The Unsung Heroes of COVID-19 Equity Markets

| By Cecilia Prieto | 0 Comentarios

As has been well-documented, equity markets were quick to recognize the increase in demand for many online services and businesses ranging from Amazon to Zoom (with many more in between). Many, including the FAANG stocks, have escalated in value as retail investors with their stimulus checks, as well as institutions, have piled back into equity markets since the March 2020 plunge. However, the ability of many of those businesses to deliver their virtual goods and services is dependent on the infrastructure that they use.

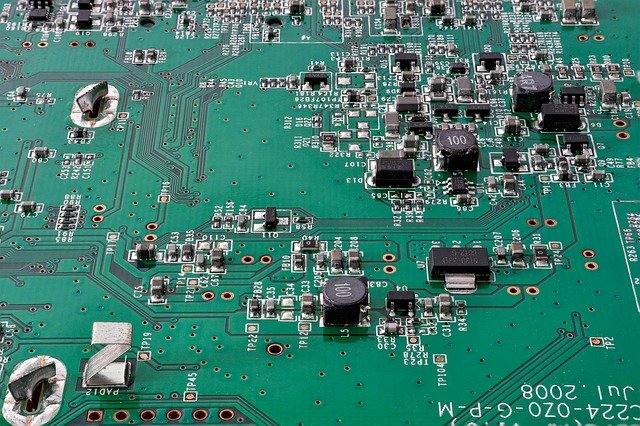

Perhaps somewhat overlooked are data center and semiconductor businesses, particularly memory chips vital to facilitating the digital economy. Despite their criticality to the digital economy and their ability to generate attractive cash flows and returns on capital, memory stocks continue to trade at a discount to other semiconductor and IT-related stocks. There is also a shortage of supply of the chips needed for many applications, including automotive, which should increase producer value until supply catches up. It typically takes more than two years to build a fabrication facility and ramp up production.

While we are generally bullish on the digital economy, we are finding attractive prospects in ‘old’ economy companies as well. Large U.S.-based banks are well capitalized and have been conservative in provisioning for potential risks in their loan and credit card portfolios during the COVID crisis. Given the significant support from the Fed and the U.S. government through the crisis, the economy has held up relatively well, all things considered.

This suggests that banks may end up overcompensating for loan losses, which could drive provision reversals in later periods, further supporting earnings growth. Additionally, banks stand to benefit from a rise in rates over time. As we look forward, we are encouraged by banks that are investing materially in digital transformation and innovation, such as developing attractive and convenient-to-use apps and tools for consumers and businesses. We believe this should improve the value-add to customers while driving operational efficiencies at the banks themselves. Despite strong balance sheets, prudent provisioning, stable underlying trends and investments on innovation, some of these banks generally trade at a fraction of book value, making an attractive entry point for potential investors.

Long-Term Thinking During a Period of Rapid Change

In a period of great innovation, disruption and high valuations, like we are experiencing today, we need to look beyond the very near-term and consider the medium- to long-term opportunities for a business and how it is allocating capital to support those objectives. If a company is investing in a large market opportunity with attractive returns at maturity, we welcome them investing heavily today for a much larger payoff tomorrow. The investments often obfuscate the true earnings power of the business and may make it seem expensive on statistical measures, but those investments may end up creating significant value for shareholders over time.

In today’s environment, a process that relies on deep fundamental research to narrow the universe of stocks by looking for strong companies driving idea generation, and which utilizes an intrinsic value framework in an attempt to understand the likelihood of a business’ ability to create long-term value, may have an advantage. Market commentators and investors often attempt to assess valuations and opportunities simply on near-term statistical metrics, such as a P/E or a P/B multiple. These can be useful datapoints but do not paint the complete picture of whether a business is fairly valued. We believe that investors should more thoroughly analyze and determine a security’s intrinsic value before placing it into a portfolio.

The recent increase in retail participation in equity markets means more investors competing in the market, which, ultimately, should make the markets more efficient with periods of excessive price moves. However, increased market efficiency also means that simple strategies utilizing easily accessed valuation multiples or other metrics will create little to no excess returns on average. In fact, greater retail participation will mean that achieving alpha returns consistently will require a well-thought-out investment philosophy and rigorous process to add value over time.

ESG Considerations Should Be Part of Any Investment Process

ESG (environmental, social and governance) considerations provide investors with an expanded toolkit for assessing whether a business is creating value for all its stakeholders, from employees to its community to shareholders. ESG also provides insight into analyzing a business’s go-forward prospects—a lens on whether that company is competing in expanding or contracting markets due to evolving environmental or regulatory considerations. Governance is another important set of issues where poor practice can lead to substantial corporate risk such as expensive legal actions and negative publicity. These insights about where risks lie are crucial in determining what the business is worth and providing effective stewardship of the investment.

So Where Do We Go from Here

While COVID accelerated many changes around the globe, equity markets rewarded many companies that were active in preparing for their future. We believe that investors should also be active and diligent with their investment allocations going forward. Opportunities abound for those that are doing the deep fundamental research on the securities that they own, who take a long-term view, and incorporate ESG considerations so that they have an even broader understanding of the risks and opportunities that each company faces.

Miguel Oleaga is a portfolio manager and managing director at Thornburg Investment Management.

Founded in 1982, Thornburg Investment Management is a privately-owned global investment firm that offers a range of multi-strategy solutions for institutions and financial advisors around the world. A recognized leader in fixed income, equity, and alternatives investing, the firm oversees US$45 billion ($43.3 billion in assets under management and $1.8 billion in assets under advisement) as of 31 December 2020 across mutual funds, institutional accounts, separate accounts for high-net-worth investors, and UCITS funds for non-U.S. investors. Thornburg is headquartered in Santa Fe, New Mexico, USA, with additional offices in London, Hong Kong and Shanghai.

For more information, please visit www.thornburg.com