The Market Downturn Is an Opportunity to Rebalance Portfolios: Strategic Outlook, Safe-Haven Assets, and “Cheap” Equities

| By Amaya Uriarte | 0 Comentarios

In a week marked by the release of macro data—including the first-quarter GDP in the U.S.—and the completion of the first 100 days of the Trump Administration, the keyword is confidence. According to international firms in the sector, markets will look for signs and proof of long-term stabilization, such as trade agreements or the action of central banks, to regain confidence. On that path, investors must be prepared to identify opportunities, but also to seek safe-haven assets, as volatility is expected to remain high.

For Benoit Anne, Senior Managing Director of the Strategy and Insights Group at MFS Investment Management, the starting point of all this uncertainty and volatility has been a crisis of credibility in economic policies. “Policy credibility is important and no country is above this basic market law. Apparently, not even the United States. In our view, the most concerning signal seems to come from the U.S. bond market. Although the deterioration of macroeconomic fundamentals should, in principle, have pushed bond yields down, what is happening now is the opposite. In the face of increased risk aversion, U.S. bonds currently do not appear to offer the protection they once did, leading to upward pressure on yields. To be clear, it is still too early to know whether this confidence shock will persist for a long time. Given the extreme level of uncertainty, we believe the market backdrop may change radically in a relatively short time,” acknowledges Anne.

He explains that this “confidence shock” is quite rare and occurs due to a “triangular market correction,” meaning that massive sell-offs occur simultaneously in a country’s Treasury bond market, equity market, and currency market. He notes that historically, this unusual market phenomenon has been observed mainly in emerging markets, such as during episodic financial crises in Brazil or Turkey in the 1990s or 2000s. “However, it is not a phenomenon exclusive to emerging markets. We all probably remember the episode of the UK’s mini-financial crisis in October 2022,” he adds.

Implications for the Investor

In this context, Lombard Odier acknowledges that it has taken advantage of the market downturn to rebalance portfolios and restore strategic equity weightings in multi-asset portfolios. “We continue to overweight fixed income. We believe our base case of slower growth, but without a recession, with interest rate cuts from central banks supports this tactical positioning. We are ready to make further adjustments as the situation evolves, following the steps outlined below,” they explain.

Based on their experience, the question investors should ask is what the path is to restore confidence. In their view, confidence tends to be restored in the markets through the initial attempts to buy assets at low prices. “While equity markets rebounded, other parts of financial markets have remained volatile, preventing this behavior from taking hold. It would be encouraging to see more buying attempts by investors at these levels. That would support other segments of the markets,” they point out.

For Michaël Lok, Group CIO and Co-CEO of UBP, “it is likely that investors will have to continue relying on strategies focused on risk management until markets better absorb the new landscape of growth, inflation, and geopolitics that is taking shape. Tactical risk management has helped us endure one of the biggest market declines since 2020. Gold and cash remain reliable safe havens.”

