Fitch Ratings says the likelihood of a severe downturn in US housing has increased; however, the rating case scenario provides for a more moderate pullback that includes a mid-single-digit decline in housing activity in 2023, and further pressure in 2024.

Although Fitch recently affirmed the ratings and Stable Outlooks for our US homebuilder portfolio, ratings could face pressure under a more pronounced downturn scenario that would likely include housing activity falling roughly 30%, or more, over a multi-year period and 10% to 15% declines in home prices.

The rating case assumes housing activity will fall mid-single digits in 2023 and low-single digits in 2024, leading to revenue contraction in the mid-to-high-single digits in 2023 and low-to-mid-single digits in 2024, with EBITDA margins contracting 600bps during the two-year period.

US GDP growth, unemployment, consumer confidence and home affordability are key indicators that could cause us to lower our rating case projections if trends weaken beyond our expectations. Continued capital allocation discipline that prioritizes liquidity will also be important for issuers to sustain strong credit profiles that support current ratings.

Fitch produced a downgrade case, which considers a stressed housing environment combined with poor operating performance and aggressive management behavior, which could lead to negative rating actions. The stress case assumes homebuilder deliveries decline around 20% in 2023 and 10% in 2024, while average sale prices fall to mid-to-high-single-digit percentages annually. The case could lead to multi-year land impairment and lot option deposit forfeitures of 20% to 30% of YE 2022 inventory.

Some issuers have slight cushion, relative to negative sensitivities, under Fitch’s downgrade case scenario in 2023 and 2024. However, builders that do not build sufficient cash reserves in a downturn would likely need to issue debt to rebuild inventory positions in a housing recovery, which would stretch credit metrics.

DAVINCI Trusted Partner, an independent firm specialized in investment funds distribution, launched two distribution units for institutional clients and alternative investments.

The firm announced the incorporation of Sebastián Ochagavía as Managing Director and Partner of the new divisions.

Sebastián Ochagavía, who was recently Country Head for Allfunds in charge of Argentina, Chile, Mexico and Uruguay, left the company to join DAVINCI Trusted Partner, in order to open the new office in Chile and to lead the business development efforts for the Institutional and Alternative Investments divisions.

Ochagavía has more than 12 years of experience in the financial industry, with an outstanding professional career, having worked in firms such as Allfunds, Compass Group, BlackRock and Corso Inversiones.

Regarding this new development, Santiago Queirolo, partner of DAVINCI Trusted Partner, points out: “We are very excited for the incorporation of Sebastián to our firm, he is an extraordinary professional with proven track record and knowledge of the Institutional market in Latin America. We are sure that his contribution will be essential for the important expansion plans that we have for these business units. Our commitment is to be close to our clients, offering the best-in-class service, as well as investment solutions that adds value to our clients’ portfolios”.

In this sense, Sebastián Ochagavía refers: “I am very excited and grateful to start this new project with my partners. We firmly believe in the same values, having a very clear vision of our business proposition and further evolution of the firm, convinced that there is high growth potential in the Latam & US Offshore markets for a specialized boutique like DAVINCI Trusted Partner.

On the other hand, I would like to thank Allfunds for all these years where I was able to lead the company’s efforts in the 4 countries that I was responsible for”.

Finally, James Whitelaw, partner of DAVINCI Trusted Partner mentioned: “The launch of our new units reinforces our commitment with our institutional clients to bring them outstanding investment strategies. We are delighted to add experience and knowledge in alternative investments, having in mind the increasing demand for this type of vehicles from our clients”.

Robeco will present a Master Class on sustainable investing in Miami that can also be followed through Funds Society’s event platforms.

The event, to be held on September 14 in Miami Beach, will feature specialists sharing their expertise and knowledge on how to navigate the current market environment and beyond.

Among the panel members will be Ana Claver, Country Head Spain, US offshore & Latam; Karin van Baardwijk, Chief Executive Officer; Michael Mullaney, Director of Global Market Research, Boston Partners; David Cohen, Client Portfolio Manager Boston Partners; Ed Verstappen, Client Portfolio Manager Trends Investing.

Also participating will be Erik Keller, Client Portfolio Manager; Nicolas Beneton, Client Portfolio Manager and Sander Duivestein as guest speaker.

To learn more about the agenda and to register for the event, both virtually and in person, you can access the following link.

Dynasty Financial Partners and financial technology company Pontera announced a partnership to allow RIAs in Dynasty’s network to fully manage 401(k), 403(b), and other held away accounts for their clients in a secure and compliant manner leveraging Pontera’s SOC 2 certified platform.

