The “Great and Beautiful” Tax Law Puts Traditional Economics to the Test

| By Magdalena Martínez | 0 Comentarios

The second half of 2025 promises to be as intense as the first. Analysts expect to begin seeing the initial effects of Donald Trump’s tariff policy (the “customs verdict”), and a new variable is entering the markets: the consequences of the approval of the “Great and Beautiful” tax law in the United States.

With both legislative chambers under pressure and in record time, Trump secured the passage of a document exceeding 800 pages that, among other things, raises the debt ceiling to $5 trillion. He achieved this with simple majorities and without negotiating with the Democrats—thus avoiding the dreaded institutional gridlock—thanks to the fact that his electoral victory granted him control of Congress for the first time in years.

Along the way, new developments emerged, including Elon Musk’s announcement of launching a new political party in response to a law he claims will lead the country to bankruptcy.

The list of measures in the law is long, but notably, it extends the tax cuts for high-net-worth individuals first approved during Trump’s previous administration (since 2017), which were set to expire this year. The new budget increases funding for immigration enforcement while cutting healthcare and social assistance programs.

Growth Booster or Fiscal Collapse: Traditional Economics Put to the Test

While Trump celebrates a major victory and a new wave of economic growth in the United States, the Congressional Budget Office estimates that the tax package will add $3.3 trillion to the deficit over ten years.

Both the tax cuts and increased spending will have to be financed with debt. Traditional economics predicts that such borrowing will push interest rates higher, offsetting the benefits of lower tax rates.

But, according to The Wall Street Journal, the U.S. president has an answer for that: breaking the link between the budget deficit and interest rates. In recent weeks, he has stepped up pressure on Federal Reserve Chairman Jerome Powell to lower rates—or step aside for someone who will.

In a note on the U.S. fiscal deficit, asset manager DWS notes that, according to theory, once interest rates exceed economic growth, federal debt grows faster than the economy—unless offset by a sustained primary surplus.

“This highlights the risks that U.S. debt dynamics could become unstable,” argues Christian Scherrmann, U.S. economist at DWS: “Wharton’s analysis identifies a critical debt-to-GDP threshold of approximately 200% and suggests that, under recent political and macroeconomic conditions, the U.S. has an estimated 20-year window to implement corrective measures—provided market conditions remain favorable overall.”

Tariffs and Another Critical Week for Currency Markets

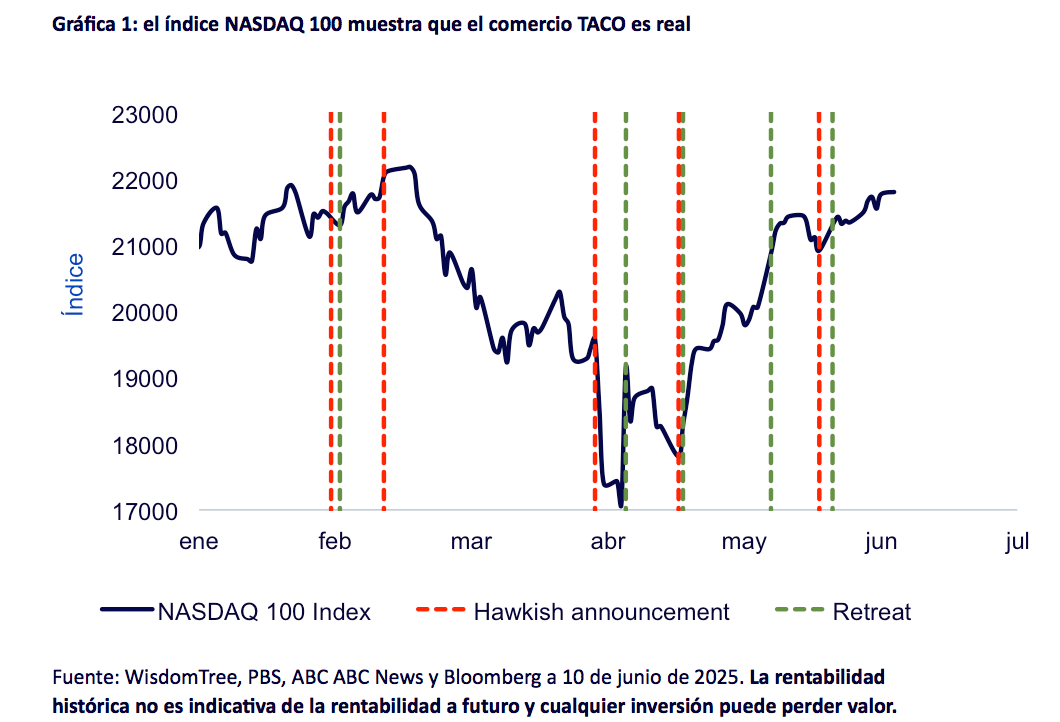

Trump’s hectic agenda continues this week with full theatrical flair: on Wednesday, July 9, the 90-day pause in U.S. reciprocal tariffs ends. Starting then, higher rates could apply to all countries without a trade agreement.

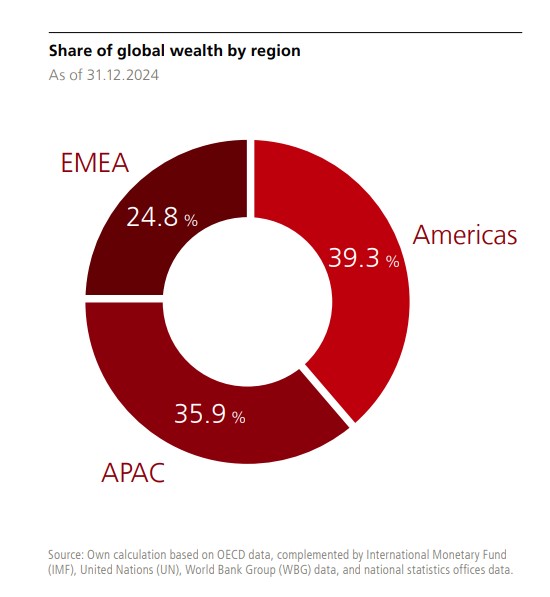

This is happening as markets still struggle to gauge the effects of Washington’s new trade policy on global flows, causing widespread investor risk aversion. As a result, investment portfolios have suffered costly miscalculations, as noted by Julius Baer CEO Yves Bonzon:

“The first half of 2025 will go down as one of the most challenging periods for navigating markets. In short, we were well positioned until April 8, after which we hedged the wrong risk at the margin: we protected against U.S. equity risk instead of currency risk in the U.S. dollar.”

Indeed, 2025 has marked the worst start to the year for the dollar since 1973: “On the dollar front, the damage seems done, but we still struggle to find bullish investors in the greenback. This creates fertile ground for short-term violent countertrend rallies, and we are prepared to use any temporary strengthening of the dollar to further reduce our exposure,” Bonzon concluded.