Pragmatic Optimism Among Managers: Expecting Higher Growth but Also More Inflation

| By Amaya Uriarte | 0 Comentarios

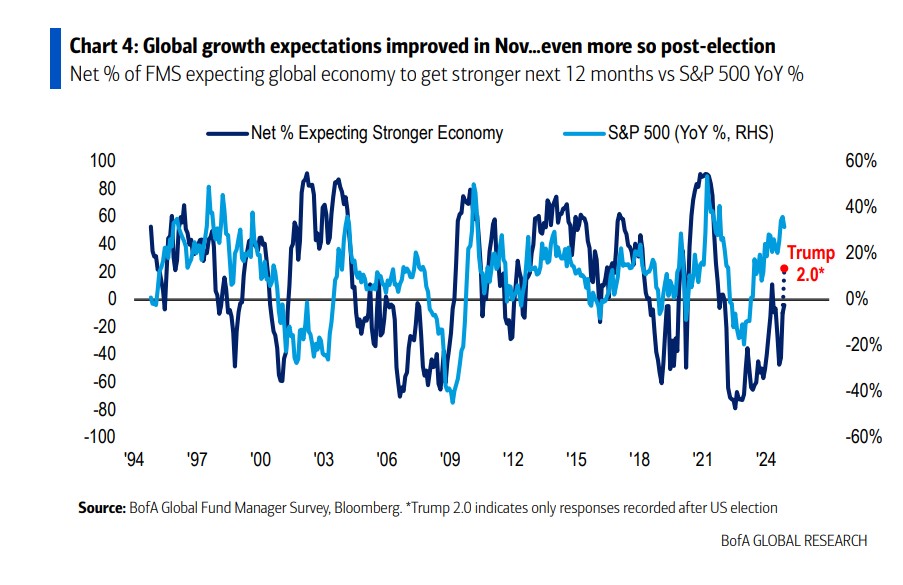

The monthly global fund manager survey conducted by BofA reflects an increase in optimism about growth, with more investors betting on a “no landing” economic scenario, U.S. equities, small-cap companies, and high-yield bonds, but also more inflation. According to the entity, as a sign of this optimism, the Bull & Bear indicator of BofA rises to 6.2, “although none are yet considered ‘extremely’ bullish, as it is not above 8,” they explain.

“The general sentiment FMS indicator, based on cash levels, equity allocation, and economic growth expectations, decreased to 5.2 in November from 5.5 in October. However, if only the post-election results are considered, the indicator would have risen to 5.9. For 22% of global managers who completed the survey after the U.S. elections, the average cash level was 4.0%,” the survey states in its conclusions.

It is noteworthy that global growth expectations improved, with a net 4% expecting a weaker economy. In fact, after Trump’s victory, 23% of respondents expect a stronger global economy, which represents the highest level of optimism since August 2021. A key issue for this vision is what managers expect regarding “landing.” In this regard, the probability among FMS investors of a “soft landing” fell to 63% from 76%, while the probability of “no landing” increased to 25% from 14%. Meanwhile, the probability of a “hard landing” remained unchanged at 8%. In contrast, the post-election survey shows a lower probability of a “soft landing”, at 55%, and a higher “no landing” probability, at 33%.

Inflation expectations for the full month of November increased, reaching their highest level since March 2022. As clarified by the entity, expectations for lower short-term interest rates also fell to 82%. “Post-election results show that 10% expect higher inflation, the highest level since July 2021, and a net 73% expect lower short-term interest rates, the lowest level since October 2023,” they explain.

What has not changed is that investors consider higher inflation the main “tail risk”, a perception that has increased from 26% in October. Meanwhile, concerns about geopolitical conflict took second place this month at 21%, down from 33% last month.

Expectations and asset allocation

When assessing managers’ expectations, the November survey shows confidence that small-cap companies will outperform large-cap ones: “Post-election results show that 35% expect small caps to outperform large caps, the highest level since February 2021.” Additionally, a net 41% expect high-yield bonds to outperform high-quality bonds, the highest level since April 2021. According to the November FMS, the asset classes expected to perform best in 2025 are: U.S. equities (27%), global equities (27%), and government bonds (14%). Post-election results indicate that the top-performing asset classes in 2025 will be: U.S. equities (43%), global equities (20%), and gold (15%).

A notable finding is that respondents to the November FMS mentioned the Japanese yen (32%), the U.S. dollar (31%), and gold (22%). However, when asked after the elections, the order shifted: the U.S. dollar (45%), gold (28%), and the Japanese yen (20%).

Finally, respondents to the November FMS noted a disorderly rise in bond yields (42%) and a global trade war (35%). This position will not change with Trump’s arrival: “Post-election respondents answered similarly: a disorderly rise in bond yields (50%) and a global trade war (30%).”

Regarding the positioning investors are taking, the survey shows they are overweight in equities, emerging markets, and healthcare, while they are more underweight in resources (energy and materials), consumer staples, and Japan. If we contextualize this reflection in the long term, the survey shows that investors are “long” in utilities, bonds, banks, and U.S. equities, and underweight in resources (energy and materials), cash, and consumer staples.