The Predictable Exit of Joe Biden Happened Last Weekend. According to data from Polymarket, Kamala Harris has a 92% chance of being the Democratic nominee for the November presidential election. The support from most Democrats, as well as from the 50 state party leaders, guarantees — barring any last-minute major surprise — her official nomination at the party congress at the end of August.

Although initially (and before news of Biden’s withdrawal), Robert F. Kennedy Jr. seemed better positioned, according to betting houses, Harris’s replacement seems to bring some hope to the Democratic ranks. After facing serious difficulties in attracting campaign contributions in recent weeks, they have reportedly raised over $150 million in donations in less than 24 hours since the new candidacy announcement, according to CNBC.

With barely three months before the elections, and seeing how the gap has widened substantially between Kamala and other Democratic candidates in the latest polls, it seems that the blue party is rallying around the least bad option they have. Kamala Harris’s contributions to the White House battle have a marginally positive balance.

On the negative side, Harris’s electoral record is not brilliant. She won the California Attorney General position in 2010 by only 0.8% more votes than her opponent, Republican Steve Cooley. As previously explained, she was not the preferred replacement for Biden. She also doesn’t seem likely to significantly diminish Trump’s apparent advantage in the electoral vote (vs. popular vote). Additionally, as Vice President of the current administration, she will bear the brunt of issues like inflation or lack of control in immigration that are dragging down poll numbers.

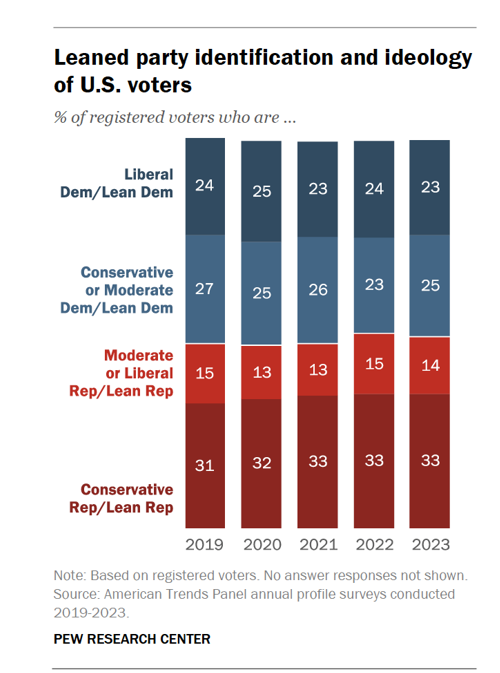

Perhaps the most unfavorable aspect, which Donald Trump will surely exploit to his advantage, is the perception among conservative Americans regarding Harris’s political positioning, which is to the left of Biden and other more conservative Democratic presidents. Considering the U.S. demographics (50.4% women and approximately 14% African Americans, with only about 23% of registered Democrats identifying as “liberals”), the median voter theorem consolidates her as a disadvantaged candidate.

On the positive side, Harris’s disapproval rating before the announcement was better than Joe Biden’s (49.5% vs. 57%). In her role as Vice President, anyone who would have voted for Biden this November would reasonably consider a scenario where Kamala would have to replace him in the Oval Office before 2028 and would be the natural alternative for Democrats in the presidential elections that year.

Additionally, it forces Republicans to rethink their strategy, facilitating their opponents’. Kamala is now in a position to attack Trump using his advanced age as a primary argument (Harris is 59 years old, compared to Trump’s 78). Counteracting the negative interpretation of her chances according to the median voter theorem, a Pew “think tank” chart suggests a “center” or moderate voter group (39%) that surpasses both blue liberals and red conservatives. In other words, if Kamala can convincingly take a step to the right — assuming, with the addition of JD Vance, that Trump won’t moderate his rhetoric — she could improve her poll numbers compared to Biden’s records.

