From January 20 to July 4: Why the U.S. Will Dominate Market Attention Throughout 2025

| By Amaya Uriarte | 0 Comentarios

We close the first half of 2025 and begin the second in the same way—with the U.S. at the center of attention. According to experts from international investment firms, the summary of markets over the past month and quarter has been one of strong U.S. recovery compared to Europe.

“Wall Street outpaces Europe with tech gains over 18% compared to 8% for the S&P 500 over the past three months. Defensive sectors are suffering most in this context, with healthcare and energy being the only sectors to retreat—by more than 8% during the last quarter. Industrials is the next strongest sector after tech, with some companies posting strong gains over the quarter. Meanwhile, the dollar just posted its worst half-year since 1973,” summarized Activotrade SV.

In addition, as explained by U.S.-based asset manager Payden & Rygel, volatility characterized the bond market in the first half of 2025. “Stepping back, we’d like to remind investors that risk-free government bond yields remain elevated. High risk-free yields have two implications. First, investors are being compensated more than they were in the 2010s for taking on additional duration risk. Second, elevated risk-free yields increase the yield cushion of corporate bonds, defined as yield per unit of duration. In other words, the current yield could generate enough income to help offset a slight rise in corporate spreads,” noted Payden & Rygel.

That’s a brief summary of the first half—but what matters now is what lies ahead in the next six months. When it comes to outlooks, there’s one word that all investment firms repeat: the United States. Why will the U.S.—and ultimately Donald Trump—be so critical for the rest of the year? The asset managers share their views:

The U.S. Economy: Uncertainty

According to Felipe Mendoza, financial markets analyst at ATFX LATAM, the semester ended with the U.S. drawing the attention of global investors following the release of June’s Nonfarm Payrolls, which showed an increase of 147,000 jobs, surpassing both the consensus estimate of 111,000 and the previous figure of 139,000.

“The optimistic reading of the jobs data has boosted positioning in U.S. equities, also supported by strong technical signals. The S&P 500 just recorded its first ‘golden cross’ since February 2023, with its 50-day moving average crossing above the 200-day—a pattern historically linked to annual returns above 10%. More than 71% of the index’s components currently trade above their 100-day moving average, the highest level this year,” Mendoza noted.

One of the latest data points closing out the first half is the employment rate. As George Brown, chief economist at Schroders, explained, despite all the turmoil around tariffs, the U.S. labor market remains notably strong. “Layoffs also remain low, as companies are hesitant to let go of workers due to the labor shortages of recent years. This may persist in some sectors and states, given the Trump administration’s stance on immigration. Since foreign workers have been a key source of job creation since the pandemic, this could slow hiring below the 100,000 jobs needed to keep the unemployment rate steady. At the same time, tariffs will lead to higher prices this summer. With the Fed focused on not falling behind again, we believe it will hold rates steady for the rest of the year,” said Brown.

For R.J. Gallo, head of the municipal bond team at Federated Hermes, the issue is that the U.S. economy has sustained high levels of political uncertainty, which has weakened both business and consumer confidence and is likely to be reflected in employment and spending decisions. “At Federated Hermes, we believe that hard data will soon begin to soften, which could prompt the Fed to restart the rate-cutting cycle and lead to a decline in Treasury yields in the coming months,” said Gallo.

Sebastian Paris Horvitz, head of research at LBP AM, noted that U.S. economic data remains mixed, pointing to June’s ISM manufacturing index, which showed continued contraction, although production picked up slightly.

“Globally, S&P’s June PMI surveys for manufacturing returned to expansion territory, while industrial activity in China appears to be improving. In the euro area, industrial activity remains stalled. Clearly, the persistence of weak growth is not good news. This reinforces our forecast that inflation will remain well contained and at low levels. We continue to expect the ECB to cut rates one final time before year-end,” Paris added.

Tax Reform Approved

In this context, last Friday the Trump administration approved its tax reform, which extends the provisions of Trump’s previous Tax Cuts and Jobs Act (TCJA 2017)—which were set to expire this year—and includes increased spending on defense and illegal immigration control. However, as analysts from Banca March explain, the law does not include one of Trump’s key campaign promises: cutting the corporate tax rate from 21% to 15%.

“As it stands, the increase in the accumulated primary deficit over the next decade is $3.4 trillion (11.6% of GDP), plus another $700 billion (2.4% of GDP) in interest. Ironically, the final version is even more deficit-expanding than the previous draft, raising publicly held debt by +10 percentage points to 127% by 2034, compared to the previous projection of 117%,” they explain.