Since 2010, the time of Dynasty’s founding, assets in employer-sponsored retirement accounts have more than doubled from $4.9 trillion to over $11 trillion as of year-end 2021. In addition to market appreciation, this growth is attributable to declines in rollovers due to retiree-friendly plan policies and better in-plan investment options, the company said.

A recent Cerulli report found that of the $3.3 trillion eligible for a distribution last year, 73% remained in-plan. Bipartisan support of accommodative legislation in the SECURE Act 2.0 and the re-enactment of the DOL Fiduciary rule suggest that the trend of employer-sponsored plan growth will only continue.

Consequently, the need for investment advice in these accounts has grown; a recent J.P. Morgan survey found that 62% of plan participants wish they could completely hand over retirement planning to an expert.

Historically, however, financial advisors have struggled to help clients with these accounts as they are typically held off wealth management advisory platforms (or “held away”). Pontera’s technology addresses this gap by allowing advisors to trade held away accounts for their clients. Pontera’s data integrations into portfolio accounting systems means that wealth managers can also run performance reporting, portfolio analytics, and trade surveillance, enabling advisors to provide clients with the same level of service on held away accounts as custodied accounts. Advisors can increase their revenue while providing a comprehensive financial picture through the addition of retirement plan accounts.

“At Pontera, our mission is to be a bridge to a better retirement for investors everywhere by allowing them to get the management they want and need in their held away accounts,” said David Goldman, Pontera’s Chief Business Officer. The benefit of professional investment management to clients can be monumental; research shows professionally managed accounts can generate over 3% in additional value per year, net of fees, and potentially even more during times of volatility like the first half of 2022. “We are humbled and excited to partner with Dynasty, who we view as a pioneer and leader in the independent wealth management space, in pursuit of our goal,” Goldman added.

“At Dynasty, we help leading advisor teams transition to independence so they can provide customized, holistic advice to their clients in ways that may not be possible in other channels,” said Shirl Penney, Dynasty’s CEO. “Managing employer sponsored retirement accounts is critical to delivering a comprehensive service to clients. We are thrilled to have found a provider that can deliver the capability in a scalable, secure, and compliant manner. We look forward to launching with Pontera to bring held away account management to all of our teams and their clients.”

Dynasty will handle the operational elements of Pontera’s services for firms within its network, including billing and performance reporting integration, allowing them to focus on delivering best-in-class client services. Dynasty joins a number of other fintech providers in recently announcing partnerships with Pontera.

Fiduciary Trust International, a global wealth manager and wholly-owned subsidiary of Franklin Templeton, announces that Sam Fraenkel has joined the firm as a wealth director based in its Coral Gables office.

“Sam possesses in-depth investment expertise which will help us serve clients’ sophisticated needs today, and in the future, in a growing market,” said Michael A. Cabanas, regional managing director of Fiduciary Trust International’s Coral Gables office. “South Florida remains an important market for our organization, and we look forward to working with Sam to build customized strategies for enabling clients in this region to increase and protect their wealth across generations.”

Mr. Fraenkel was most recently head of mergers and acquisitions at REDZONE, a software business delivering plant floor connectivity for companies in the food and beverage industry. He was also founder and president of Tomahawk, a leader in the aggregation and analysis of web-based data for hedge funds. Earlier in his career, Mr. Fraenkel worked on the equity sales team at Evercore ISI, a research-driven investment bank. In addition, he was head of equity research at Beacon Trust, a full-service wealth management firm.

Mr. Fraenkel received his bachelor-of-science degree in finance from Tulane University.

“Fiduciary Trust International is well-respected in the industry for its commitment to client service, and I am proud to join this organization,” said Mr. Fraenkel. “I am eager to work with my new colleagues to help clients and their families meet their short- and long-term financial goals, and enable them to achieve financial peace of mind.”

Mr. Fraenkel is the latest addition to the Fiduciary Trust International team in South Florida. In June 2020, the firm welcomed Todd Stoller as senior portfolio manager and regional managing director for its office in Boca Raton. Mr. Cabanas was named regional managing director of Fiduciary Trust International’s Coral Gables office in April 2019. Edgardo Gonzalez joined the firm’s Coral Gables office as a managing director and senior portfolio manager in August 2018.

About Fiduciary Trust International

Fiduciary Trust International, a global wealth management firm headquartered in New York, has served individuals, families, endowments and foundations since 1931. With over $86 billion in assets under management and administration as of June 30, 2022, the firm specializes in strategic wealth planning, investment management and trust and estate services, as well as tax and custody service, according the company information.

iCapital and UBS today announced they entered into a definitive agreement whereby iCapital will acquire UBS Fund Advisor LLC, UBS’s legacy proprietary US alternative investment manager and the feeder fund platform it manages. The platform, generally referred to as “AlphaKeys Funds,” represents more than US$7 billion in client assets.

