ISM and Employment: Persistent Slowdown, Not Collapse

| By Amaya Uriarte | 0 Comentarios

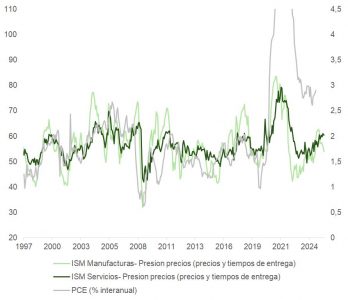

The November ISM manufacturing index fell to 48.2 (from 48.7), marking its ninth consecutive month in contraction. The new orders sub-index remains below that of inventories, signaling further weakness ahead. The employment component also declined (from 46 to 44), reinforcing the narrative of a still-weak industrial sector.

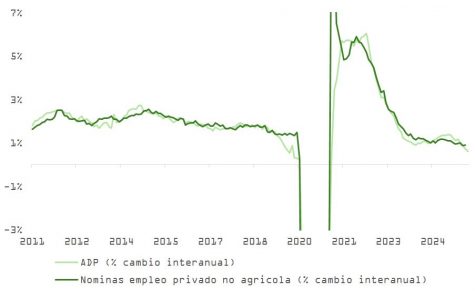

On the other hand, the ADP employment report shows a reduction of 32,000 jobs, while the Challenger report reflected a year-over-year increase in layoffs of 23.5%, though well below October’s 175%. Even so, limited hiring and low turnover continue to characterize the labor market, with no signs of collapse.

Consumption: Dynamic on the Surface, Fragile at the Core

During Black Friday, consumers spent a record $11.8 billion online, with holiday spending projected to exceed one trillion dollars. However, the momentum was driven by aggressive promotions, value-seeking behavior, and the use of “buy now, pay later” schemes—pointing to defensive strategies by the average consumer. This same pattern was evident, for example, in Walmart’s quarterly results, which showed higher-income families switching brands or slightly adjusting purchase quality to cut spending.

The stability of consumption now depends on political stimulus, such as the possible $2,000 check that Trump could distribute, and the expectation of declining financing costs. The “K-shaped” economy is becoming more apparent: high-income households continue spending, while middle-income ones are forced to seek liquidity.

The Fed: Cut in Sight, but With a Hawkish Stamp

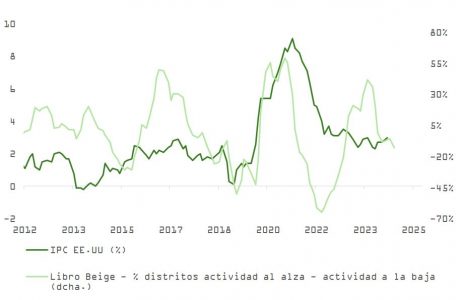

Given the lack of complete data due to the shutdown, the Fed will pay close attention to the Beige Book, which shows a nearly -20% gap between expanding and contracting districts, and a clear moderation in price indices.

Amid the absence of consensus within the Fed, a hawkish cut is shaping up for the December 10 meeting, with a cautious message aimed at containing expectations. This move could strengthen the dollar (DXY), which is threatening to break above its 200-day moving average. In that case, EURUSD would target the 1.14–1.12 range. While it is important to monitor the technical evolution of the exchange rate—which has briefly recovered its 50-day moving average—productivity gains, more evident in the U.S., are translating into increases in real incomes that should, in the short term, support U.S. asset prices and, consequently, international flows into its currency. The DXY dollar index (mostly reflecting the dollar’s crosses with the euro, Canadian dollar, and Japanese yen) is attempting to break above its 200-day moving average. If Powell ends up casting doubt on the integrity of the three cuts currently priced into the 2026 curve, a recovery of this reference level would boost the greenback’s exchange rate.

The Nasdaq Rebounds, but Sentiment Remains Mixed

The Nasdaq has recovered nearly 80% of the decline suffered in November, while the S&P 500 has corrected its overbought condition. However, investor sentiment remains cautious. The market has priced in the rate cut scenario, but is beginning to question the sustainability of the rally if data do not improve uniformly.

2026: When the Rest of the “K” Comes Into Play

U.S. macroeconomic data shows signs that justify rate cuts:

Stagnant private consumption: Real retail sales have been flat since December, and credit card delinquencies remain high, though stabilizing.

Weak housing: Residential investment has declined for two consecutive quarters, and over 60% of counties are seeing price drops (Zillow).

Soft labor market: So far, job growth is slowing and real income growth is below its historical pace.

But a shift on the horizon is beginning to take shape:

Tariff uncertainty is starting to fade, and Trump is closing off geopolitical stress points (Israel, Ukraine, China).

Tax exemptions from the OBBA plan will take effect in 2026.

AI-related productivity is showing results that are starting to extend beyond the technology and communications services sectors.

Financing costs have dropped substantially, with rates similar to 2018 levels, and the balance sheets of households and businesses remain healthy, leaving room for increased borrowing to boost investment and spending.

Credit Demand and Positive Releveraging

With a still-weak but stable labor market and a more optimistic view of the economic outlook, credit demand is beginning to pick up among both households and businesses. Leverage, measured against GDP and historical levels, remains low, creating room for positive releveraging.

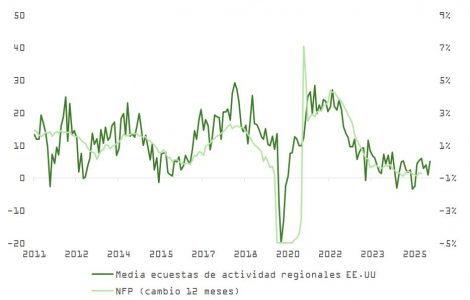

In addition, leading employment indicators are showing signs of improvement:

The index from the American Staffing Association has risen for 10 consecutive weeks, suggesting a recovery in temporary employment demand.

Employment sub-indices from regional surveys indicate stabilization of manufacturing payrolls for 2026.

Capital expenditure intentions are rebounding after the tariff-driven slowdown.

Fiscal Risk and Shift in Republican Strategy

With debt levels at 120% of GDP, the fiscal lever is running out. Starting in the second half of 2026, fiscal stimulus could turn negative, even though the OBBA plan may still contribute 0.4% to GDP.

This alters the political approach: Trump and the Republicans will aim to sustain consumption without additional public spending. This implies reducing tariffs on consumer goods, reinstating direct transfers (such as the $2,000 check), and — critically — ensuring low interest rates to reduce financing costs.

Starting in May 2026, Trump is expected to take control of the Fed, which would reinforce this growth strategy through the cost of money rather than public spending.

Conclusion: A Reactive Fed, a Selective Market

The current environment gives the Fed room to continue cutting, but with measured communication. The market has priced in the cuts but needs evidence that the lower part of the “K” is picking up in order to sustain the rally.

The greatest risk is no longer inflation or recession, but rather a combination of uneven growth, instrumentalized monetary policy, and excessive optimism in tech segments that have yet to deliver clear profitability.

It makes sense, for now, to maintain positions in sectors most linked to the AI boom, but also to begin balancing with others that may benefit from the abandonment of the “K” theory.