Jim Caron (Morgan Stanley IM): “Investing Today Requires Looking Beyond Tariffs: Fiscal Policy and Deregulation Are Game Changers”

| By Amaya Uriarte | 0 Comentarios

Equities have risen steadily throughout 2025, even in the face of geopolitical uncertainty and market volatility. In the opinion of Jim Caron, Head of Macro Strategies for Fixed Income and Portfolio Manager at Morgan Stanley IM, and despite his fixed income focus, the standout asset this year has been equities: “Valuations and price levels have continued to rise steadily despite general and geopolitical uncertainty. This asset class has proven resilient to crises, recovering more strongly after each downturn.” With two months left in the year, the manager offered an early assessment of 2025 in his latest interview with Funds Society.

What is your assessment of the performance of the main asset classes so far this year?

We’re in a year where both fiscal and monetary policy appear to be working in tandem, resulting in a revival of both equity and bond assets. Fiscal stimulus and monetary easing can be observed in Germany, Japan, and the United States, which favors equities. In the U.S. and Europe, monetary policy is easing, which benefits bonds. Only the Bank of Japan is gradually raising interest rates, and even then, from very low levels.

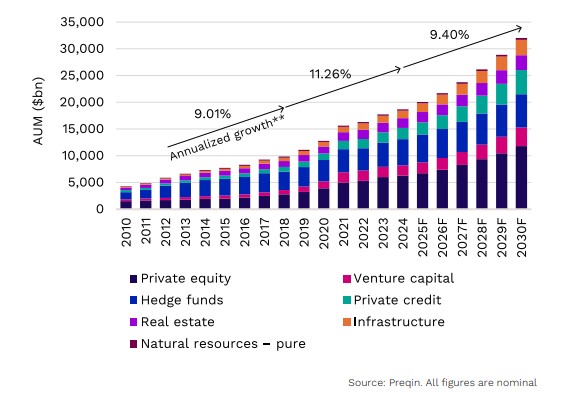

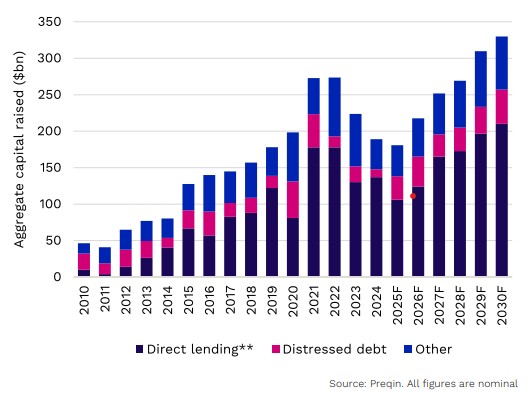

The alternatives landscape is mixed. Private credit has been well-valued and has recently entered a phase of stress. Private equity, on the other hand, seems to have stabilized at lower levels, and for those with patience, this may be a good time to gain exposure.

2025 has been marked by Trump, geopolitics, and monetary policy. How has this impacted and changed how managers have approached investment opportunities this year?

Investment managers have learned to analyze policy holistically. Beyond tariffs, which are negative, these are offset by deregulation and fiscal stimulus policies, which are positive. The key lies in considering all three factors and not focusing solely on tariffs in order to have a global view and assess the net effect of tariffs, fiscal policy, and deregulation on asset performance. So far, the net balance is positive for the market.

Looking ahead to 2026: what do you think will be the main themes to watch next year?

The labor market is fundamental. If the labor market weakens significantly, consumption and profit margins will suffer. This will lead to more layoffs and a decline in consumption and GDP. That’s the main focus. Business investment, capital spending, and whether these will not only continue in 2026 but also lead to greater economic productivity supporting potential growth, earnings, and valuations are also being closely watched.

More and more institutional investors are demanding customized solutions over standardized products. What types of tailored structures or strategies are you developing to meet this need?

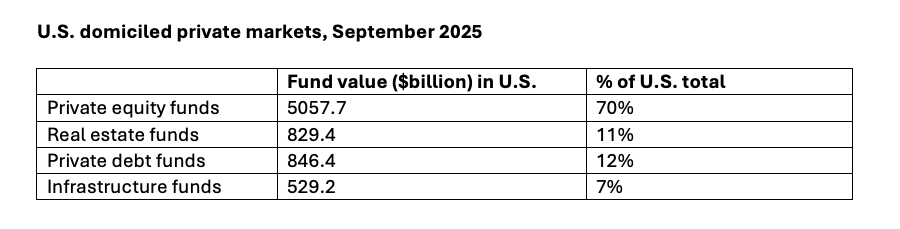

This is a broad area, but let me highlight one example. Many investors are seeking to incorporate both public and private markets into their portfolios. Return objectives and liquidity needs are not uniform, so customized solutions are essential. Our team has been designing and managing portfolio risk across public and private markets for nearly 20 years. This type of strategy was primarily used for institutions, OCIOs, and high-net-worth investors. However, today we can offer more personalized portfolio solutions in both public and private markets to clients with a much lower minimum investment requirement.

The Portfolio Solutions Group is described as an innovation “laboratory” in asset management. How are you integrating quantitative tools, artificial intelligence, or advanced optimization models into the asset allocation process?

We have incorporated large language models and AI tools to help us identify sectors and individual companies and build equity baskets tied to market trends. Essentially, we’ve developed a thematic investment approach that goes beyond traditional factor-based investing to implement our views and build portfolios. We can quickly absorb a vast amount of information and data and distill it into actionable insights that become thematic expressions of our views. We believe this is the way forward for investing.