Creand Wealth Management, an entity specialized in private banking, addresses how financial markets have behaved after those periods of crisis, with the aim of analyzing how long they took to recover and observing the impact of those crises on the development of stock markets in the medium and long term.

The Dot-Com Bubble (1999–2000)

The dot-com bubble crisis refers to the period between the end of the 20th century and the beginning of the 21st, where companies whose business was based on technological advances experienced very rapid growth, which led to problems derived from the lack of knowledge about those new business models and a miscalculation regarding expectations of profit generation.

This crisis gave rise to the massive bankruptcy of tech companies and a reduction of jobs related to the sector, with a drop of more than 82% in the Nasdaq-100, the U.S. stock index that includes the 100 most important technology companies, during the period between March 27, 2000, and October 9, 2002. The index took 15 years to recover, although the growth experienced since 2015 has allowed it to increase its stock market value by 405% over the last decade.

The Global Financial Crisis (2007–2008)

This was the most serious financial crisis since the Great Depression of 1929, caused by a situation where excess credit and laxity in granting mortgages to people with low credit profiles (subprime) converged. Mortgage debts multiplied, causing a wave of foreclosures that ultimately pushed systemic entities into bankruptcy, such as the case of Lehman Brothers in September 2008. This situation led to a global crisis of confidence and a freeze in credit granted to both companies and individuals.

This crisis caused a sustained drop in financial markets globally, which lasted until 2010. If we take the MSCI World index as a reference, a broad global equity index that represents the performance of mid- and large-cap equity, markets took almost six years (February 2013) to reach the highs prior to the crisis.

The European Sovereign Debt Crisis and the Euro Crisis (2010–2012)

The increase in public and private debt levels worldwide, to stimulate growth and rescue entities after the great financial crisis, fostered a breeding ground that led to a sovereign debt crisis, a banking system crisis, and an economic system crisis in the European Union. This scenario triggered a wave of downgrades in the credit ratings of several European states’ government debt.

The impact was especially significant in countries like Spain, Italy, Portugal, and Greece, whose chronic deficit levels worsened due to a lack of control. The loss of confidence in these markets caused a sell-off of debt from countries with higher exposure to risk and an increase in the risk premium that led to a generalized loss of confidence.

If we take as a reference the evolution of the main indices of Spain and Italy, the two most important economies in the eurozone that suffered the impact of the debt crisis, we observe that in Spain, the Ibex has not returned to the levels of 11,900 points until January 2025, despite already coming from a downward trend due to the 2007 crisis, when it had reached its all-time highs, standing at 15,945 points in November 2007.

In the case of Italy, its benchmark index, the FTSE MIB, suffered a 72% drop from May 18, 2007, to March 9, 2009. After a slight recovery during that year, it took almost nine years to recover the levels reached in September 2009 (23,900), in April 2018.

The Market Drop Due to the COVID-19 Pandemic (2020)

The global pandemic caused by COVID-19 is another example of a black swan for markets. It unexpectedly affected the entire planet at the beginning of 2020, and caused lockdowns and closures never before seen worldwide. Taking the MSCI World as a reference, in just two months, markets fell 34%, from February to March 2020, as a result of nervousness and the paralysis of economic activity. In fact, two of the five largest stock market crashes in history occurred almost consecutively during the first days of the health crisis, on 03/12/20 (-9.9%) and 03/16/20 (-9.9%).

Despite that nearly 20% drop between January and March 2020, the recovery was also very fast. Markets had already recovered pre-pandemic levels by December of that same year and, from that moment on, stock markets have experienced robust growth, driven by the momentum of large technology companies.

The Impact of Global Inflation and Restrictive Monetary Policies (2021–2025)

After the COVID-19 pandemic, the global economy faced a scenario of rising energy prices, never-before-seen fiscal stimulus, and a supply chain crisis that caused a significant increase in global inflation. The rise in prices, along with restrictive monetary policies by major central banks, posed some challenges for the economy: minimizing the rising cost of credit and the drop in investment and consumption, market volatility, and the risk of economic stagnation.

Nonetheless, the impact was limited in the markets. According to the MSCI World, from the historical high reached in December 2021 up to that moment—when markets were riding a bullish trend driven by the progressive return to post-COVID-19 normalcy—stock markets took 26 months to recover (February 2024), and from that moment, they have experienced sustained growth.

