FTX, once the world’s third largest crypto exchange and a private company previously valued at $32.5 billion, is reportedly on the brink of bankruptcy after its rival Binance walked away from a deal to acquire it.

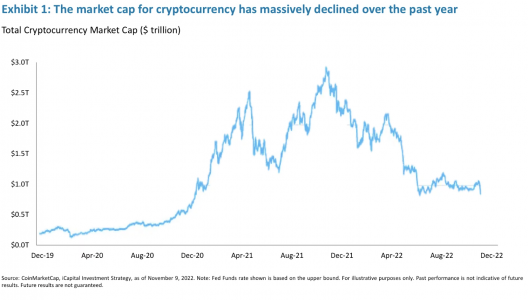

This in turn unnerved the broader crypto markets, putting pressure on bitcoin, which is now trading at $16,700. It’s clear that crypto is the “something that breaks” as the Fed aggressively hikes rates. The question for iCapital now is – how systemic is it?

The phrase “liquidity crunch” is eerily reminiscent of what we heard during the financial crisis, so when Binance said that in a statement about FTX, it raised concerns about systemic implications. Latest reports suggest that FTX investors were told that without more capital, bankruptcy is likely. Given the current state and persistent weakness of the market, there could be other bankruptcies, especially in companies that relied on trading volumes to grow and price appreciation of cryptocurrencies to continue, said the Anastasia Amoroso report.

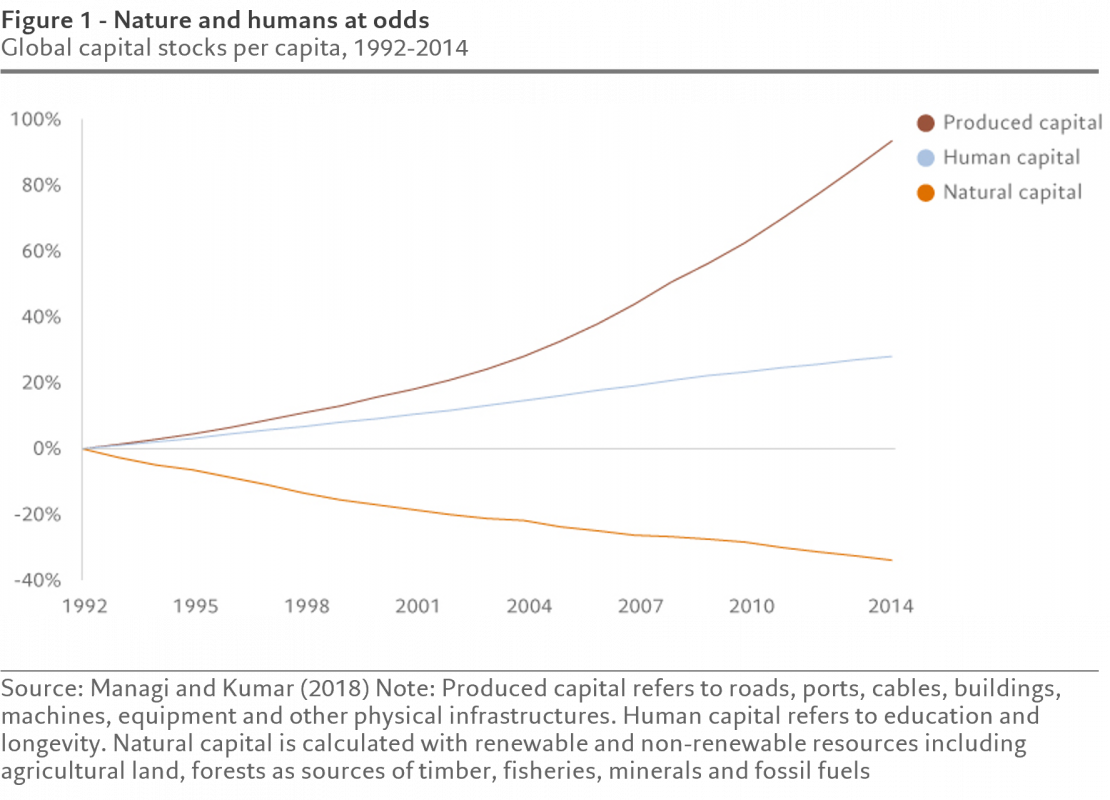

Overall trading volumes have risen significantly most recently, with the current daily trading volume across the crypto universe at $610 billion vs. the year-to-date average of roughly $300 billion per day. However, this year this average is lower than the 2021 average daily trading which peaked at just north of $1.5 trillion. And the market cap of cryptocurrencies declined by 72% in a year falling from nearly $3 trillion a year ago to roughly $800 billion. This is a massive wipe-out and wealth destruction, almost on par with the $3.3 trillion in home equity U.S. homeowners cumulatively lost during 2008 or the nearly $4 trillion lost in the overall market cap of the Nasdaq Composite Index between 2000-2001.

However, “we believe the crypto meltdown should not have the same systemic consequences as the housing crisis did in 2008”, added Amoroso.

Still limited household exposure to crypto. Roughly 10% of all households in both the U.S. and in Europe have some cryptocurrency exposure. Of those households in Europe that have exposure, roughly 65% hold less than $5,000 worth of cryptoassets. Within the U.S., the average crypto holding is roughly $1,000. This is in stark contrast to housing, for example, where a significant share of the population was exposed, as 66.0% of U.S. households are homeowners and the share of homeowners with a mortgage is 64.8%.

