From Bonds to Equities: Five Investment Themes for 2025

| By Amaya Uriarte | 0 Comentarios

As we enter 2025, it is crucial to reflect on the events of the past year and prepare for the challenges and opportunities ahead. At the end of 2024, the investment leaders of Neuberger Berman gathered to analyze the evolving investment environment and identify the themes they consider essential for the next twelve months. As a result of this exercise, the investment firm highlights five key themes.

A Year of Above-Trend Growth

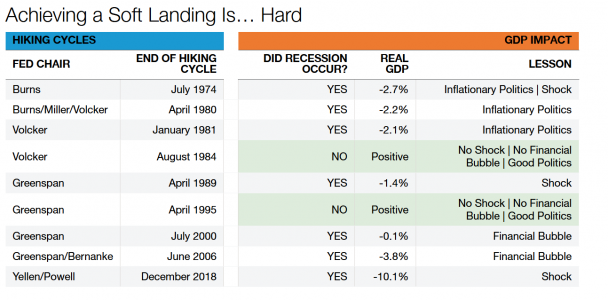

Although policies may change, industrial strategies aimed at influencing domestic production patterns will continue, whether through government spending and investment, fiscal policy, trade policy, deregulation, or other means, according to Neuberger Berman. “If inflation can remain contained—and we believe it is possible—central banks could stay on the sidelines and allow economies to operate at a slightly faster pace. This scenario suggests above-trend U.S. GDP growth, which could pull other global economies along. The implications for debt and deficits, as well as the efficient allocation of capital, could surprise investors by proving to be manageable concerns in 2025,” the experts highlight.

Extending the Soft Landing with Real Income Growth

The negative impact of high inflation on lower-income consumers and small businesses has been a key factor in this year’s political uncertainty. According to the firm, countries and governments that achieve moderate inflation and greater participation in real wage and income growth will define success, reflected in data such as higher consumer confidence, improved political approval ratings, and GDP growth rates. “While it remains to be seen whether certain policy combinations can achieve this, we see evidence that the new U.S. administration at least recognizes this goal, and active industrial policies are proof of a growing recognition in other regions,” the experts emphasize.Setting the Stage for Broader Equity Market Performance

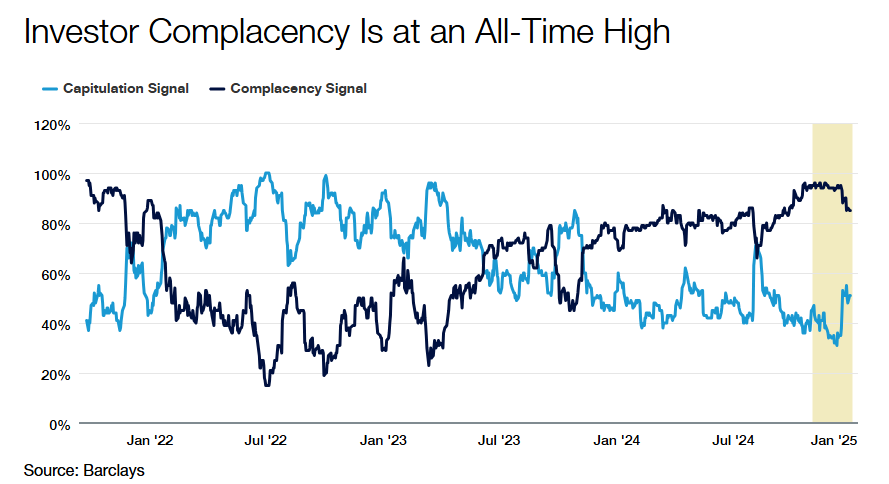

Deregulation, business-friendly policies, moderate inflation, and lower rates could allow for broader earnings growth and price performance, according to Neuberger Berman. “At the same time, the growth rates of large technology companies are likely to slow and normalize as capital expenditures increase. Value stocks, small-cap stocks, and sectors such as financials and industrials could start to regain ground against large tech companies. Non-U.S. markets could perform more strongly due to higher global growth and lower commodity prices. Relative valuations, along with fundamentals, should support this trend,” the experts note.