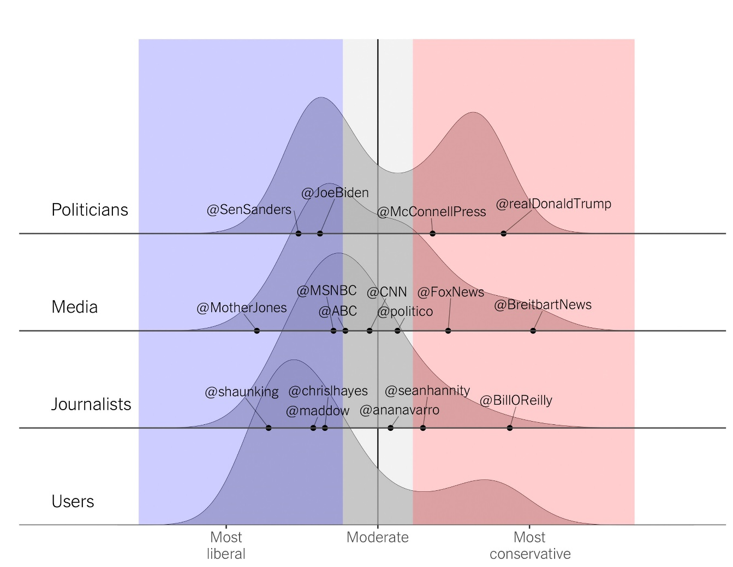

As explained in this analysis published in 2022, Americans who actively use X to interact with politicians, media, or journalists in public forums demonstrate that Harris could leverage this tool to present a more moderate profile: as distribution graphs show, blues have much more exposure to the social network than conservative Republicans.

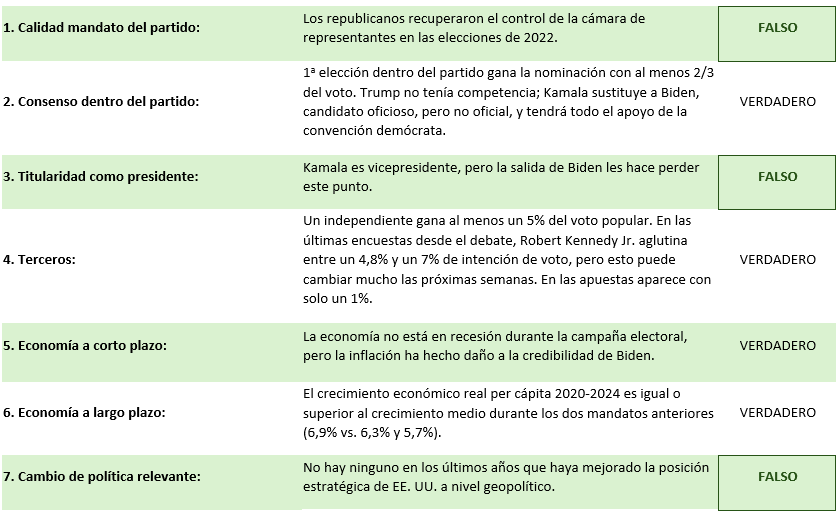

Applying the 13 criteria of historian Allan Lichtman, which have accurately predicted the popular vote direction in all presidential elections from 1984 to 2020 and offer an interesting framework to study contenders’ merits despite being subjective at times and dependent on almost real-time information at others, my result would favor Trump (6 or more false criteria coincide with a change of White House occupant).

In the coming weeks, we’ll start receiving poll results that will show whether the Democrats’ surprise move allows Kamala Harris to close the gap with Donald Trump. The first, from Quinnipiac University, conducted a day after the announcement, seems to point in this direction: 49% of participants supported Trump, compared to 47% for Harris, improving the 48% – 45% shown in the previous poll with Biden. Another Ipsos poll on Wednesday placed her two points ahead of her opponent. The average of the three most recent polls leaves the difference at just one point.

For now, although Trump remains the favorite, his approval rating is low at 42.3%, but it surpasses Kamala Harris’s 37.8%. The balance of the few polls conducted since July 19 gives him a three-point advantage. The bets, which have been more accurate in identifying winners in other electoral processes, are 61%-36% in favor of the Republican, although he has lost three points in the last three days.

The election remains close, and it’s important to follow the polls in the “swing states” identified a couple of weeks ago, as they could be key: a shift towards normalization in Pennsylvania, Michigan, or Wisconsin (historically Democratic strongholds now leaning the other way).

Only a month has passed since the first presidential debate, and things have moved very quickly since then. Although it’s very likely that Powell will clarify his intention to start lowering rates in September at the July Fed meeting, the other support for portfolio rotation discussed last week has become much more unstable.

The rebalancing towards more cyclical, value, and small-cap companies could continue to benefit from macro announcements pointing to a consolidation in the disinflation trend, allowing the Fed on the 31st to lay the foundations for the start of a cycle of easing monetary policy.

However, more evident signs of a cooling job market or loss of momentum in the first quarter’s industrial activity rebound would deny the hypothesis of a cycle elongation. Additionally, investors, after the initial boost, may reassess the macro implications of a second Trump term, which might not be as favorable for the stock market.