Pimco Makes 4 Additional Portfolio Management Leadership Appointments

| By Alicia Miguel | 0 Comentarios

Pimco, a global investment management firm, announced today four additional Deputy Chief Investment Officers, a senior Generalist Portfolio Manager hire and two departures. Changes come after Chief Executive Officer and Co-Chief Investment Officer, Mohamed A. El-Erian, decided to step down from his role and leave the firm in mid-March.

The leadership appointments as Deputy Chief Investment Officers are Mark Kiesel (a Managing Director in the Newport Beach officer, a Generalist Portfolio Manager and Global Head of the Corporate Bond Portfolio Management Group); Virginie Maisonneuve (a Managing Director in the London Office and Global Head of Equities); Scott Mather (a Managing Director in the Newport Beach office and Head of Global Portfolio Management); and Mihir Worah (a Managing Director in the Newport Beach office and head of the Real Return Portfolio Management team).

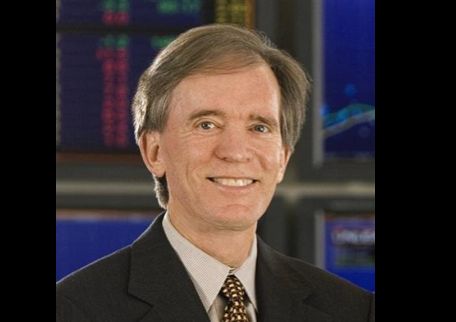

They join Dan Ivascyn (Managing Director in the Newport Beach office and Morningstar 2013 Fixed-Income Fund Manager of the Year (US)) and Andrew Balls (Managing Director in the London office and Head of European Portfolio Management) as Pimco’s Deputy Chief Investment Officers, reporting to Founder and Chief Investment Officer Bill Gross.

“Our six Deputy CIOs demonstrate the strength, depth and breadth of investment talent at Pimco. Individually and as a team they have delivered for clients consistently, and they will now help lead Pimco’s investing excellence into the future”, said Gross. “Together with our newly appointed CEO Doug Hodge, who has 25 years at Pimco, and President Jay Jacobs with a 15-year tenure (much of it globally), they will lead Your Global Investment Authority. The future here is bright, and it will get even brighter in the months and years ahead!”

The firm has also hired Sudi Mariappa, who will re-join Pimco as a Managing Director and Generalist Portfolio Manager, based in the Newport Beach office. Mr. Mariappa will return to Pimco from GLG where he has served since 2012 co-managing that firm’s absolute return fixed income offering. He was previously at Pimco from 2000-2011 as a Managing Director, Portfolio Manager and Senior Advisor.

The departures

Charles Lahr, a Managing Director and Equities Portfolio Manager, has decided to leave the firm pursue other opportunities, including spending more time with his family. Marc Seidner, a Managing Director and Portfolio Manager, has decided to return to Boston to take a role outside of Pimco. They both joined the firm in 2009.