With Sentiment in the Negative, Family Offices Focus on Risk Management and Increasing Diversification

| By Amaya Uriarte | 0 Comentarios

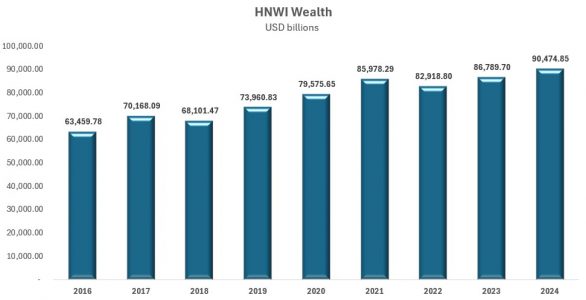

Geopolitical uncertainty has become the primary concern for family offices (FOs) globally, significantly influencing capital allocation decisions. At the same time, overall sentiment has turned negative, driven by growing concerns over trade disruptions and increasing geopolitical fragmentation. In this environment, allocations to private credit and infrastructure are rising, and there is growing interest in partnering with external managers, particularly in private markets.

These are the key findings of BlackRock’s Global Family Office Survey 2025, titled “Rewriting the Rules”, with the subtitle: “Family Offices Navigate a New World Order.”

“Investors are increasingly turning to private markets as a way to achieve greater diversification with the potential for higher returns,” the report states, adding that the global alternative assets industry is expected to exceed $30 trillion in assets under management by 2030, according to Preqin.

The report states that FOs are “in risk management mode.” 84% highlight the current geopolitical environment as a key challenge and an increasingly critical factor in their investment decisions; 68% are focused on increasing diversification, and 47% are increasing the use of various sources of return, including illiquid alternative assets, equities outside the U.S., liquid alternative assets, and cash.

“Family offices globally entered 2025 cautiously, a stance expected to continue through 2026, as geopolitical tensions, policy changes, and market fragmentation affect overall sentiment,” said Armando Senra, Head of Institutional Business for the Americas at the firm.

“With 60% of family offices pessimistic about global prospects, confidence has been further impacted by the new U.S. tariffs. They are now prioritizing diversification, liquidity, and a structural reassessment of risk to build resilience in their investment portfolios,” he added.

This cautious economic outlook—but relatively optimistic view regarding their ability to meet return objectives—shifted after “Liberation Day,” when the U.S. administration announced tariffs on all its trading partners.

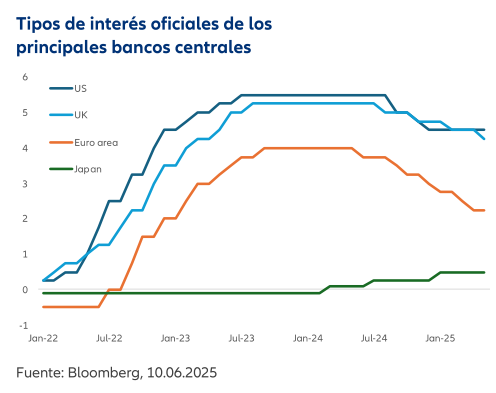

Before these announcements, the majority (57%) of family offices were already pessimistic about the global outlook, and many (39%) were concerned about a potential U.S. economic slowdown. After April 3, those figures rose to 62% and 43%, respectively, and FOs expressed greater concerns about higher inflation, rising interest rates, and slower growth in developed markets.

A significant majority of FOs had already made or planned to make allocation changes prior to the tariff announcements. Nearly three-quarters (72%) have made or plan to make portfolio allocation changes, and nearly all (94%) are either making changes or seeking opportunities to do so.

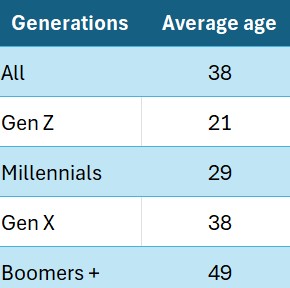

The survey was conducted by BlackRock and Illuminas between March 17 and May 19, polling 175 single-family offices that collectively manage over $320 billion in assets.

Alternative Investments Step Forward

To meet the goal of building resilient portfolios, alternative assets are “more important than ever,” according to BlackRock. The survey shows that this type of investment now represents 42% of family office portfolios, compared to 39% in the 2022–2023 survey.

Within this segment, private credit and infrastructure are the most preferred alternative assets. According to the 2025 survey, nearly one-third of family offices plan to increase their allocations to private credit (32%) and infrastructure (30%) in 2025–2026. Within private credit, the preferred strategies are special situations/opportunistic and direct lending.

Infrastructure is gaining momentum. 75% of respondents have a positive view of its outlook. These types of investments are attractive for their ability to generate stable cash flows, act as portfolio diversifiers, and offer resilience.

Over the next year, respondents plan to increase allocations to both opportunistic (54%) and value-add (51%) strategies, due to their higher return potential, favorable momentum, and flexibility.

“The sustained demand and interest in private credit and infrastructure from family offices reflects the illiquidity premium and differentiated return opportunities in today’s environment. Access to the right opportunities and strategies is becoming increasingly important as these assets move from niche strategies to core pillars of client portfolios,” said Francisco Rosemberg, Head of Wealth and Family Offices for BlackRock in Latin America.

However, 72% of family offices cited high fees as a major challenge for investing in private markets, a significant increase from 40% in the previous survey. For many families, the issue lies not so much in the compensation model itself but in the relationship between cost and value received. FOs remain willing to commit to partners and strategies they trust and that are well-positioned to seize specific opportunities.

On the other hand, fewer than one in five are taking on risk, while many more are diversifying and managing liquidity as much as possible, including building up cash positions, moving to the front end of the yield curve, and exploring secondary markets.