Weak Corporate Investment Jeopardises the Potential for Economic Growth over the Medium Term

| By Gabriela Huerta | 0 Comentarios

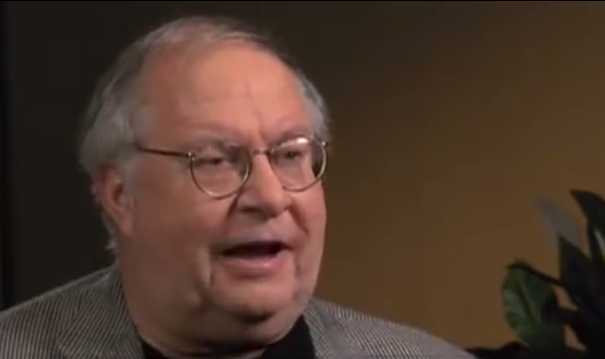

Domestic consumption continues to be favourable but corporate investment is particularly weak, jeopardising the potential for economic growth in the US over the medium term. This is the view of Guy Wagner, Chief Investment Officer at Banque de Luxembourg, and his team, in their monthly analysis, ‘Highlights’.

US GDP data for the second quarter confirmed the continuation of stable, moderate growth despite economic activity being increasingly fragile. Domestic consumption continues to be favourable but “corporate investment is particularly weak, jeopardising the potential for economic growth in the US over the medium term,” indicates Wagner, and continues: “In Europe, political uncertainties have not so far led to an economic slowdown and growth is weak but positive.” In Japan, the government announced a new public spending programme to stimulate economic growth. In China, the short-term economic goals are reached on the back of public stimulus measures.

After the Brexit: Bank of England cuts interest rates

At the Federal Reserve’s monetary policy committee (FOMC) meeting in July, the monetary authorities left interest rates unchanged despite the recent improvement in economic statistics and the stock market rebound since the British referendum. “There is still uncertainty over a second hike in key interest rates – following that in December 2015 – due to the weakness of economic growth. The flattening of the US yield curve since the start of the year could continue”, thinks the Luxembourgish economist. The European Central Bank is continuing to execute its planned programme of buying up debt securities from corporate and public issuers in the eurozone. The Bank of England cut the interest rates to 0.25% to offset the unfavourable economic and financial impact of ‘Brexit’.

Equity markets have fully recovered from Brexit decision

In July, the main stock markets posted gains. Guy Wagner: “Paradoxically, the British decision to leave the European Union has had a positive impact on share prices due to the central banks declaring that they would introduce support measures in the event of unfavourable economic and financial repercussions from Brexit.” The recent improvement in US economic statistics also boosted risk assets. The S&P 500 in the United States, the Stoxx 600 in Europe, the Topix in Japan and the MSCI Emerging Markets (in USD) gained during the month. Given the central banks’ strategies to support equity markets and the lack of alternatives, share prices are continuing to rise despite less than encouraging economic prospects and a proliferation of political risks.

Euro appreciated slightly against the dollar

In July, the euro appreciated slightly against the dollar. The recent improvement in US economic statistics helped the dollar strengthen slightly at the beginning of the month. But the Federal Reserve’s decision to leave interest rates unchanged subsequently put pressure on the US currency.