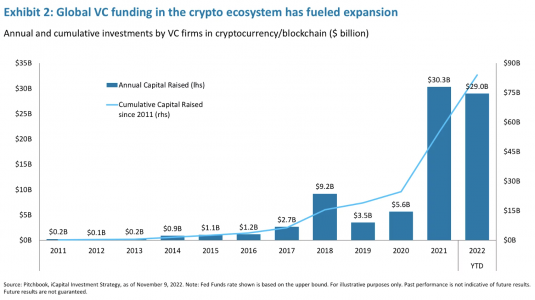

Limited banks’ exposure to crypto, expansion of which was largely financed by venture capital. Banks have made efforts to add crypto to their offerings, but are just getting started, having largely avoided the space to date. According to the Basel Committee on Banking Supervision as of the end of 2021, total cryptoasset exposures reported by banks amounted to roughly $9 billon, which is less than 0.14% of the surveyed banks overall risk exposure. And given that most of the crypto ecosystem is private – there are 10,036 private crypto companies globally vs. 218 that are public – the growth of it has mostly been financed by venture capital (VC).

For example, global VC funding in the crypto ecosystem has reached $29.0 billion through the first three quarters of 2022 after a banner $30.3 billion in 2021, which was an 5.4x step-up from 2020 funding levels. Cumulatively, $83.9 billion has been invested by VC firms in various cryptocurrency and blockchain companies since 2011, and unfortunately, some portion of this funding is now at risk of a write down. For example, Sequoia Capital just put out a note to LPs stating that it is reducing its investment in FTX to zero.

Select institutions and corporates have bumped up their allocation to crypto, but not uniformly and to manageable levels. In fact, while a recent study found that 94% of state and government pension plans invest in cryptocurrencies, most pension still allocate a very small portion to cryptos. For example, the Houston Firefighters’ Relief and Retirement Fund, which has the ability to allocate up to 5% of its overall portfolio to cryptocurrencies, has 0.5% of its portfolio in crypto.

Given this lack of broad exposure within the finances of most stakeholders, we don’t view the crypto meltdown as systemic, however, the impacts on tech and growth can be more far reaching.

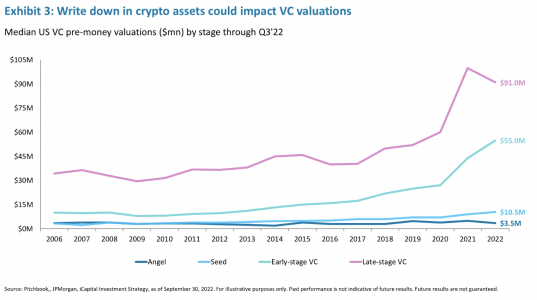

First, venture capital funds will bear the brunt of the losses. These same funds were likely funding deals in other areas of growth and tech. And having to write down their crypto investments could limit their ability and willingness to take on risk to finance other areas of growth. All in, this will create a more subdued risk-taking environment. VC valuations have grown rapidly from 2020 through the first half of 2022 which generated spectacular returns for VC firms – 3-year annualized return of 30.5% for VC vs. 3.9% for the Russell 2000. Now we are likely facing a period of repair and valuation deflation, and therefore, lower returns.

Second, crypto is a part of the tech ecosystem, and as a result, the impact of its collapse will be felt in other parts of tech earnings adversely impacting earnings. For example, as new coin creation stalls and existing coin mining declines, so should demand for cryptomining processor semiconductor chips. AMD estimated that 5-10% of overall demand comes from cryptominers, which would decline significantly during period of turmoil. Taiwan Semi estimates while crypto accounted for 10% of sales in 2018, but this percentage declined to 1% in 2021. While these percentages are not large, they add to other overhangs facing the semiconductor industry.

Third, the other concern is as crypto leverage unwinds and investors face margin calls, other assets may need to be liquidated. And given the overweight to tech many investors held in recent years, that could be a candidate for liquidations. The bottom line is if together with crypto there is selling pressure on other parts of tech, this will certainly cap (if not depress) any market upside since Information Technology and Communications Services account for a third of the overall S&P 500 market cap.

While “we don’t see crypto unwind as systemic,” what’s playing out is reminiscent of the tech and housing bubbles, where valuations rose without a corresponding rise in revenues/profits, said Amoroso. They collapsed when too much leverage and “asset packaging” accumulated in the system. The realities of unsustainable crypto schemes are coming to the forefront right now. The amount of crypto financial engineering appears to be staggering. Lack of regulation, lack of consumer protections, and lack of liquidity buffers are blatantly apparent and unfortunate. Select actors, knowingly or unknowingly, created business models that are untenable if asset values decline, withdrawals pile up, and liquidations occur.

The good news is that those untenable use cases will be exposed and will fail. The crypto correction is healthy for the overall ecosystem as froth and exuberance will be flushed out. Crypto applications solving real-world problems should survive. And in an interesting turn of events, TradFi (traditional finance) is actually among those building sustainable DeFi (de-centralized finance) solutions. Despite the meltdown in many parts of the crypto ecosystem, traditional finance players are leveraging blockchain technology to process cross-border payments, issue digital bonds, or make private equity available on the public blockchain to expand access to individual investors. These are some examples of viable use cases and types of applications that have merit and should survive. And importantly, they are being done within the established regulatory framework.

Bitcoin overtime should also find more viable applications. It is not financially over engineered and does have applications in payments. But in an environment where cash pays 4%, bitcoin will likely struggle. History suggests that it takes time for broken leaders to regain their dominance. For crypto broadly, we would expect any recovery after the FTX collapse to be L-shaped.

To access the full report you must access the following link.