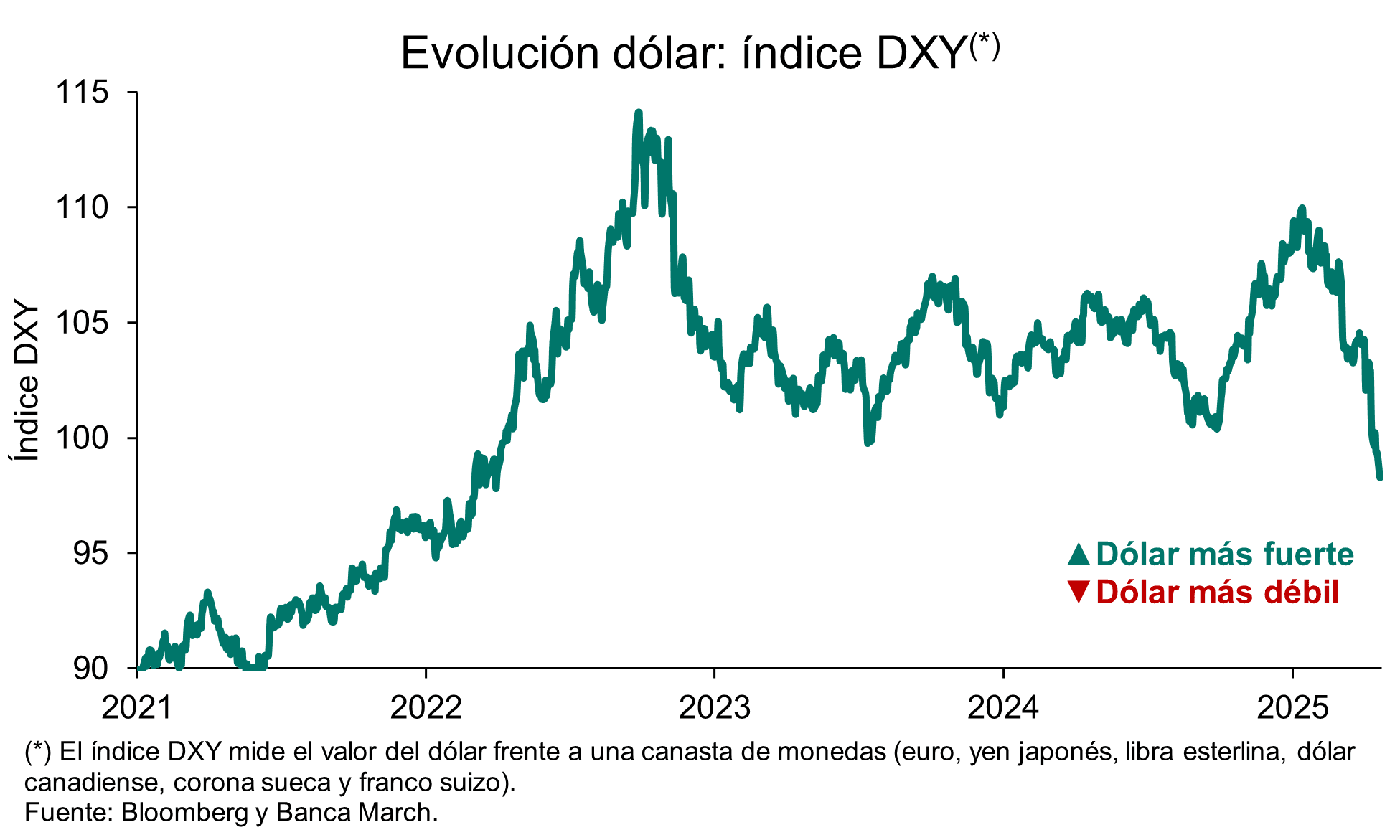

When discussing more reliable assets, MFS IM adds that, leaving aside the U.S. bond market, the best fixed income results will likely be found in asset classes with low duration and low credit risk, along with low correlation to the U.S. “With this in mind, the Global Agg index was the best refuge, with a positive return of 0.83%. The EUR IG also showed great resilience, with a marginally negative return (-0.20%). On the other hand, it is worth noting that local emerging market debt performed well during this period, favored by the weakness of the dollar. The local EM debt index delivered a return of 0.72%. Beyond fixed income, some currencies benefited significantly from the widespread weakness of the dollar. The Swiss franc has risen nearly 8% since April 1, reaffirming its status as a defensive asset. And gold has gained nearly 3.5% during this time,” argues Anne.

Finally, Duncan Lamont, Head of Strategic Research at Schroders, does not believe that investors should close the door on equities. According to Lamont, the market downturn means that the cash you’re considering investing will go further. “Valuations have come down and, in the case of non-U.S. markets, are cheap compared to history. Not too much, but bargains can be found. Even the U.S., which for so long has been an outlier, is quickly converging toward more neutral valuations compared to history,” he notes.

Calm: Declines Are Not Unusual

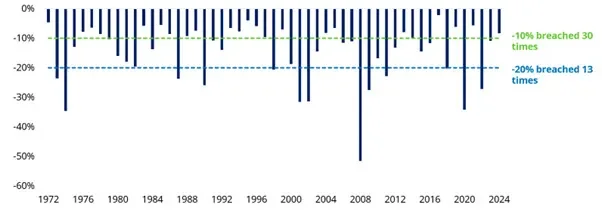

Lamont, Head of Strategic Research at Schroders, reminds us that downturns in equity markets are normal and part of the financial system’s mechanics. In fact, he points out that in global equity markets (represented by the MSCI World Index), 10% drops occurred in 30 of the 53 calendar years prior to 2025. In the past decade, this includes 2015, 2016, 2018, 2020, 2022, and 2023. Meanwhile, more significant declines of 20% occurred in 13 of the 52 years—once every four years on average. But if it happens this year, it would make it four times in the last eight years: in 2018, 2020, and 2022.

“That markets fall is nothing new, but that doesn’t prevent the feeling of panic from taking hold of investors. The stock market falls by 20% once every four years on average, and by 10% in most years. It’s easy to forget this. Even if you’re an experienced investor, how much comfort does that bring you when you’re in the thick of it? The simple reality is that the stock market has tremendous power to help grow wealth over the long term, but short-term volatility and the risk of drawdowns are the toll to pay,” points out Lamont.

The reading made by Union Bancaire Privée (UBP) is that markets appear to be focusing on weaker growth (the first impact) and a “transitory” rise in inflation, as described by Fed Chair Jerome Powell in his March press conference.

“In fact, 5-year inflation expectations are now at their lowest level in comparison with their 2-year counterparts since 1980 (outside of the initial deflationary shock of the 2020 global pandemic), which suggests that markets are not focusing on medium-term inflation concerns and instead, U.S. Treasury yields are closer to pricing in a recessionary environment—that is, weak growth and weak inflation in the medium term,” they point out in their April “House View” report, titled “Navigating Market Instability.”

In fact, UBP highlights that despite equity market declines, global equity valuations have returned to nearly historical averages.

“This suggests that markets are no longer discounting a repeat of the economic and corporate earnings boom centered in the U.S. in 2017, which occurred in the first year of Trump’s term. Instead, they reflect expectations of more moderate, though still favorable, economic and earnings growth. However, these more moderate expectations do not reach the recessionary scenario that bond markets are increasingly pricing in,” they indicate.