The publication of the Fed minutes has led the market to drastically lower the probability of a 25-basis-point cut in December, from around 75% at the beginning of the month to just 37%. The minutes confirmed the lack of consensus that had already been sensed when, in September, only 10 of the 19 FOMC members supported cuts in both October and December.

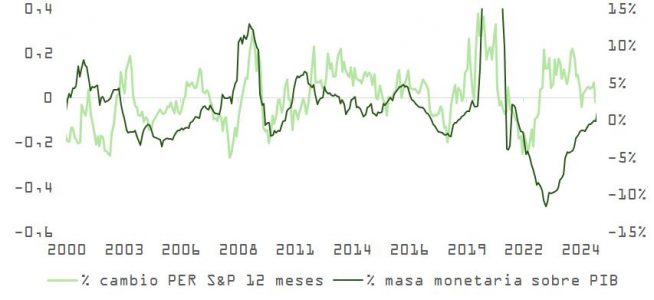

The underlying bias remains “dovish,” and there is agreement that more cuts will come later, but many members prefer not to act in the final meeting of 2025. If they don’t cut now, it is likely they will do so on January 28; what is relevant is that the market has stopped seeing a “guaranteed rate-cut cycle,” and that nuance has weighed on risk assets.

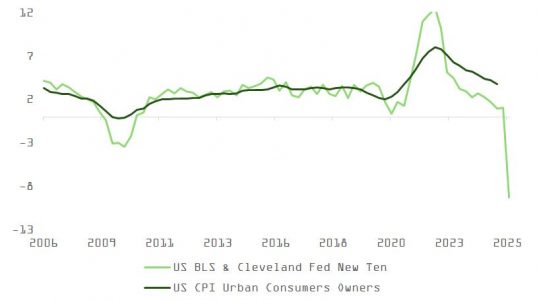

Although there was discussion of financial conditions, private credit, and valuations (“some participants commented on stretched valuations in financial markets”), the central message was a rise in concern about a possible inflation rebound—more explicit than in recent public statements.

Schmid Versus Waller: Two Interpretations of the Same Cycle

In this context, the statements by Schmid, president of the Kansas Fed and the only vote against the October cut, stand out. In his view, inflation remains a broad phenomenon, persistently above 2%, while growth remains reasonable and the labor market is, overall, balanced.

This view contrasts with that of Christopher Waller, one of the most “dovish” members, who is more concerned about the risk of an economic slowdown. The debate between them encapsulates the current discussion well: is it more important to finish bringing inflation under control or to avoid excessive deterioration in employment and credit? The answer will shape the pace of cuts in 2025–2026.

A Labor Market That Doesn’t Settle the Debate

The September employment report does not settle the debate either. The U.S. economy created 119,000 jobs, above expectations, with gains concentrated in healthcare, food and beverages, and social assistance.

On the other hand, revisions to July and August subtracted 33,000 jobs, and the three-month moving average rose from 29,000 to 62,000 new payrolls, within the range that the Dallas Fed considers consistent with a stable unemployment rate. Even so, the more pessimistic analysts will rely on the monthly upside surprise to justify a less generous Fed and a slightly more strained long end of the yield curve.

The labor force participation rate rose from 62.3% to 62.4%, and the unemployment rate ticked up from 4.3% to 4.44%, very much in line with the Chicago Fed’s real-time employment model. The reasonable reading is that labor demand has increased, in a context of immigration restrictions and the gradual exit of the baby boomers, while the labor supply remains relatively scarce. This point raises some doubts about the balance between labor demand and supply.

Inflation, Productivity, and the Fed’s Room for Maneuver

If this diagnosis is correct, the possibility of a positive surprise on inflation in 2026 gains weight. The rising cost of certain goods could also affect spending on services (“crowding out”), the moderation in housing costs—the main component of the CPI—would continue, and the productivity gains associated with digitalization and AI are, by definition, disinflationary.

In that scenario, the Fed could continue cutting rates with somewhat more confidence, unlike in recent quarters, when each inflation reading reinforced caution. It is worth remembering that the Fed’s year-end unemployment target is 4.4%, and we are already slightly above that. This provides some room to prioritize anchoring inflation expectations without completely stifling activity.