Analysts at the firm note that while the reform includes relief measures for businesses—such as accelerated asset depreciation—their impact is limited compared to a direct tax rate cut. “Instead, tax benefits are more heavily directed toward individuals—especially high-income earners—with exemptions on high-income tax and a permanent reduction in personal income tax rates. Among the new measures is also the tax exclusion for overtime and tips,” they note. Additionally, the debt ceiling is raised by $5 trillion, ensuring the federal government’s ability to make payments, which was previously expected to run out as early as mid-August.

According to Blerina Uruci, chief U.S. economist at T. Rowe Price, the prospect of a new fiscal stimulus package should provide a timely boost to an economy that has slowed this year. However, she expects a recession will be avoided in her base case. “Looking to next year, economic growth should improve, as fiscal stimulus typically takes time to impact the real economy. Businesses may respond more quickly than consumers if capital expenditure tax breaks are made retroactive to January 2025, as they would aim to maximize the benefit. However, it’s uncertain whether they can act quickly enough. Nonetheless, it’s unlikely that improved growth will offset the impact of reduced tax revenue on the fiscal deficit,” said Uruci.

Tariff Policy

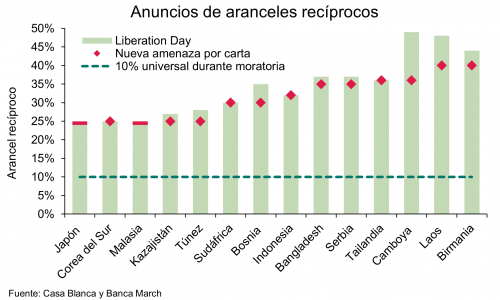

In the short term—mainly in July and August—U.S. trade policy will once again take center stage. According to the BlackRock Investment Institute (BII) in its latest report, policy-making has been contributing to market volatility, and several key policy developments have occurred in recent days. “Consider the ceasefire in the Middle East, NATO’s commitment to increasing defense spending, and a G7 fiscal deal. The U.S. now appears to be adopting a more flexible approach to tariffs. Although the current effective tariff rate of 15% remains the highest since the 1930s, we’ve repeatedly seen that there are unchanging rules that prevent a rapid shift from the status quo,” they note.

In their analysis, one such rule—that supply chains cannot be quickly reorganized without serious consequences—likely led to exceptions for some industries and the resumption of U.S.–China trade talks. Another—the sustainability of U.S. debt depends on foreign investors—was likely a factor in the 90-day pause on tariffs that had driven up yields. “We don’t foresee a return to the April tariff peaks, and trade uncertainty is now well below the April highs,” they state.

In this context, the U.S. ends the first half by signing a trade agreement with Vietnam, with 20% tariffs and a commitment to fully open the Vietnamese market to U.S. exports. “President Trump announced the signing of a trade deal with Vietnam, with 20% tariffs on all Vietnamese imports and 40% on transshipments. Vietnam will also fully open its market to the U.S. This development makes Vietnam the third country to sign an agreement with the White House. We believe this move will ease the macroeconomic uncertainty weighing on the market,” said Jen-Ai Chua, fixed income research analyst in Asia at Julius Baer.

Raphael Olszyna-Marzys, international economist at J. Safra Sarasin Sustainable AM, pointed out that based on 2024 trade flows, the effective tariff rate has risen by nearly 13% year-to-date—from 2.5% last year to approximately 15.5% now. He notes that assuming full pass-through to import prices, and that half the increase is absorbed in margins while the other half is passed on to consumers, “we estimate that tariffs will increase prices by 0.7% this year.”

The Fed and Powell

The other major focus for the rest of the year is what the U.S. Federal Reserve (Fed) will do—and every word of its chair, Jerome Powell, will be closely watched. The question is how long the Fed will extend its pause in rate cuts, or whether we could even see possible hikes. For Gallo, “hard data will soon begin to soften, which could prompt the Fed to restart its rate-cutting cycle,” and he warns that “the U.S. economy has sustained high levels of political uncertainty, which has weakened both business and consumer confidence.”

Meanwhile, Paul Dalton, head of equity investments at Federated Hermes, examines the implications of the S&P 500’s new all-time high and the risks that could mark a market turning point. According to Dalton, “the pressure on Powell to cut rates is mounting,” and he suggests that “a rate cut could unleash significant capital flows into equities.”

Finally, we cannot overlook the tensions between President Trump and Powell. On this matter, Clément Inbona, fund manager at La Financière de l’Échiquier, believes that “the prospect of appointing a new Fed chair opens the door to speculation,” and that it is “most likely that a leadership transition at the Fed would mark a break” in areas such as “the Fed’s independence from the executive branch” or “in terms of the interest rate path, which may to some extent follow the dictates of the White House.”