With this transaction, iCapital will assume the management and operation of the platform, which includes private equity, hedge fund and real estate feeder funds. UBS Financial Advisors will continue to serve their high and ultra-high net worth clients that hold feeder funds as they always have, providing advice and solutions to help meet their unique needs and financial goals.

“iCapital has a long-standing global relationship with UBS through which we utilize our market-leading technology to facilitate the management of their direct and feeder funds on a single platform and offer their advisors the tools they need to be successful,” said Lawrence Calcano, Chairman and Chief Executive Officer of iCapital. “We are thrilled to expand that relationship to include management of UBS Fund Advisor and the feeder fund platform.”

“This agreement underscores the importance of having partners like iCapital, with aligned values and priorities to support clients’ financial goals,” said Jerry Pascucci, Global Co-Head of Alternative Investment Solutions at UBS Global Wealth Management. “iCapital is uniquely qualified to manage the on-going operations of this platform and service our clients’ existing investments, enabling us to help our financial advisors focus on what’s important – providing personalized advice and solutions to their clients.”

In 2017, UBS became an investor in iCapital and entered into a strategic relationship with the firm to structure new feeder funds for UBS to distribute going forward. At that time, UBS also integrated iCapital’s proprietary technology into its private fund operations to streamline and automate its alternative investment offerings.

In 2021, the strategic partnership was enhanced to further digitize the UBS Advisor experience, improving the information and analytics of clients’ private market investments across its international locations, including Switzerland, Hong Kong, and Singapore.

The transaction is expected to close during the second half of 2022. Terms of the agreement were not disclosed.

Sanctuary Wealth welcomes The Alteri Group, formerly with Merrill Lynch, to its network of independent advisors.

Headed by Max Alvis and based in Lufkin, Texas, the team, with assets under management of $460 million, will be joining Sanctuary Wealth through partner firm 6 Degrees Wealth, a joint venture of G Squared Private Wealth led by George Georgiades and Victoria Greene, and Concenture Wealth Advisors led by Robert Gilliland.

The Alteri Group is the second team this year to choose independence by affiliating with 6 Degrees on Sanctuary’s platform.

“There are many flavors of independence and several avenues through which advisors can choose to join Sanctuary. In this case, the team chose to do so by tucking in to 6 Degrees Wealth, one of our rapidly growing partner firms,” said Jim Dickson, CEO and Founder of Sanctuary Wealth. “As a company, Sanctuary is committed to helping our partner firms grow organically by constantly expanding the offerings on our platform and inorganically through co-investment that facilitates M&A activity.”

Max Alvis who served as the Senior Resident Director of the Lufkin, TX office, began his career as a financial advisor at Merrill Lynch Wealth Management in 1991. He has earned the Certified Investment Management Analyst® (CIMA®), Certified 401(k) Professional (C(k)P® ), and Certified Plan Fiduciary Advisor (CPFA®) designations and is also a member of the Investments & Wealth Institute™.

“The impetus behind the decision to leave Merrill Lynch after 31 years is that we feel working with an independent firm is what will be best for our clients over the long term. It also made sense at this point in my career, although I’m not planning to retire, to think about a succession plan,” said Max Alvis, CIMA®, CPFA®, C(k)P®, Managing Director, The Alteri Group at 6 Degrees Wealth. “I know the character of the people at Sanctuary and that means a lot to me. Years ago, Vince Fertitta and I were young producing managers working together in the same complex and we’ve maintained a relationship since the 90’s. George, Robert, and I were also producing managers in the same region for decades, becoming close friends, and I relied on Vicki’s market expertise for years at Merrill. I have always admired their professionalism and know we share the same philosophy and client-first mentality.”

“One of the great things about being a Sanctuary Wealth partner is how committed they are to providing resources we need to continue growing,” said George Georgiades, CIMA®, Chief Executive Officer, 6 Degrees Wealth. “I couldn’t be happier that Max Alvis has decided to join us at 6 Degrees. He has a young team of all-stars who have already proven they have what it takes to succeed in this business. We are excited to work with them on the next phase of their careers and look forward to adding their contributions to the 6 Degrees success story.”

Joining Max Alvis at 6 Degrees Wealth will be the other team members of The Alteri Group, including Wealth Advisors Will Alvis, and Alexis Hudson Pigg as well as Registered Client Associate Jennifer Hansard and Client Associates Elisabeth Alvis Kennedy and Viridiana Cruz.

