Uncertainty and Opportunities in Fixed Income: A Key Theme at the Funds Society Investment Summit in Houston

One word was repeated over and over again at the V Funds Society Investment Summit in Houston: uncertainty. Uncertainty regarding Donald Trump and his tariff policies, as well as geopolitical conflicts and persistent inflation, with its consequent impact on economic growth and interest rates.

However, investment managers Thornburg Investment Management and Muzinich & Co. presented global fixed income investment strategies and assured that there are significant opportunities, even in the current environment.

The event, held on Thursday, March 6, in Houston, and aimed at professional investors from Texas and California, brought together five international asset managers. On Wednesday, March 12, we published a second report summarizing the presentations from State Street Global Advisors, M&G, and Vanguard.

Flight to Quality in Fixed Income

Benjamin Keating, Client Portfolio Manager at Thornburg IM, expressed his astonishment at the latest market developments and remarked that there is significant uncertainty in Washington.

He referred to the dramatic rise in interest rates and the tightening of credit spreads, highlighting that U.S. corporate balance sheets are stronger today than before 2008.

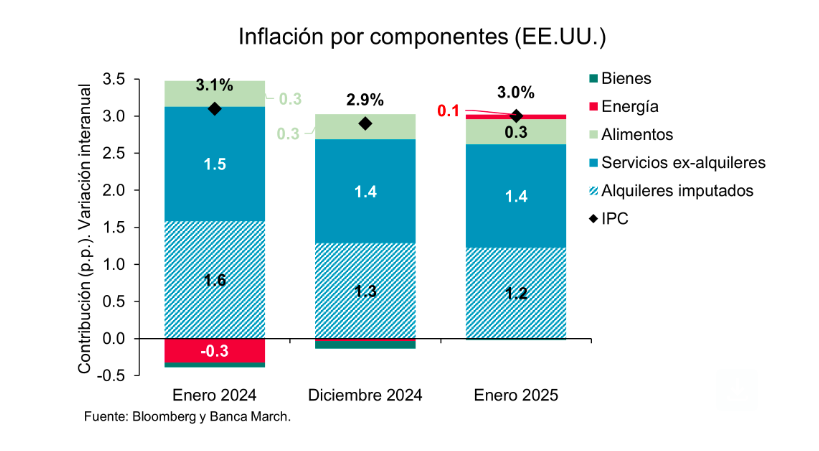

However, when the Federal Reserve cut rates last fall, long-term bond yields rose. In his view, inflation is not collapsing in the U.S., unlike in other regions.

“What keeps us up at night at Thornburg is not SPACs, cryptocurrencies, or non-bank entities. What keeps us up at night is the possibility that Germany or the U.S. Treasury might struggle to issue debt.”

Keating also raised concerns about U.S. tariffs on Mexico and Canada, stating that this key issue is not yet priced into bonds. He warned of a potential tariff race between the two countries, which could lead to falling yields and a flight to quality.

Regarding the dollar, he projected a weaker trend in the next cycle, though maintaining its role as a store of value.

Comparing the current scenario to the 1990s, he pointed to U.S. fixed income as a valuable investment, particularly mortgages and 10-year Treasuries, predicting that Treasury yields will fall below 4% in the next 18 months.

Thornburg Strategic Income Fund: A Multisector Fixed Income Strategy

Keating presented the Thornburg Strategic Income Fund, which manages nearly $10 billion in AUM. The firm believes that higher coupons help hedge against rising rates while also supporting total return potential.

The portfolio focuses on higher-yielding segments of the fixed income market, investing in a mix of income-generating securities.

Actively Managing Short-Term Fixed Income

Ian Horn, co-Lead Portfolio Manager at Muzinich & Co., introduced the Muzinich Enhancedyield Short Term Fund, a global corporate credit fund with an average investment-grade rating and a duration below two years.

“This is our largest and most popular fund, managing $8 billion in AUM,” he noted. Launched in 2003, it has only seen two negative years: 2008 and 2022.

With a current yield of 5.25%, Horn anticipates yields around 6% this year, thanks to active strategy management.

He emphasized that now is not the time for excessive risk-taking but rather an opportunity to capture yield.

The fund’s global strategy currently allocates 54% to the U.S. and 36% to Europe, rotating quickly to reinvest weekly and monthly cash flows.

Europe has been offering a spread premium over the U.S., largely influenced by the Russia-Ukraine conflict. This has led the fund to increase European allocations, as the firm sees no major default risks in the region.

Regarding emerging markets, Muzinich remains cautious, selectively investing in short-term bonds with conservative risk management.