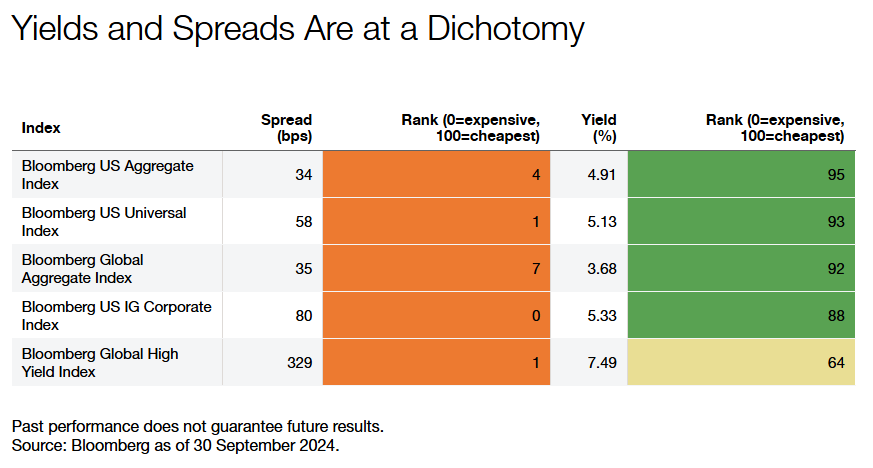

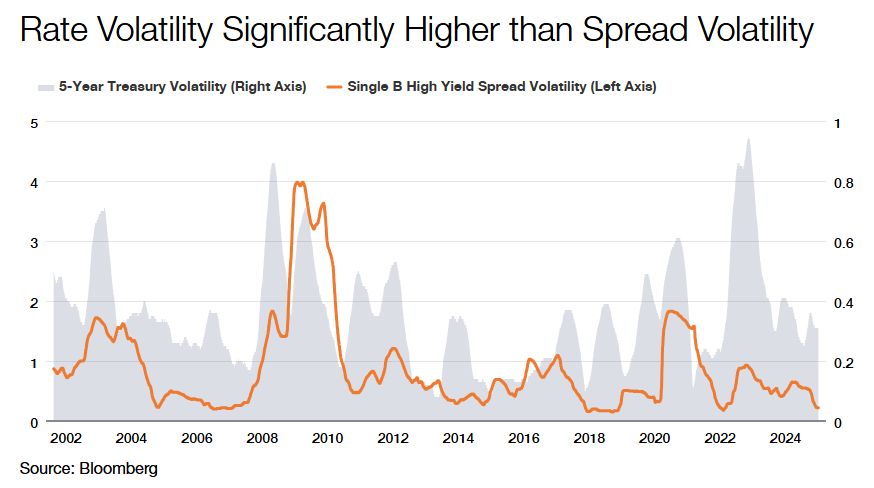

Bond Markets to Focus on Fiscal Policy Over Monetary Policy

“For more than two years, bond markets have been dominated by inflation data and central bank responses. We believe that in 2025, a reacceleration of inflation can be avoided, and central banks will settle into the more predictable routine of debating the level of the neutral rate,” Neuberger Berman states.

Bond investors are likely to shift their focus toward growth prospects for most of 2025, and possibly toward deficits and the issue of the term premium by the end of the year and into 2026, according to the firm’s experts. The result will be a moderate steepening of yield curves and a migration of bond market volatility from the short end of the curve to the intermediate and long ends.

A Boom in Mergers and Acquisitions

“Several factors are converging to unleash a pent-up wave of corporate deals: above-trend growth, optimistic valuations in public equity markets, a more stable outlook on inflation and central bank policies, the return of banks to the leveraged loan market, declining interest rates, and tighter credit spreads. Perhaps most importantly, a shift in the regulatory approach in the U.S. is anticipated,” the firm highlights.

That said, secondary private equity markets and co-investments will continue to thrive, as liquidity is still required to manage a large backlog of mature investments. However, raising new primary funds will remain a challenge. Event-driven hedge fund strategies will benefit from a large set of new opportunities, the experts conclude.