Investing in The Evolution of Medical Technology

| By Cecilia Prieto | 0 Comentarios

Throughout history, the intersection between technology and medicine has touched the lives of nearly every person in the world. Whether it’s the development of technology that allows us to look deep inside the body or breakthrough medicines that extend the lives of those with chronic diseases, these advances have not only impacted our lives, but also intensified pharmaceutical drug development over the past few decades.

The earliest drugs of our days, or “conventional medicines,” were first developed in the early 20th century, and were initially made from small molecules that were chemically synthesized in a lab. In the last decade biologics have become one of the fastest-growing areas of modern pharmaceuticals.

Biologic drugs are fundamentally different than conventional, small molecule-based drugs. Rather than being synthesized chemically, biologics — as the term suggests — ultimately derive from living organisms (e.g., bacteria, yeast, and even animal tissues or cells) and are considered large molecular drugs. In comparison to the development of conventional drugs, the production of biologic drugs requires a highly complex manufacturing process.

Today, biologic drugs, or “biopharmaceuticals,” are the fastest-growing parts of the pharmaceutical industry. According to McKinsey, biopharmaceuticals generate global revenues of $163 billion, making up about 20% of the pharmaceutical market. While biologic drugs have clearly become the medicine of today, we believe the next frontier in treatments will likely be in cell and gene therapy (CGT).

The foundational concept of CGT is developing treatments that aim to alter the genetic instruction of a patient’s cells. It accomplishes this by either replacing defective or absent genes with healthy ones, or by changing the way genes are regulated by the body so that defective cells can operate normally. These advances will be game changers because they can help cure or significantly improve the management of diseases that currently have few or no existing treatments. Moreover, the application of CGT can cover a wide range of challenging conditions, such as advanced, late-stage cancer or rare, inherited genetic disorders.

The Future Is in Cell and Gene Therapies

The past five years have been the renaissance period for CGT innovations, and COVID-19 accelerated the pace of these developments even more. According to a 2019 FDA report, in the last two years alone, CGT developers submitted almost 500 applications to the FDA to begin clinical trials. Of those submitted, the FDA anticipates that by 2025 roughly 10 to 20 CGT products will be approved every year. Given the pace of therapies expected to hit the market, it is no wonder that the Alliance for Regenerative Medicine expects CGT industry revenues to grow at 40% CAGR to $30 billion by 2025.

It is clear that CGT is at an important inflection point. Its trajectory is poised to accelerate as newer CGT therapies come to the market to treat a diverse range of health ailments, such as inherited blindness, cancers, blood disorders, leukemia, and multiple myeloma.

We believe CGT is at a tipping point today. Below we highlight two compelling, FDA-approved CGT developments — recent successes that will lay the foundation for the next generation of CGT technologies.

- Spinal muscular atrophy (SMA). In 2019, the FDA approved Zolgensma, the first gene therapy approved to treat children under age 2 with SMA, a leading genetic cause of infant mortality when left untreated. SMA is a rare genetic disease caused by a mutation in the survival motor neuron gene (SMN1) that is critical for the functioning of nerve cells that control muscle movement. Children with this rare condition have issues holding their head up, swallowing, and even breathing. Zolgensma delivers a fully functional copy of the SMN1 gene into the target motor neuron cells to improve muscle movement and function.

- Lymphoma. In early 2021, the FDA approved Breyanzi, a cell-based gene therapy to treat patients with certain types of large B-cell lymphoma cancer. Each dose of Breyanzi is a customized treatment that uses the patient’s own T-cells to help fight relapsed or refractory disease.

What’s on the Horizon for Cell and Gene Therapy?

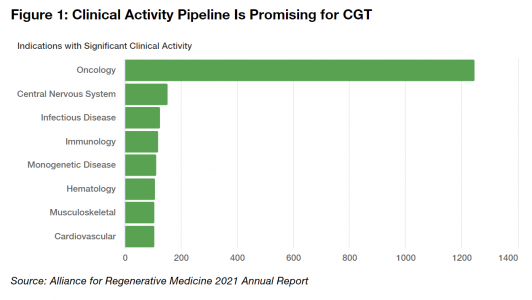

The remarkable developments mentioned above are only the tip of the iceberg for the CGT landscape. The clinical pipeline is robust. Over half of the trials focus on oncology, and they are sponsored equally by industry, academic participants, and governments. While historically only a small fraction of these trials is likely to become a FDA approved CGT product, the therapies that do get approved will provide enormous, life-changing benefits to patients who otherwise would have little hope for a cure or a meaningful improvement in their disease. Personalized treatments can reduce the need for chronic therapies and improve the quality of life for many.

Thus, even if a small selection of these clinical trials receives the FDA green light, the implications could still be far-reaching for the healthcare system and its patients. Notably, we anticipate a shift in the incurrence and timing of healthcare costs.

Identifying Next-Gen Opportunities for Investors

Although CGT is still a relatively nascent market compared with that of biologics, we see tremendous growth opportunities in biopharmaceutical manufacturers and biotechnology companies. Specifically, we view companies that provide the equipment, consumables, or services critical to the development and delivery of therapies as especially attractive. These key players can indirectly benefit when new therapies come into the market without being exposed to the binary risks of clinical trial outcomes. For example, these companies may include:

- Transportation companies skilled in moving patient samples that are sensitive to temperature or other variables to processing facilities.

- Manufacturing companies with expanded capability and capacity to produce T-cells.

- Compliance companies that ensure product safety and quality through oversight and implementation of biomanufacturing processes.

- Infusion companies providing at-home infusion for patients who can’t go to hospitals.

- Bioprocessing companies that increase production yields while lowering manufacturing costs.

The outlook for the CGT field is promising due to the robust clinical trial pipeline, the increased rate of FDA approvals, and patient enthusiasm. We believe continued advances in CGT will transform the way we treat diseases and dramatically alter the delivery of healthcare on both the individual and industry levels.