Will Alvis spent more than 9 years with Merrill Lynch, where he was a Senior Financial Advisor, Vice President, and holds the Certified Plan Fiduciary Advisor (CPFA®) and Chartered Retirement Planning Counselor designations. Alexis Hudson Pigg joined Merrill Lynch Wealth Management in 2012 after earning her bachelor’s degree in marketing from Stephen F. Austin State University and holds the Chartered Retirement Plans SpecialistSM, (CRPS®) designation.

Northern Trust has appointed Jose M. Perez Senior Lending Officer of the South Florida Market. He will be responsible for a significant diversified loan and deposit portfolio comprised of domestic and international clients, including affluent families and closely held companies.

Perez brings to Northern Trust more than 25 years of experience in private, commercial, and corporate banking, with a focus on providing lending solutions and depository services.

Previously, he served as Senior Loan Team Manager and Senior Vice President at the Commercial Real Estate Department of Wells Fargo, covering the Mid-Atlantic and South regions.

“Jose’s leadership exemplifies our commitment to providing world-class solutions to the families and institutions we serve in South Florida,” said Alexander Adams, Northern Trust Wealth Management President, South Florida.

Perez earned his Masters of Business Administration in Finance from the University of Rochester, as well as his Bachelor of Arts in Economics from Rutgers University.

The idea that the more risk taken, the higher the expected return is well understood by the public and is at the core of an investment professional’s knowledge. However, in a context of high volatility and choppy markets, many investors struggle to truly incorporate this concept when it comes to making real investment decisions.

The current environment for dollar denominated LatAm corporate debt, as well as for other risky assets that might form part of a diversified portfolio, poses a dilemma: on the one hand, valuations and spreads look particularly attractive amid a volatile market, but on the other, managers are taking extremely cautious stances and holding cash on the sidelines, reflecting risk aversion.

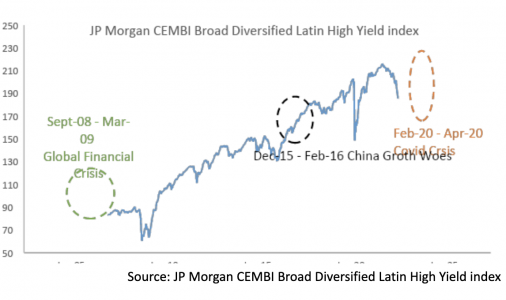

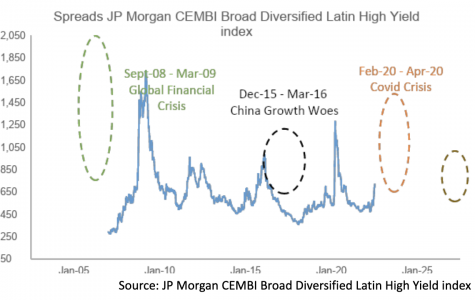

Taking a closer look at the last 15 years of history, we find three periods of abrupt sell offs of the JPMorgan CEMBI Broad Diversified Latin HY index. All three episodes share two main features: spreads widening above 300 basis points in less than 3 months and returns tumbling more than 15% in that same period. These are the 2008 global financial crisis between September that year and March of 2009, then the concerns over Chinese growth between December 2015 until February 2016, and finally the covid crisis between February and April of 2020.

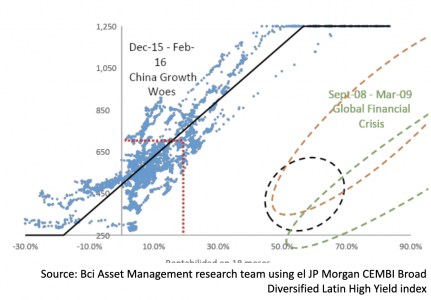

Looking deeper, if we analyze the returns obtained after 18 months elapsed from investing in the index for each day of the last 15 years, we find a direct positive relation between the entry spread level and the final return after 18 months, as shown in the following chart.

This exercise provides evidence that in this asset class, the entry level of spread or valuation at the moment of investing has historically held a direct relation with the returns obtained after 18 months. This implies that, the lower the spread at entry, the lower the final return or inversely, the higher the spread level at the time of investing, the higher the achieved return. The relationship is especially apparent in the case of investments during the three crisis episodes identified and highlighted in the chart above. The red dotted line shows the current spread level of LatAm high yield corporate debt and the potential expected return after 18 months using this historic relation between the spread entry level and the terminal return in this period.

