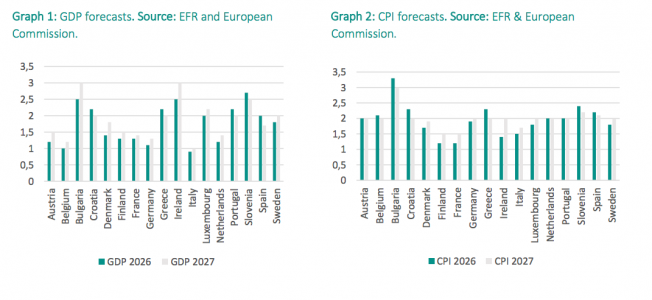

Anthony Willis, senior economist in the Multi-Asset Solutions team at Columbia Threadneedle Investments, shares Cleveland’s view and goes a step further: “Rising oil prices will likely amplify inflation risks in developed economies, just as new CPI releases begin to influence interest rate expectations. Higher energy costs may also threaten the disinflationary trend observed in several markets and could place renewed pressure on central banks to reassess the timing and magnitude of rate cuts.”

In this regard, Samy Chaar, chief economist at Lombard Odier, argues that the risk of an oil shock would not only affect the U.S. and its growth and inflation outlook, but the broader economy as well. “Real GDP growth in the U.S. would slow, and the Fed’s task of balancing its dual mandate would become more difficult. For other economies, especially in Asia and in emerging markets in Europe, the Middle East and Africa, the second scenario would justify further downward revisions to real GDP growth and upward revisions to inflation due to their high dependence on external energy imports,” he notes.

On oil prices

It should not be forgotten that oil is a barometer of geopolitics, and its reaction has been clear following the escalation of the conflict in the Middle East. Although oil has traded mainly in the USD 60–70 range over the past 12 months, prices have already exceeded USD 70 and are expected to continue rising at the start of trading on Monday. For Adam Hetts, these moves are significant, but not yet particularly concerning in the broader context of investment implications.

“A continued rise to USD 80 would be consistent with the June 2025 conflict, and USD 90 with April 2024, when global markets were largely able to look through the price increases as the conflicts were resolved relatively quickly. Taking Russia’s invasion of Ukraine in early 2022 as a reference, that conflict pushed oil prices above USD 100 for a prolonged period, with brief spikes above USD 120. Current oil prices reflect a limited and relatively short-lived conflict,” Hetts explains.

In the view of Norbert Rücker, Head of Economics and Next Generation Research at Julius Baer, in the coming weeks we will see the usual pattern of a brief spike in oil and gas prices, though he believes it will be more intense this time. “This pattern could be prolonged by the complications associated with a regime-change mission, or shortened by Iran’s military exhaustion. In this base scenario, over the next few months, oil prices will depend on whether Iran experiences a disruption to its exports and, if so, whether compensation comes from producing countries or from the U.S. shale business. Assuming a combination of both, we raise our three-month oil price forecast to USD 60 per barrel. We maintain our neutral view on oil and shift our view on European natural gas to neutral from cautious,” he states.

And the role of the Strait of Hormuz

In this context, experts’ attention is once again focused on the Strait of Hormuz. Although Schulz considers its imminent closure unlikely, its stability is key to the global energy market. It is important to recall that if it were closed, global oil production could fall by 20%. “OPEC+ decided to increase supply by 206,000 barrels per day, and spare capacity (just under 3 million barrels per day) could, in theory, offset the loss of Iranian exports (1.6 million), while OECD inventories are within normal ranges. However, preventing oil prices from exceeding USD 100 per barrel depends on the reopening of Hormuz,” notes Paolo Zanghieri, senior economist at Generali AM.

According to Zanghieri, a partial disruption through sporadic attacks on vessels and the mining of the strait could push prices to USD 90 or higher. “Direct attacks on Gulf oil facilities would significantly raise prices, but would also strain Iran’s already fragile regional relationships and irritate China,” he adds.

By contrast, in Rücker’s view, the most feared scenario is not its closure, but severe damage to the region’s key oil and gas infrastructure. “So far, either Iran has not attempted to attack the region’s key oil and gas infrastructure, which would be surprising, or it has not succeeded. Such an attempt would trigger a forceful response, draw regional powers, including Saudi Arabia and the United Arab Emirates, into the conflict, and likely could not be sustained over time. Therefore, the most feared scenario, a disruption of oil and gas supply with economic impact, would require severe infrastructure damage, rather than the closure of the Strait of Hormuz, something that should have occurred in the early days of the conflict,” argues the Julius Baer expert.