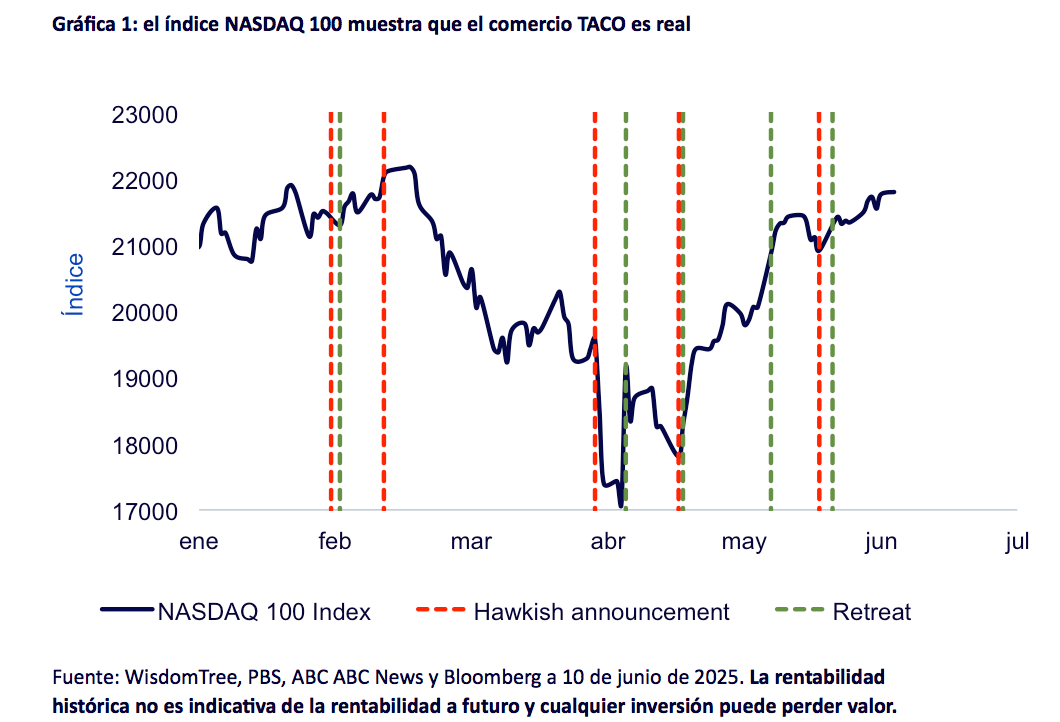

The Return of Donald Trump to the U.S. Presidency (2025)

The growth potential of the markets in recent years, mainly under the momentum of technology companies, has been halted following the arrival of Donald Trump to the presidency of the U.S., in his second term. His aggressive tariff policy has caused declines greater than 10% in financial markets globally. The MSCI World fell 11.29% and recovered the levels prior to the announcement (3,668 points) on May 1, 2025. In particular, markets suffered major declines after the so-called Liberation Day, last April 2, when Trump announced his massive tariff package. However, it is still too early to see the short- and medium-term impact and how the stock markets will recover.

Patience, Discipline, and Diversification

In a financial environment that is in constant change and evolution, black swans—those unpredictable surprises that can drastically alter markets—will always be present. From economic crises to global pandemics, events that seem distant and unlikely can happen at any moment and affect the stability of assets and challenge traditional strategies. However, history teaches a fundamental lesson: patience and discipline, along with proper diversification, are the keys to surviving and thriving in times of uncertainty.

Remaining invested during sharp downturns, far from being a risky strategy, is actually one of the most prudent decisions an investor can make. Juan Litrán, analyst at Creand Family Office, explains that “market corrections, no matter how painful they may seem in the short term, have historically been the breeding ground for long-term opportunities. Black swans, though challenging, also bring with them a market recalibration that, for those who stay true to their diversified investment strategies, offers significant returns once the volatility is overcome.”

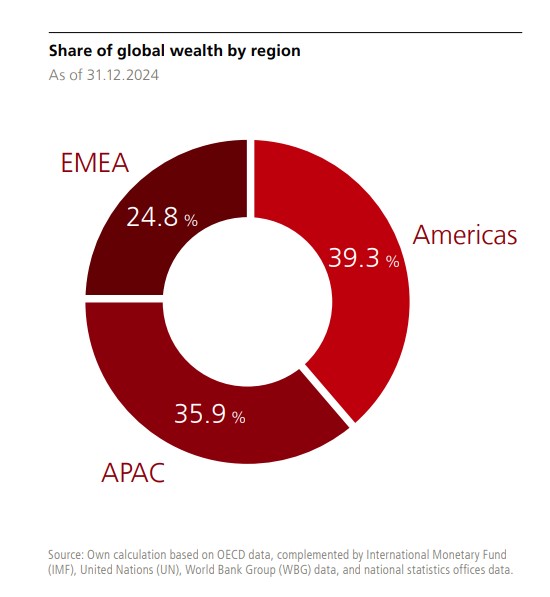

On the other hand, diversification, far from being just a technique to mitigate risks, becomes a lifeline in the face of global uncertainty. According to Litrán, “by spreading risk across different asset classes, sectors, and geographies, investors not only protect their portfolio against the unexpected, but also position themselves to capture growth when the market recovers.”

Thus, what today seems like a black swan, with the passage of time, can be perceived as an opportunity. “That is why it is essential that investors do not get carried away by emotions or panic that distance them from their long-term goal. Investing requires vision, discipline, and above all, a well-diversified strategy that withstands the test of time, even in the most turbulent moments,” adds Litrán.