Nvidia and the Verdict on the “AI Bubble”

Despite the relevance of the minutes and the labor market after the shutdown, investors’ attention was focused on Nvidia’s earnings, which became a referendum on the sustainability of the investment boom in artificial intelligence.

Jensen Huang, the company’s CEO, was clear from the start: “Demand for AI infrastructure continues to exceed our expectations,” dismissing the idea of an imminent slowdown in the investment cycle. Nvidia claims to have visibility on around $500 billion in potential revenue from its Blackwell and Rubin platforms through the end of 2026—a figure presented more as demand commitments than secured sales, but whose scale and time horizon remain highly significant.

Revenue from H10 GPUs for China is around $50 million and currently marginal. Any easing of trade restrictions between the United States and China could, therefore, generate a significant additional boost on a margin base close to 70%.

Circularity, Software Pricing, and GPU Lifespan

At the same time, news of the joint investment by Microsoft and Nvidia in Anthropic or the $100 billion program by Brookfield—also involving Nvidia and KIA—fuels the narrative about risks of “circularity” in the AI ecosystem: the same actors that sell hardware participate in financing clients and projects.

However, other developments point in the opposite direction. Alphabet has raised prices for Gemini 3 Pro by around 20% compared to the previous version, disproving the idea that AI software is being “commoditized.” The Ramp AI Index also indicates that nearly half of U.S. companies already have a paid subscription to AI tools, suggesting a growing base of recurring revenue.

On another note, a recent Bernstein report challenges Michael Burry’s thesis on GPU lifespan: the evidence points to depreciation horizons closer to six years than two. Nvidia insists that its software and parallel computing platform extend the economic life of its chips. If data centers extract more years of use from each hardware generation, ROIC improves and the narrative of “irrational capex” without return is weakened.

Nvidia as Architect of AI Infrastructure

The quarterly figures also reflect a qualitative shift: data center revenue is up 66%, and networking revenue is up 162%, reinforcing the perception of Nvidia not only as a GPU manufacturer but as a full architect of AI data centers (computing, networking, and software), capturing an increasing share of the value stack.

This result reduces the risk of a short-term “earnings cliff” and strengthens the thesis of an AI “supercycle,” though it does not eliminate all doubts. It is clear that Huang will never openly acknowledge a capex bubble, but it is also true that in two or three years, investors will demand tangible cash flows to justify the investments announced for 2026–2028. We are not yet at that point of maximum scrutiny.

Implications for Investors: Rates, AI, and the S&P 500 Over 12 Months

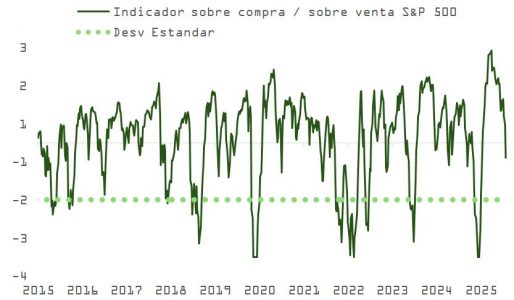

The recent declines seem to respond to technical and sentiment-driven factors. The market may continue to correct, but it already shows signs of being oversold, with a mood dominated by caution and even fear. It does not seem likely that AI investment will collapse in the next 12 months; the project pipeline remains substantial, and the debate is more about the pace of growth than its continuation.

With a Fed still in a rate-cutting phase, a money supply with room for expansion (especially if asset purchase programs are reactivated), and a positive fiscal impulse heading into 2026, the probability of a recession is not high, and it is feasible that, as our model indicates, corporate earnings will post growth above their historical average. In this context, an S&P 500 in the range of 7,100 – 7,700 points over 12 months is perfectly plausible, even considering some degree of multiple compression.

For investors, the key issue is not so much anticipating the next headline—a slightly more “hawkish” tone from the Fed or a renewed debate about an AI bubble—as it is seizing volatility to strengthen positions in quality assets with the ability to generate sustainable earnings in an environment of moderately lower interest rates and rising productivity driven by AI itself.