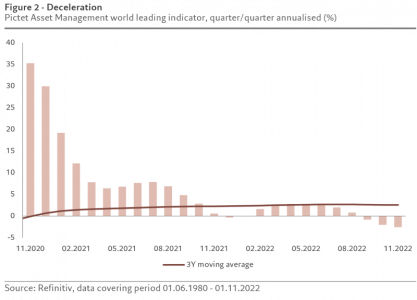

In the US, the high level of excess household savings should support consumption and help the economy avoid a sharp contraction; we expect the US to register real growth of 0.4 per cent this year.

We also think the risk of a deep recession in the euro zone has somewhat receded. Despite weak economic activity and tighter lending standards, industrial production remains resilient.

Falling energy prices, meanwhile, should lead to a significant decline in price pressures across the region, with core inflation more than halving to 1.6 per cent from a 2022 peak.

Japan’s economy, meanwhile, is likely to outperform the rest of the world next year, supported by improving leading indicators, booming tourism and resilient capital spending.

That said, weak retail sales and consumer morale and a rapid deterioration in the current account balance – which is now negative for the first time since 2014 – point to a weak recovery in the coming months.

China’s recent economic data has been weak across the board, but the recent reopening of its economy suggests plenty of scope for recovery, especially for retail sales, which are currently some 22 per cent below their long-term trend on a real basis.

Beijing is likely to adopt a more pro-growth economic agenda, which should help lift growth in the world’s second largest economy to 5 per cent in 2023 from last year’s 3 per cent, according to our calculations.

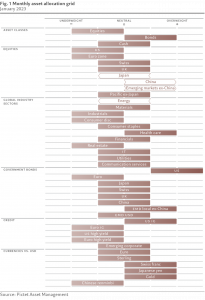

Our liquidity indicators support the case for retaining a cautious stance on risky assets over the near term. But conditions will likely improve after the first quarter of 2023, especially in emerging economies.

We expect the global economy to experience a net liquidity drain equivalent to 6 per cent of GDP in 2023 as central banks including the US Federal Reserve and European Central Bank continue to tighten the monetary reins. Investors should however expect a shift in monetary tightening trends.

The Fed is, we believe, entering the final phases of its tightening campaign with the benchmark cost of borrowing set to peak at 4.75-5 per cent in the first quarter of this year. The ECB’s balance sheet contraction, meanwhile, is likely to be more aggressive than the Fed’s, amounting to a reduction of some EUR1.5 trillion, or 11 per cent of GDP, which should add to downward pressure on the dollar.

After a hawkish statement in December, investors now expect euro zone interest rates to rise to 3.25 per cent by September 2023.

The Bank of Japan’s surprise change to its bond yield control policy – it will now allow the 10-year bond yield to move 50 basis points either side of its zero rate target – should pave the way for the central bank’s eventual exit from its zero interest rate policy.

Bucking the global trend, China is leading a moderate easing cycle with the People’s Bank of China delivering targeted support measures.

The credit impulse – a leading economic indicator – is positive while China’s real money supply (M2) is expanding at 12 per cent year on year, the highest in six years. In contrast, developed economies continue to experience tighter conditions.

Our valuation model shows bonds and equities are both trading at fair value.

Valuations for global bonds are neutral for the first time since February, with yields 50 basis points lower than their peak in mid-October.

Global equities, meanwhile, trade at a 12-month price earnings ratio of 15 times, in line with our expectations, but our models point to mid-single digit re-rating of multiples over the next year provided that US inflation-adjusted 10-year bond yields fall to 1 per cent.

Corporate earnings momentum remains weak across the world and we forecast 2023 global EPS growth to be flat, which is below consensus forecasts of around 3 per cent growth, with significant downside risks in earnings in case of weaker than expected economic growth.

Our technical and sentiment indicators remain neutral for equities with seasonal factors no longer supporting the asset class.

Data shows equity funds experienced outflows of USD17 billion in the past four weeks. Emerging market hard currency and corporate bonds posted consecutive weekly inflows for the first time since August.