Markets on Edge Over the New Clash Between Powell and Trump

| By Marta Rodriguez | 0 Comentarios

It seems the Trump administration intends to make the final months of Jerome Powell’s tenure at the Federal Reserve more difficult. Over the weekend, the Department of Justice launched a criminal investigation into the Federal Reserve (Fed) over the renovation of the central bank’s headquarters. Jerome Powell, its chairman, views this as a pretext to escalate pressure on the Fed, as President Trump remains dissatisfied with monetary policy, putting the central bank’s independence at risk.

How Have Markets Responded to This Latest Episode?

According to experts, as in previous cases, the Fed’s lack of independence doesn’t go unnoticed, and markets don’t like it. “The global financial ecosystem has entered a phase of systemic volatility and power realignment reminiscent of periods of intense geopolitical friction in the 20th century. The convergence of an institutional crisis at the heart of the Federal Reserve, an aggressive resource-grabbing policy in the Southern Hemisphere, and escalating tensions in the Arctic and Middle East has fractured the stability narrative that dominated the end of last year,” says Felipe Mendoza, CEO of IMB Capital Quants.

Jon Butcher, Senior U.S. Economist at Aberdeen, notes that the initial market reaction appears negative, with rising risks that a devaluation could weigh on the U.S. dollar, equities, and bonds. In particular, he warns, “the long end of the curve could see an increase in term premiums.” In his view, this also raises questions about the composition of the Fed’s Board of Governors. “A new chair is expected to be appointed this month, likely filling the seat of Stephen Miran, whose term ends on January 31. However, Republican Senator Thom Tillis has stated he will oppose any Fed nomination until this legal matter is fully resolved,” Butcher explains.

Powell’s term as a governor runs through 2028, and he had been expected to step down once his term as chair ends in May. However, his recent statement raises questions about whether he will remain on the Board to defend the Fed’s independence despite legal risks. “Regardless of whether this legal action has merit, it signals the administration’s willingness to continue pressuring the Fed to adopt a more accommodative monetary policy. Given that President Donald Trump is also considering fiscal measures that would widen the deficit, we expect growing concerns over fiscal dominance and the external risk of yield curve control,” Butcher adds.

The Question of Independence

Paul Donovan, Chief Economist at UBS Global Wealth Management, believes that if the move is aimed at weakening the Fed’s independence, it could backfire on the administration. He speculates that Powell now has “less incentive to resign as a Fed governor, given the publicly defiant stance he has taken against this criminal investigation.”

“Trump doesn’t directly appoint the next Fed chair—he only nominates the candidate,” he continues. “That candidate must either be a sitting governor or fill a board vacancy. The Senate must confirm the next Fed chair, and that process could become more complicated if this situation is seen as a direct attack on the central bank’s independence.”

Donovan outlines a more extreme scenario, suggesting that if a future interest rate decision is particularly close, “these explicit attacks on central bank independence could push FOMC members toward a more hawkish stance as a show of autonomy.” In fact, he argues, based on market reactions, that may be the safest response from a bond market perspective. “The need to underline independence could become a key factor in rate-setting, both institutionally and in terms of market consequences,” he emphasizes.

The Gold Market Narrative

For Carsten Menke, Head of Next Generation Research at Julius Baer, it’s clear that concerns over the Fed’s independence are being reflected in the commodities market. “Gold and silver reacted positively to the news, rising 1.5% and 5% respectively in early Monday trading. We see increased interference in the Fed as a clearly bullish wildcard for precious metals in 2026. While silver is expected to respond more strongly to such concerns, we still believe its outperformance relative to gold has become excessive,” says Menke.

He concludes that, although the U.S. dollar is also weakening, the reaction in precious metals markets, especially silver, seems somewhat disproportionate. For Menke, growing interference with the Fed and doubts about its independence are among the main bullish wildcards for precious metals in 2026. “With Powell’s expected departure in May, the future of the Fed’s independence will hinge on whether his successor acts independently or aligns closely with the administration. Ongoing concerns over the Fed’s independence and the U.S. dollar’s status as the world’s reserve currency could drive more safe-haven investment into gold and silver, pushing prices even higher than current levels,” he adds.

