Wall Street and the BMV: Between Heaven and Earth During 2024

| By Amaya Uriarte | 0 Comentarios

“If Wall Street catches a cold, the BMV gets pneumonia; but when New York is booming, the BMV celebrates.” “The BMV is inevitably tied to Wall Street, for better or worse.”

These and other sayings have long been commonplace in the stock markets of Mexico and the United States, referring to the performance of the Mexican Stock Exchange (BMV), historically linked to the influential New York exchange.

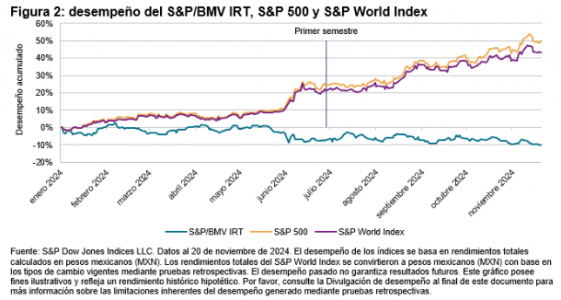

Until 2024, when everything changed. Among the many unprecedented events of the year, the performance of the two markets diverged sharply. The numbers are telling: Wall Street soared in 2024, while the BMV stayed grounded—or perhaps even ventured below ground in its performance over the past year.

On Wall Street, the S&P 500 index—the world’s most prominent benchmark—posted a gain of 24.5% in 2024. The Nasdaq recorded the strongest advance, up 31.9%, driven by the global tech boom. The iconic Dow Jones had a more modest gain of 12.9% for the year. On average, the influential U.S. stock market delivered an impressive gain of 23.1% in 2024.

In past years, this performance would have inevitably boosted the Mexican market. At the beginning of 2024, when Wall Street showed signs of a positive year, many expected the BMV to follow suit. But it didn’t happen. While it’s not the first time this has occurred, it is the first time in modern history that the gap has been so pronounced, with gains in New York and losses in Mexico.

The BMV ended the year with a decline of 14.2%, reflecting the challenging conditions under which the Mexican market operated last year. The other stock exchange in Mexico didn’t fare better, with its 2024 results showing a 16.21% drop, also far from New York’s gains.

What Happened? Why Did U.S. and Mexican Indicators Diverge?

Concerns About Reforms

Throughout the year, various analyses highlighted three main risk factors for Mexico. The performance of its stock market suggests investors validated these concerns.

Like many countries, Mexico held presidential elections last year. The process was historic, not only because a woman assumed the country’s highest political office for the first time but also because of the overwhelming voter turnout and support she received. In this sense, the markets showed no fear. Most analysts and independent experts had all but assured Claudia Sheinbaum’s victory, which indeed came to pass.

However, while the political factor did not present any direct risk for investors, one issue stood out: the reforms promoted by outgoing president Andrés Manuel López Obrador (AMLO)—supported by the incoming president and backed by the ruling party’s decisive legislative majority. The most concerning for markets and investors was the judicial reform, which includes electing judges, magistrates, and Supreme Court justices. Many fear that these officials could be government-aligned appointees.

The judicial reform was approved, and an unprecedented electoral process in Mexico will take place this June. But many doubts remain. As a result, fears deepened in the Mexican market during the second half of the year. The BMV reflected this with a 6.87% drop during that period.

The Insecurity Dilemma

Another negative factor for Mexico is the growing public insecurity, where the news continues to be unfavorable. Surveys of financial analysts now rank insecurity as the top internal risk for the country. This hasn’t been the case in the last three decades, since the era of the peso devaluation and the “tequila effect,” which plunged Mexico into its worst economic crisis to date.

The risks associated with insecurity are closely linked to investments during a crucial moment for Mexico, particularly those driven by nearshoring. Many of these investments are being made in northern Mexico, a region currently experiencing significant insecurity crises, such as in the state of Sinaloa.

After the capture of the historic drug lord Ismael “El Mayo” Zambada, there is concern that the crisis could spill over into other states like Nuevo León, Sonora, Baja California Sur, and Baja California Norte, key destinations for major investments and located near Sinaloa.

External Factors

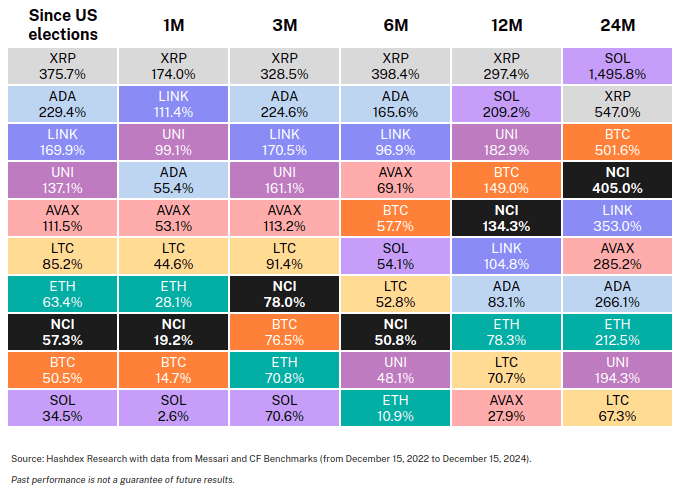

Finally, external elements also contributed to the divergence between the BMV and Wall Street in 2024. One notable factor was the eventual victory of Republican Donald Trump in the November U.S. election. The rest is history.

Unfortunately, the start of 2025 might not bring positive news for the BMV, as Trump assumes office on January 20. Even before taking office, he has threatened Mexico with tariffs on its exports to the U.S. Should these be implemented and persist for a prolonged period, they will undoubtedly impact the Mexican economy.

A New Market Narrative

The time-honored sayings that once linked the trajectories of the BMV and Wall Street may need revising. After all, 2024 was a year of stark contrasts—between heaven and earth—for the two markets.