From Inflation to Employment: The Fed’s New Priority After the Jackson Hole Speech

| By Cecilia Prieto | 0 Comentarios

On August 22, we likely witnessed Jerome Powell’s final Jackson Hole appearance as head of the Federal Reserve (Fed). As usual, his speech covered key topics: inflation, the labor market, and economic growth. However, this time there was a special emphasis on something that often goes unnoticed: the importance of distinguishing between cyclical and structural factors when crafting monetary policy. Gradually, the Fed’s focus seems to be shifting. Inflation, which dominated headlines in recent years, is now giving way to the labor market, which—with each new report and revision—is becoming the Fed’s main challenge.

Inflation: No Longer the Main Problem?

After several months of slowing down, some inflation indicators—like the PCE, CPI, and PPI—have started to rise again since April. Even the “prices paid” components in the ISM manufacturing and services indices continue to show expansion. However, looking beyond the short term, there are signs that inflation may be structurally losing strength. For example, housing inflation, which carries significant weight in price indices, continues to decelerate. Additionally, concerns about the impact of tariffs on prices, while visible in some goods categories, appear to be under control for now. Powell noted that, for now, he sees this effect as more temporary than structural. The two major risks that could complicate the outlook—unanchored inflation expectations and persistent wage increases—don’t seem likely given current labor market behavior.

For now, inflation data leading up to the Fed’s next meeting will be key: an uptick could suggest strong demand and the ability to pass costs to consumers, while a downside surprise might indicate consumer weakness and potential job cuts to manage costs. Currently, major indicators and surveys show inflation expectations remain aligned with the long-term 2% target, while the labor market no longer appears as tight as in previous months.

Labor Market: The New Concern?

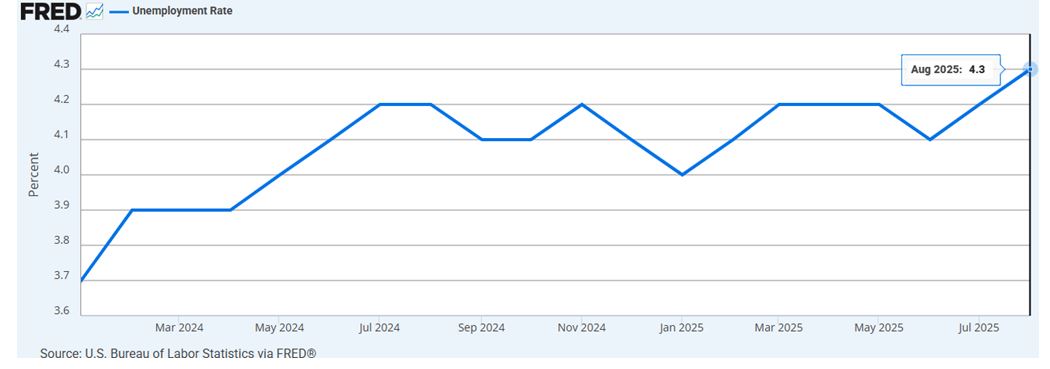

This is where Powell’s speech becomes especially relevant. The Fed Chair acknowledged that July’s employment data was weaker than expected, and previous months’ figures were significantly revised downward. Although the unemployment rate remains low—around 4.3%—job creation is clearly slowing.

In fact, the August jobs report revealed fewer than 600,000 jobs created so far this year. Excluding 2020, the first eight months of 2025 are shaping up to be one of the worst years for job creation since 2009. Interestingly, this lower labor demand is being offset by reduced supply, partly due to lower immigration, which has helped maintain some balance in the market.

However, Powell warned that risks in the labor market are rising. If it weakens further, it could do so abruptly, with accelerated layoffs and a spike in unemployment. Leading indicators, such as the employment components in the ISM indices, are already showing signs of contraction, prompting markets to anticipate a more accommodative Fed going forward.

What Does This Mean for Monetary Policy?

The Fed estimates that the long-term neutral rate—one that neither stimulates nor restricts the economy—may be around 3%, meaning the current level (4.25%-4.50%) remains restrictive. In the June Summary of Economic Projections (SEP), the median Fed member expected to end 2025 with 3% inflation and 4.5% unemployment, implying a federal funds rate of 3.875%—suggesting two more 0.25% cuts for the rest of the year.

However, since then, several changes have occurred within the Fed’s Board of Governors. Adriana Kugler stepped down, Lisa Cook may lose her seat, and it’s expected that President Trump will appoint a new Fed Chair when Powell’s term ends in May. This could completely reshape the Board’s composition, potentially favoring a more dovish stance. In fact, markets are already pricing in up to six additional rate cuts by December 2026, which would bring the terminal rate to a range of 2.75%-3.00%. This outlook aligns with the views of Christopher Waller, a leading candidate to replace Powell.

Conclusion: Is It for Real This Time?

Although markets have previously had false hopes for rate cuts, this time the context seems different. With a weakening labor market, a Fed that may soon include members more aligned with the president’s views, and inflation that no longer poses a structural threat, the case for rate cuts appears stronger. While temporary spikes in bond yields may occur, the overall direction of the yield curve—especially in the short and intermediate segments—seems to point toward a new rate-cutting cycle.

Opinion article by Sebastian Salamanca, Sebastian Salamanca, CFA, CAIA – Senior Invesment Advisor at Boreal Capital Management