Euronext Prepares Its Unified ETF Trading Platform to End Fragmentation in This Market

| By Amaya Uriarte | 0 Comentarios

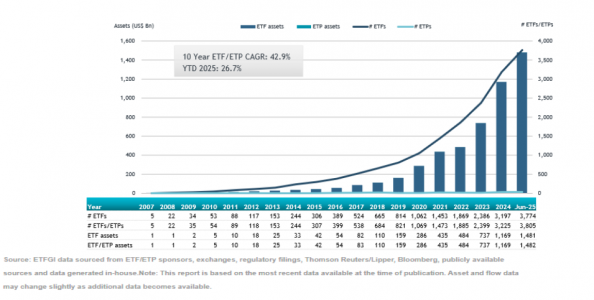

The ETF industry in Europe is growing rapidly, and Euronext aims to be a key player in it: it has advanced plans to launch a unified trading platform for European exchange-traded funds, Euronext ETF Europe.

It will be operational starting in September of this year, initially concentrating the liquidity of Euronext Paris and Euronext Amsterdam; Borsa Italiana (Euronext Milan) will be added in the “medium term.” Funds Society has learned the details surrounding its operation from Aurélien Narminio, head of Indices, ETFs and Securitised Derivatives at Euronext.

Narminio explains that the current situation in Europe means an ETF is listed an average of three and a half times on different exchanges. “There are Euronext-operated listing platforms that are quite significant in the European ETF market: these are the Euronext Amsterdam, Euronext Paris, and Euronext Milan locations,” he says.

Therefore, Narminio continues, although everything is traded in the same data center and through the same firm, teams, market rules, etc., ETF issuers must list multiple times on different Euronext markets in order to distribute a given ETF to all the target end investors, especially retail investors. “This means that, for example, to reach the French retail market, listing in Milan is often not enough, as their brokers operate in isolation for reasons related to post-trade.”

According to the expert, this implies that if a trade is executed on a certain platform, it is settled in a specific infrastructure based on where it was matched. Therefore, “what we are doing with Euronext ETF Europe is creating the conditions so that multiple or cross listings become irrelevant and unnecessary.”

With the launch of Euronext ETF Europe, a single listing on any Euronext platform will be sufficient, with the same price and operating conditions for any investor, regardless of the intermediary. To achieve this, Euronext will ensure that all exchange members trading ETFs are connected to all platforms so they can trade all products seamlessly. It will also ensure that post-trade chains are unified and optimized, thanks to Euronext’s own clearing house (Euronext Clearing) and central securities depository (CSD). Behind this entire operation is the goal of eliminating “one of the problems of the European ETF market: fragmentation.”

This situation “fragments order books and liquidity,” which, according to Narminio, “generates additional costs and inefficiencies between buyers and sellers.” Now, by concentrating all available liquidity at Euronext into a single order book per ETF, “it achieves spread compression and reduces trading costs for investors, while increasing efficiency and transparency.”

Ultimately, the project is an attempt to “radically simplify the market” while creating a “pan-European ETF market.” Moreover, it’s not a project that was designed “in a dark room,” but rather one that clients “have been requesting for a long time.” In fact, Narminio notes that “it’s one of the problems that likely holds back the growth of European ETFs compared to U.S. ones.”

This new platform will be available to both retail and institutional investors, he explains. The goal of the project is that any connected member anywhere in Euronext can access ETFs in the same way, at the same cost, and with the same post-trade configurations. “Obviously, there are nuances due to the numerous technical specificities, but that is essentially the model,” he states, going further to say that with this solution applied to a specific product like ETFs, “we are, in a way, implementing the vision of a single savings and investment union.”

The platform’s operability—whose technical aspects are handled internally by Euronext through its Optiq trading system—is ready for a hypothetical short-term implementation of T+1 settlement. “It’s not a determining factor nor has a significant impact,” he states, explaining that with Euronext ETF Europe, settlement is simplified and the number of instructions in the market is reduced: “it’s a small step in the right direction.”

One of the consequences of the implementation of Euronext ETF Europe is that the number of ETFs listed on Euronext will be streamlined. Narminio explains that they currently have around 4,000 ETFs with a single listing, but admits there are products with double and triple listings. “The idea now is to gradually reduce the number of products with double and triple listings because the model is one listing per product,” he clarifies.

Starting in September, issuers with ETFs listed on multiple Euronext locations will choose which domestic Euronext venue they want to remain listed on. The new platform will then combine liquidity with the other Euronext venues.

At this point, he admits that they are working “closely” with issuers to streamline their portfolios. “We will do it gradually, so everything is properly tested, and we can ensure that client access works correctly,” says the executive, who, although aware that it will be a time-consuming process, is confident that starting in September, it will begin with the major issuers.

Narminio explains that the good thing about the ETF market is that there is significant market concentration; there are dozens of issuers, some of them quite large, with whom they are collaborating because they share interests: “For us, it’s about reducing trading costs and improving ETF trading conditions in Europe. For them, it means improving their distribution by gaining greater leverage through a single listing and lowering access costs to their products for their investors,” he explains, concluding that “this is a major coordinated change at the industry level.”