Why is the Italian Referendum Important?

| By Gabriela Huerta | 0 Comentarios

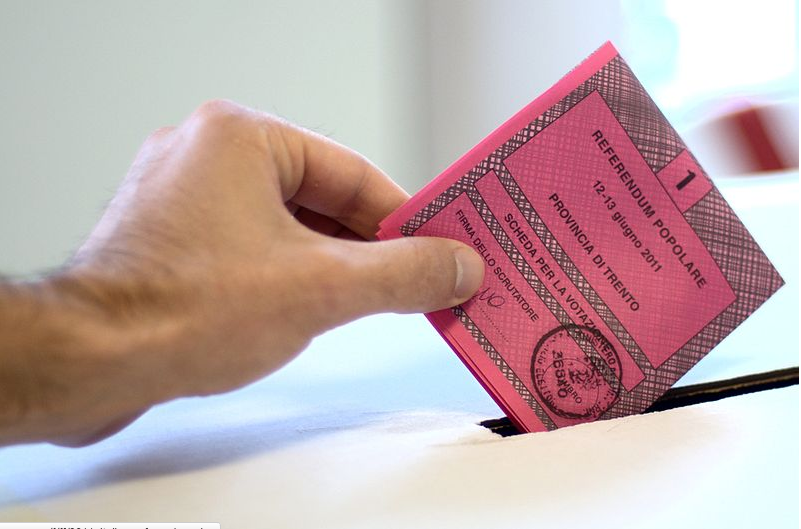

On December 4th, a constitutional referendum is to be held in Italy to vote on amending the Italian constitution. The referendum poses the question:

Do you approve the constitutional bill concerning the dispositions to overcome the perfect bicameralism, the reduction of the number of members of the Parliament, the restraint of the institutions’ operating costs, the abolition of CNEL and the revision of Titolo V of the 2nd part of the Constitution, which was approved by the Parliament and published on the Gazzetta Ufficiale n. 88, on April 15, 2016?

According to Columbia Threadneedle’s Philip Dicken and Andrea Carzana, over the longer term, reform in Italy is critical for increased economic growth and the ultimate well-being of the Italian people, but it is also important to the economy of Europe and the political stability of the EU.

Columbia Threadneedle believes investors should be very aware of the political risks as, in many parts of Europe they see dissatisfaction with globalisation, the rise of populism (and in some cases nationalism) and a frustration with incumbent politicians. Political risk is on the rise and investors need to get used to it they state. “Italy has many fine attributes but has struggled with low growth and political instability. Indeed, Renzi is the third Prime Minister in four years and his government is the 63rd in the past 70 years. If the referendum succeeds the hope is that Italy will have more stability in its political structure, opening the way to economic reforms which could allow the government to tackle several serious structural issues hindering economic growth.”

There are three areas of the economy which they believe need to be addressed:

- Labour and demographics – an ageing population with high unemployment amongst the young.

- Productivity – persistently low growth and productivity.

- Debt and leverage – high public sector debt and a poorly capitalised banking system, but a wealthy population.

They believe the consequences are:

YES VOTE

- We believe that this will be received positively by markets, at least in the short term. Renzi would have a mandate for his reforms and would probably seek to amend the Italicum law to head off a possible Five Star win in the expected 2018 general election.

- However, if Renzi is not able the change the Italicum law and Five Star continue to gain in popularity from their around 30% in the polls today, then there is an increased risk of a populist, anti-EU, anti-euro government in 2018.

NO VOTE

- This would be negatively received in the short term, in our view, but the longer-term impact would be less clear.

- Renzi could resign and a technocratic government be formed by the President, Sergio Mattarella. The new PM could again be Renzi who would continue to argue for reform, not least because the Italicum law would be neutered by the unreformed Senate retaining its power.

- A technocratic government could be led by others or a general election could be called, both leading to periods of uncertainty.

- Or, Renzi may not resign as threatened and simply continue as PM, albeit with reduced political capital.