If the Historical Trend Continues, the Dollar Could Decline By 8% in 2026

| By Marta Rodriguez | 0 Comentarios

History suggests major dollar sell-offs tend to occur in consecutive years. This is the conclusion reached by Bank of America after analyzing the behavior of the U.S. dollar since the 1980s. Looking ahead to this year, the institution argues that the closest historical analogues point to an additional 8% decline in the Dollar Index (DXY Index) in 2026.

“2018 was the exception, but it coincided with Fed rate hikes, the trade war, and weak European growth. For now, the dollar remains in broad downward trends against G10 currencies. The fact that global equities are outperforming U.S. equities at the start of 2026 warrants attention,” they argue.

Reference to 1995

Focusing on the dollar’s decline in 2025, the institution explains that in the main historical analogues with the highest correlation to last year’s dollar movements, the dollar’s weakness continued the following year in four out of five cases. “The average of the five best analogues would imply an additional -8% drop in the dollar in 2026. Among these analogues, 1995 may be the most relevant for 2026, as it also featured a soft landing of the U.S. economy driven by technology and Fed rate cuts in the second half of the year. The dollar weakened by -4.2% in 1995, close to our forecast that the DXY index will fall toward the 95 level in 2026,” the report notes.

They also highlight that 2018 was an unusual year in which the dollar reversed its 2017 losses and rose by 4.7% due to Fed rate hikes, headlines surrounding the U.S., China trade war, and a weak eurozone economy. According to their analysis, despite a moderate rebound toward the end of 2025, the dollar remains in broad downward trends against G10 currencies. “Global equity markets also began 2026 outperforming the U.S. This factor deserves attention, as equity flows and hedging could become a clearly bearish trigger for the dollar in 2026,” they add.

Years “Similar” to 2025

The dollar fell by 9.4% in 2025 against G10 currencies, according to the DXY index, making it the second-largest annual dollar decline in the past two decades. In identifying the historical years most closely correlated with the dollar’s performance in 2025 and drawing possible implications for 2026, the institution highlights 2005, 1995, and 1975.

Since 1975, the five closest historical analogues have shown an average correlation of 81% with the dollar’s performance in 2025, the report states.

In those five years, the dollar weakened by an average of 10.5%, with most of the decline concentrated in the first half of the year, similar to what occurred in 2025. And in all five historical analogues, the dollar continued to fall the following year, with the sole exception of 2018. On average, the dollar recorded a further 8.3% drop in the subsequent year.

The report also argues that 1995 may be the most relevant analogue for 2026 among the DXY’s imperfect historical comparisons. According to the bank’s analysis, tech-driven growth helped the U.S. economy achieve a soft landing instead of a recession. Additionally, the Fed began cutting rates in the second half of 1995, even though inflation was closer to 3% than 2%.

In light of these findings, the conclusion is that large dollar sell-offs rarely happen in isolation: “This bearish quantitative outcome supports our base case for currencies in 2026, where we expect further dollar weakness due to interest rate convergence between the U.S. and the rest of the world post-Powell, stimulus in the eurozone and China, and increased currency hedging on dollar-denominated assets.”

Outlook for 2026

Looking ahead, Bank of America expects the U.S. economy to struggle after a temporary setback in Q4 2025 caused by the government shutdown, and sees the Fed continuing to cut rates after midyear. Under this scenario, the 1995 analogue alone would imply a further 4.2% decline in the dollar, closely in line with the bank’s forecast for the DXY to fall toward the 95 level in 2026.

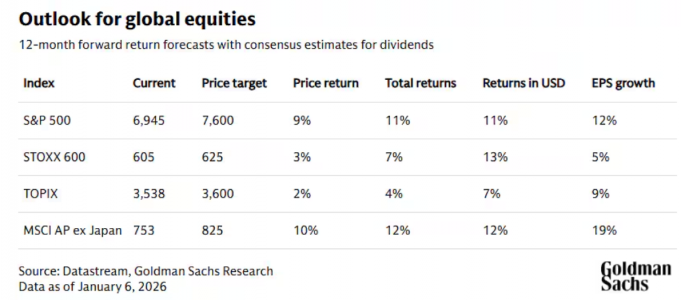

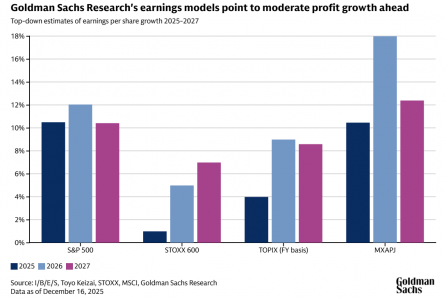

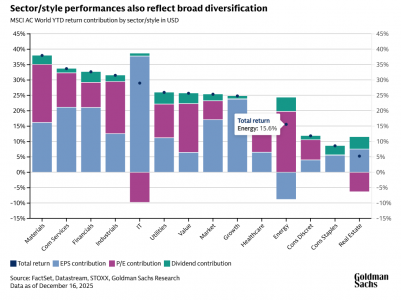

Another key observation is that divergence in equity markets could prolong the dollar’s downward trend in 2026. “Although U.S. stock markets reached new all-time highs at the start of 2026, their performance has lagged most global equity markets. With global central bank easing cycles nearing their end, the FX regime is gradually shifting from being almost entirely rate-driven, as it was between 2022 and 2024, to being more influenced by equities. The relative performance of equity markets across countries should be watched closely, as continued divergence like we’ve seen so far in 2026 could become a major bearish driver for the dollar,” the Bank of America report concludes.