“There is a structural trend toward the international diversification of assets”

| By Marta Rodriguez | 0 Comentarios

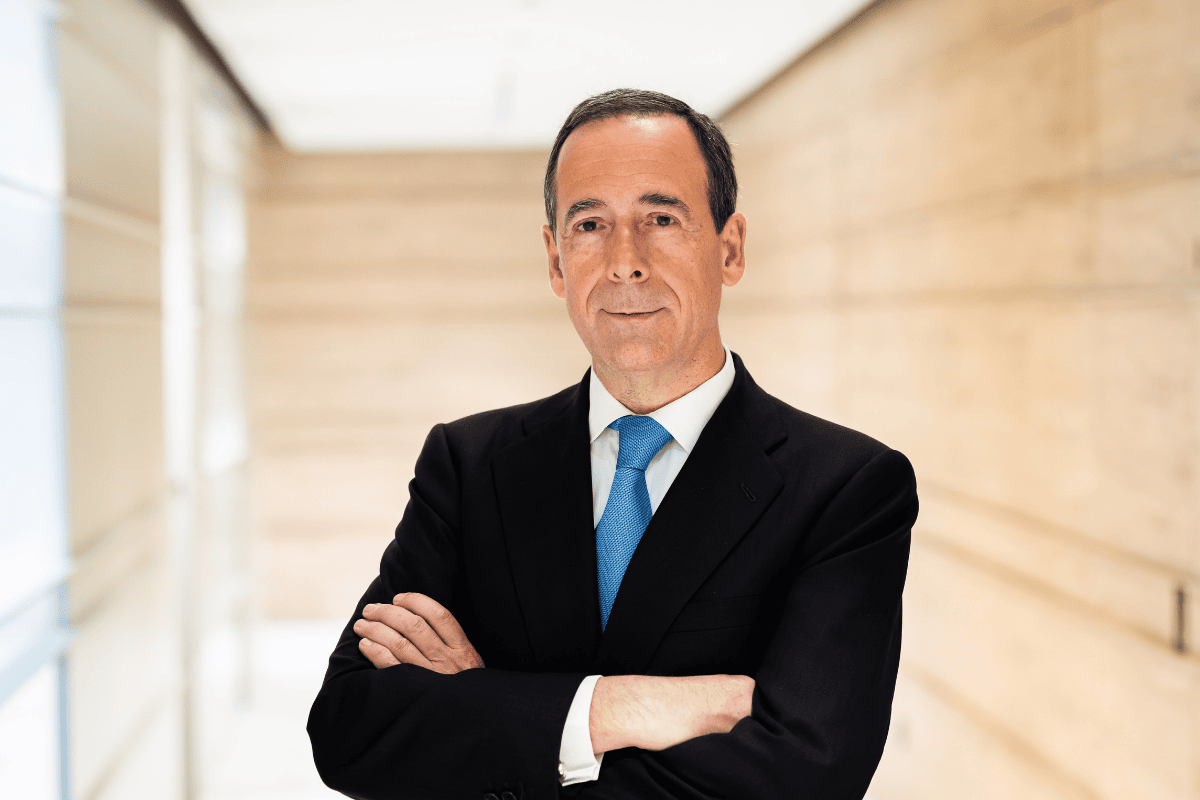

The recent approval of BICE US as a Registered Investment Adviser by the SEC marks a turning point in the institution’s strategy in the United States. “In sophisticated markets, regulation is a key reputational asset,” stated Patricio Ureta, Managing Director, Country Head of BICE US, the platform of the Chilean financial group, emphasizing that the authorization not only expands the company’s operational reach at the federal level, but also strengthens its institutional positioning within the US Offshore ecosystem, as they continue to observe a “structural trend toward the international diversification of assets.”

In an interview with Funds Society, the executive highlighted that from an operational standpoint, SEC registration allows the company to operate throughout the United States, interacting with “global counterparties under a fully recognized regulatory framework.” From a regulatory perspective, it also entails adhering to “the most demanding market standards and to ongoing compliance obligations, in line with international best practices.”

A Reputational Asset for Clients and Counterparties

Beyond the operational impact, SEC approval carries significant weight in terms of credibility. According to Ureta, the registration serves as “a seal of institutional trust, particularly relevant for Latin American clients seeking to structure and manage their wealth in the United States under top-tier standards.”

“For our counterparties, custodians, managers, brokers, and international asset managers, it reinforces the credibility, transparency, and strength of BICE,” he added.

The new regulatory status opens up opportunities to deepen BICE US’s participation in the offshore ecosystem, supporting clients in processes of international diversification, wealth structuring, and access to global opportunities, the executive noted.

“It allows us to move toward more complex advisory mandates,” he explained, “work with family offices, and access alternative managers or co-investment structures, always within the U.S. regulatory framework.”

As a financial group, BICE focuses on corporate banking, investment banking, asset management, and wealth management, primarily oriented toward institutional clients, companies, and high-net-worth individuals. It is part of the Matte Group and, in recent years, has strengthened its international strategy, particularly through BICE US, its U.S.-based platform, from where it serves Latin American clients within the US Offshore ecosystem.

Proximity With Institutional Backing

In a highly competitive market, BICE US seeks to differentiate itself from both large global banks and independent boutiques. Compared to the former, it offers a more personal, flexible, and customized model, while compared to the latter, it brings scale, regional experience, and a solid institutional platform, Ureta detailed.

At this stage, the focus is on HNW and UHNW clients, as well as family offices with sophisticated needs. The firm offers these clients personalized advisory mandates and solutions that integrate wealth planning, alternative assets, and coordination with legal and tax advisors across different jurisdictions.

“We operate under an open architecture model, with a strong focus on fiduciary advisory. This allows us to select products and managers based on the client’s profile and objectives, without conflicts of interest,” the Managing Director explained.

“Guidance is central,” he continued. “It’s not just about building portfolios, but about supporting long-term wealth decisions, especially in contexts of volatility or regulatory and personal changes.”

Investment Trends: ETFs and Alternatives

Ureta noted that today’s clients are “more informed, demanding, and globalized.” In his view, this creates opportunities for platforms like BICE US, which can offer financial education, access to sophisticated products, and strategic support beyond short-term returns. “We see particular value in our capabilities in wealth structuring, co-investments, and the development of tailored solutions,” he added.

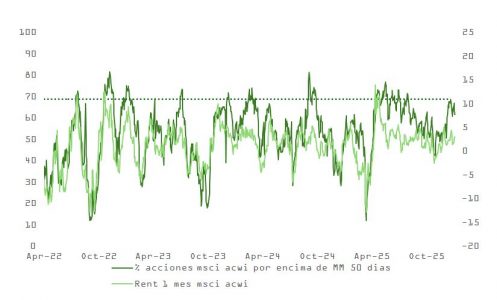

Regarding investment trends, Ureta stated that international diversification into the United States remains structural. In the case of Chile, there have been no significant moves toward capital repatriation following the last electoral cycle, although there have been gradual portfolio rebalancing processes. In the most recent presidential elections, far-right politician José Antonio Kast won the runoff.

Looking ahead to 2026, the executive anticipates that ETFs will continue to play a key role due to their efficiency and liquidity, while alternative assets will keep gaining space in high-net-worth portfolios. Strategically, BICE US will focus on consolidating the platform and scaling in an orderly manner.

“Right now, we are focused on deepening relationships with our clients and counterparties. We are moving step by step,” he concluded.