“This is Actually a Good Time to Be Invested in Fixed Income, But Investors Need to Be Thoughtful”

| By Cecilia Prieto | 0 Comentarios

“This is actually a very good time to have a substantial allocation to fixed income after the normalization of two years ago.” These words are from Christian Hoffmann, head of fixed income and a portfolio manager for Thornburg Investment Management. Hoffmann recently sat for an interview with Funds Society to offer insights into the current market environment.

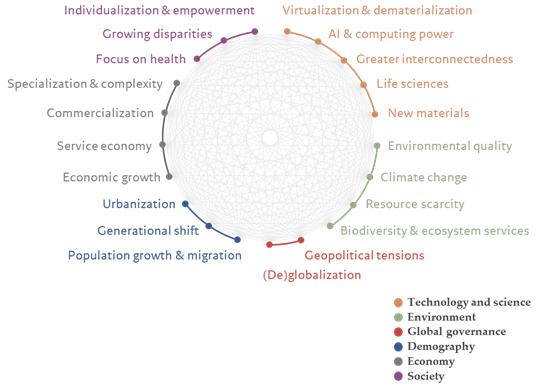

Hoffmann has been operating for 20 years in the industry. He likes to put facts in context for a better understanding of market conditions. For instance, he says that it is important for investors to understand that their fixed income portfolio won’t necessarily operate like they did in the 2010s or even in the same way it’s done for the past 40 years: “I think it’s important to always challenge historic correlations and regressions because the world is never exactly the same. This is a very good time to be invested in fixed income, but in a thoughtful way, and in a way that might challenge some investor assumptions.”

Hoffmann also throws out a warning: “Reinvestment risk is real, particularly as we see declining short-term rates.” So, to his point, this is “certainly an environment where taking some duration is favorable.” Thornburg considers its Strategic Income and Limited Term Income Funds to be suitable strategies to help investors navigate this complex market, depending on an investor’s risk tolerance and their long-term needs.

What is your outlook for the Fed’s new rate cutting cycle?

I still think that the market is probably looking for too much, especially as we’ve seen a slightly uncomfortable inflation print and certainly uncomfortable jobs numbers. We’re also heading into not just an election and some potential volatility and uncertainty, but also what is likely to be more noisy numbers owing to job strikes, hurricanes, and other exogenous events. The Fed has talked so much about data dependence that it’s hard to imagine why they feel the need to cut it all now. The argument would be, we’re in restrictive territory, we believe inflation is going in the right direction. The job market seems okay, but we want to protect it. The reaction function is based on data dependency, so I think the market should be concerned and recognize this needs to be more restrictive than we originally planned. I think it’s unlikely that we will see another 50-basis point move.

What should fixed income investors expect going forward?

We are living in a period of very high-interest rate volatility and actually very low spread volatility in credit. This environment should position investors to be somewhat cautious and thoughtful because the premium for taking risk is quite low relative to history at this point in the cycle. It also means a more opportunistic and tactical approach is warranted, given a lot of uncertainty around the economic path forward, on inflation, interest rates, monetary policy and on the fiscal side as well. I think it’s a good idea to have some dry powder because it’s unlikely we experience a lot of additional tightening from here.

It’s also important to point out that most people in financial markets have grown up in a zero-interest rate world. Zooming out and looking at the longer course of history, that’s a very abnormal period related to history. We had a gigantic reset, as we’ve shifted from a zero-interest rate world to something that looks a lot more normal now, so investors can again get income from a fixed income portfolio and achieve some ballast with a diversified portfolio relative to other risk assets.

Where are you finding opportunities in credit?

In volatile markets, there are more opportunities. But in the past couple of years, we’ve been very constructive on both agency and non-agency MBS. We feel good about home prices, so that’s led to opportunities in the non-agency space. But even in the agency space, credit risk is all but out of the picture. Historically, convexity risk has played a part, given that those securities traded near par, and investors were compensated with additional income. But given those prices had suddenly sold off, investors still have nice income as well as a lot of protection as it relates to pay downs and potential price appreciation. Several buyers in terms of the large banks exited the space, and the Federal Reserve unwound its balance sheet and created a supply-demand mismatch which offered an opportunity for investors like us. It could go tighter, but not much tighter: 10 basis points, possibly 30.

Are markets underestimating geopolitical risks?

We see a lot of complacency in the market right now. I think there’s probably too much focus on the Fed and not enough on global markets. The Chinese economy is clearly challenged and has issues, and the measures announced by its government tend to be a bit choppy, uncertain and hard to telegraph. There’s also tremendous geopolitical uncertainty in the Middle East, China and Russia. The market has been sanguine about them so far. When investors no longer feel sanguine, they tend to move to a more defensive position. A recession isn’t necessary to have risk assets misprice, because assets look through the future and to future expectations. All the market needs is fear to see credit spreads reprice.

Are you worried about the path of the fiscal policy and the possible outcomes after the elections?

It’s certainly a close election, and the likely best outcome for markets is some kind of split government. That said the two candidates both espouse policies and actions that I think an economist would not be particularly happy about, from Trump’s rhetoric about wanting more of a say in in central bank policy, which is, frankly, anathema to how the Federal Reserve has always been run in this country and I think should be a point of concern. Another problem is that neither candidate seems particularly interested in fiscal discipline. Government spending continues to increase, and that has been in a very good economic environment. So, we certainly worry about what that might look like in a less good economic environment. That could also mean that the bond reaction function operates a bit differently relative to the past. If we find ourselves in a bad environment, and people are also worried about the fiscal situation and monetary discipline, bonds might be less of a safe haven and people might move into cash or gold.