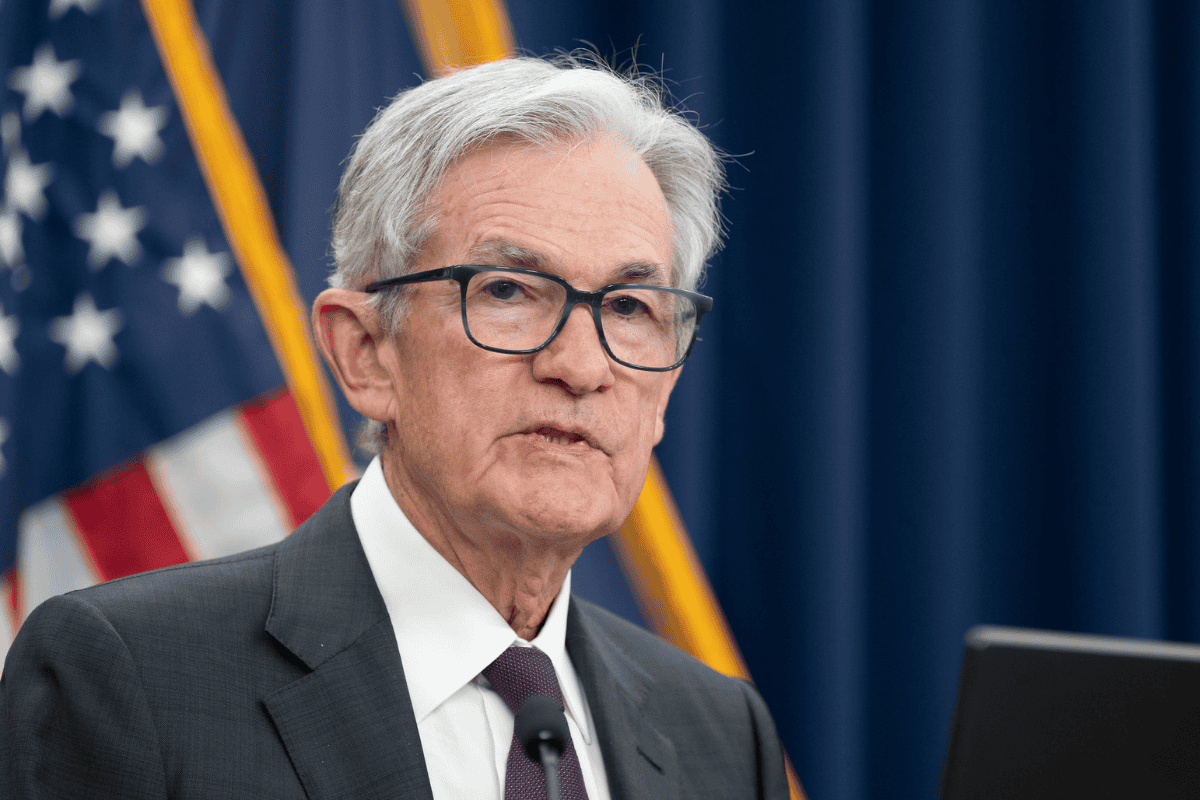

Powell Defends the Fed

In a rare statement from a central bank chair, Powell said the move represents “an unprecedented action” that should be understood “in the broader context of the administration’s threats and continued pressure.” He stated:

“This new threat has nothing to do with my June testimony or the renovation of the Federal Reserve buildings. Nor does it relate to the Congressional oversight function; the Fed, through testimony and other public disclosures, has made every effort to keep Congress informed about the renovation project. These are pretexts. The threat of criminal charges stems from the Federal Reserve setting interest rates based on our best judgment of what serves the public interest, rather than following the President’s preferences. The real issue is whether the Fed will continue to set interest rates based on evidence and economic conditions, or whether monetary policy will be dictated by political pressure or intimidation.”

To help restore confidence in the monetary institution, he added that throughout his service under four different administrations, he has performed his duties without fear or political favoritism, focusing solely on the Fed’s dual mandate of price stability and maximum employment.

“Public service sometimes requires standing firm in the face of threats. I will continue to do the job the Senate confirmed me to do, with integrity and a commitment to serve the American people,” Powell concluded in his statement.