What can we expect for markets in the coming months? What will be the peak levels for LatAm corporate bonds spreads? We do not know; the answer to these questions depends on the evolution of global markets and investors’ risk aversion, as well as whether central banks efforts to control the persistent inflation and investors’ expectations are successful or not, among other developments impossible to predict. Furthermore, the answer will depend on whether or not the global economy avoids a deep recession brought on by monetary policy overshooting the necessary amount of tightening.

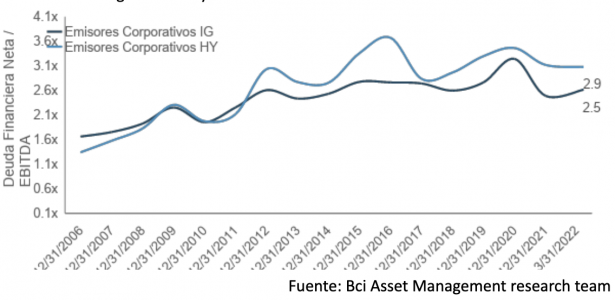

Today we see spread levels over 700 basis points and yields around 10% for the CEMBI Latin HY Index. Latin America is a region that maintains its historical dependency on commodities and continues to be subject to political uncertainty – the regional backdrop is the same as for the last 15 years. However, corporate issuers today have the lowest debt levels they have had in almost 10 years, suggesting resiliency in the face of a wavering business cycle.

It is important to recognize our own incapacity to accurately time an investment exactly at the market bottom while simultaneously acknowledging the significant impact that timing can have. For example, those who chose to invest in LatAm corporate high yield debt in the first month after the fall of Lehman Brothers in September, 2008 (at a spread around 700 basis points) saw returns after 18 months close to 20%. However, those who waited 6 months more until spreads reached 1,500 basis points were richly rewarded with returns after 18 months of approximately 60%. Despite these differences, it’s clear that in both cases, the decision to invest was correct. Final returns were double-digit, compensating the risk undertaken in the throes of the greatest economic and financial crisis of modern history.

In summary, we are neither likely to perfectly time the market, nor are we likely to predict the duration of the downturn in Latin American debt markets. However, given this universe of issuers with healthy financial situations, we feel comfortable extrapolating that current spread levels allow for double-digit returns over the next year and a half, based on the historical precedent of the last three similar market downturns.

Just when the industry thought it had begun to understand cryptocurrencies and the digital world, new concepts like non-fungible tokens (NFTs) and the metaverse begin to dominate the conversation.

If you grew up in an era of cassette tapes, drive-in movies and pay phones, these evolving frontiers may seem foreign and a bit overwhelming, a Morgan Stanley report interjects.

Even if you don’t engage in NFTs or the metaverse now, you may do so in the future.

“NFTs recently broke a monthly sales record with $4 billion in trading activity. Meanwhile, Gartner, a leading research and consulting firm, predicts that 25% of the population will spend at least one hour a day in the metaverse for work, shopping, education, social networking or entertainment by 2026,” adds the report.

For this reason, investors should be wary of the most common scams surrounding NFTs.

For example, the price of NFTs can be manipulated. With this scam, a group of fraudsters work in harmony to buy select NFTs to pump up the demand for them—which causes the price to rise. When the price reaches their target, the cybercriminals will cash out. Without the artificial demand from the fraudsters, the price of the NFTs plummets—leaving newer buyers with a sharply devalued or worthless asset.

If you’re interested in an NFT, review its transaction history and wallet records before buying. If you notice unusual activity—such as a large number of transactions within a short timeframe—it could be due to scammers trying to inflate the value of the NFT.

Another popular scam are the phishing sites, ads and pop-ups. In a twist on typical phishing scams, fraudsters will create NFT sites that closely replicate authentic sites in appearance. As a result, it’s easy for eager buyers to end up purchasing worthless, counterfeit NFTs on these bogus sites.

Additionally, phony ads or pop-ups may lure you to fake login pages for legitimate NFT sites. And, if you enter your information, cybercriminals will capture it. So, make sure to verify the URL of any NFT site before logging in or making a purchase.

For additional safety, type the URL directly into your browser instead of relying on a search engine result. Also, don’t click on any ads, pop-ups or links for NFT sites. Always go directly to the verified site instead.

Fake social media profiles: Unfortunately, fraudsters are also adept at creating social media accounts that seem to represent legitimate NFT organizations. They use these platforms to hawk counterfeit NFT artwork, hype fake NFT endorsements from celebrities/influencers and promote phony NFT giveaways.

While it’s not foolproof, look for a blue verification tick on the profile to verify the authenticity of the account and check to see if reputable personalities follow the page.

Another rule of thumb is to not link your social media to any Crypto or NFT exchange. This provides a way for fraudsters to create tailored phishing messages based on your portfolio.