Do Nvidia’s Results Silence the AI Debate?

| By Amaya Uriarte | 0 Comentarios

Amid the emerging debate over whether an AI bubble is forming—or already exists—what do the results of the tech giant mean?

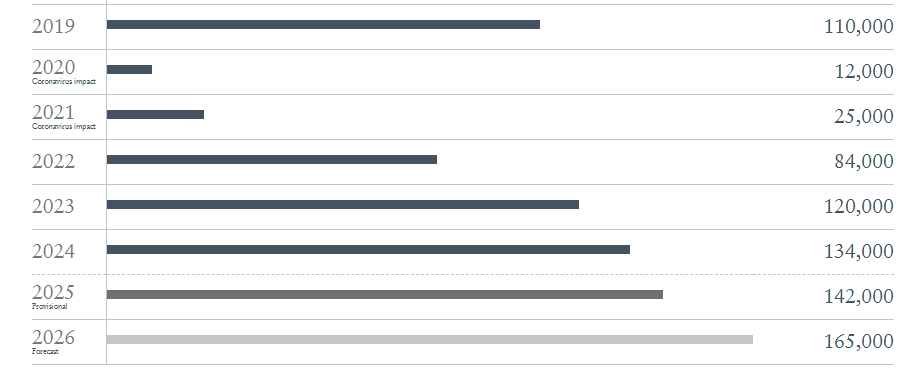

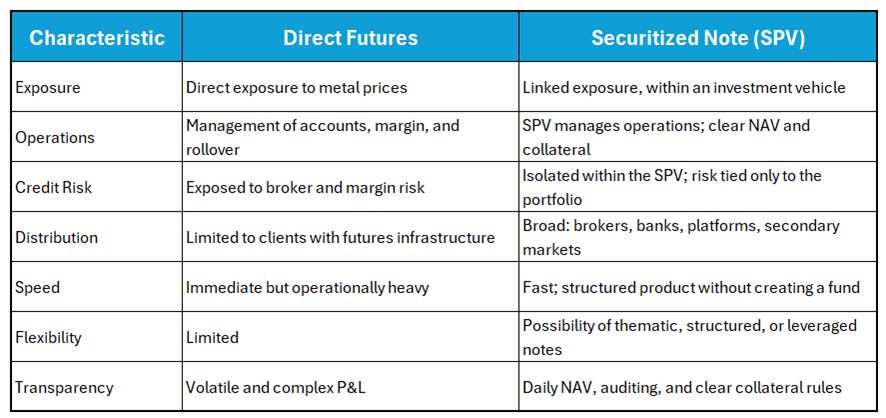

According to Richard Clode, portfolio manager of the Global Technology Leaders team at Janus Henderson, Nvidia exceeded expectations, reaccelerating growth and having already presented at its recent GTC Washington event a roadmap to reach over $300 billion in data center sales next year. He stated that this week’s agreements with HUMAIN Saudi Arabia and Anthropic contributed to that figure.

In fact, after the presentation, Nvidia’s shares surged sharply after market close, following the chipmaker’s release of a strong revenue forecast for the current quarter, reinforcing investor confidence in the growth of artificial intelligence (AI).

“The buyers’ forecasts remain well ahead of the formal consensus of the sellers, so the overnight upgrades are more of a catch-up. Still, the shares are trading at a valuation far from exaggerated, which remains a key response to recent concerns about the AI bubble and comparisons with the year 2000,” comments Clode.

Dispelling Fears

According to experts at Banca March, recent fears surrounding investment in artificial intelligence are easing after another quarter in which expectations were not only met but exceeded. “The fervor continues in a changing environment. For now, the more skeptical voices are quieting—at least until the next earnings report in February,” note the Banca March experts in their analysis.

At UBS Global Wealth Management, they believe that the continuation of investments in AI, the strong financial health of major tech firms, and the growing evidence of AI monetization reinforce their conviction that the global equity rally still has room to run in the coming months.

“Without taking positions on individual companies, we believe that having sufficient exposure to AI-related stocks is key to building and preserving long-term wealth. Investors should ensure they are present across the entire AI value chain, including the intelligence and application layers, as well as the enabling layer,” states Mark Haefele, CIO at UBS GWM.

The Concerns

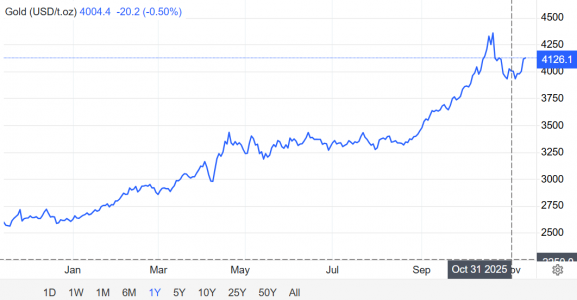

However, other recent concerns have included Michael Burry’s short thesis on hyperscalers exaggerating their earnings through the underestimation of depreciation, circular financing, and recent deals with competitors’ clients. In this regard, Charlotte Daughtrey, Director of Equities Investments at Federated Hermes Limited, points out that this is more of a reality check amid the AI boom. “The market has been under pressure this week due to a drop in investor sentiment amid growing doubts about the sustainability of the AI boom. However, Nvidia’s excellent earnings provided a bright spot, reinforcing strong demand for AI infrastructure,” she explains.

Meanwhile, Patrick Artus, Senior Economic Advisor at Ostrum AM, an affiliate of Natixis IM, highlights three areas of concern in his latest analysis regarding this boom: the weight of the sectors that will be heavily affected by AI, with estimates varying widely; whether AI will complement or replace employment, which will determine macroeconomic productivity gains or losses; and who will benefit from the profits generated by AI, depending on whether the AI producer market is competitive or oligopolistic.

According to Artus, the most favorable outcomes for the economy would occur if AI impacts many sectors, complements employment, and AI users capture the majority of the gains.