In recent years, the offshore wealth management market toward the United States has experienced notable growth, driven by both structural factors and short-term developments.

Traditionally linked to the wealth protection of Latin American families, this segment has evolved into more sophisticated and diversified models that are better aligned with the needs of today’s investors.

The transformation of this market is no longer merely about protecting wealth; it is about managing it with a global vision, technological tools, generational empathy, and clear ethical principles.

New generations are redefining the relationship with wealth. Women—both as clients and as advisors—are playing an increasingly central role. And artificial intelligence is optimizing operational efficiency without sacrificing personalization. In the face of global volatility, well-prepared and empathetic advisors are more valuable than ever.

Sustained Growth with Strong Foundations

Several Latin American countries have increased their assets under management on offshore platforms located in the United States, driven by the pursuit of financial stability, access to global markets, and legal protection through structures such as trusts, Limited Liability Companies (LLCs), and corporations. While uncertainty in some countries has accelerated this migration of wealth, more structural factors also play a role: the strengthening of platforms with advanced technological capabilities, regulatory openness with greater transparency (FATCA, CRS), and the need for more efficient estate planning structures.

Changes in Country Participation

Mexico remains one of the main sources of capital flowing to offshore platforms, with a strong interest in fiduciary structures and insurance-based wealth planning solutions.

In Brazil, the recent tax reform has encouraged formalization of wealth and capital flows toward jurisdictions with clear rules.

Argentina, with its currency controls, maintains its traditional focus on the United States as a destination for assets.

Colombia and Chile, though smaller in volume, show steady growth driven by emerging upper-middle classes interested in international diversification. Meanwhile, in Peru, there is increasing interest among business owners and professionals with mid-sized estates seeking stability and estate planning.

Key Trends

Growth has been both quantitative and qualitative. Platforms offering robust custody, digital tools, and international regulatory compliance are consolidating, and several firms have capitalized on this.

At the same time, the market is shifting toward hybrid models that combine traditional advisory services with discretionary management and more segmented service offerings based on clients’ wealth profiles. Sophisticated clients are seeking access to alternative investment vehicles, tax solutions, and comprehensive risk management.

New Generations and the Impact of Diversity

One of the most profound changes in the sector is the emergence of new generations. Millennial and Gen Z clients value immediacy, transparency, and alignment with their values.

They prefer digital experiences, sustainable investments (ESG), and clear communication. This generation is not only poised to inherit a significant portion of global wealth but is already making independent financial decisions.

At the same time, women are increasingly playing a decision-making role in financial matters. This not only expands the client base but also changes how advisory services are delivered: women often prefer consultative, long-term, and holistic relationships. Additionally, the offshore market is witnessing a steady rise in the number of female financial advisors, who bring new perspectives, more empathetic communication styles, and greater diversity to wealth management teams.

This trend reflects both a generational shift and institutional recognition of the value gender diversity brings to client relationships. Firms once dominated by men are now promoting female leadership, fostering more inclusive environments, and strengthening connections with an increasingly diverse clientele.

The inclusion of more female advisors has also improved representation, strengthened client relationships, and enriched decision-making by incorporating different approaches from the traditional norm.

Artificial Intelligence and the Transformation of the Advisory Model

Technology—and especially artificial intelligence (AI)—is redefining the financial advisory model. From using algorithms to design personalized portfolios to automating compliance, onboarding, and risk monitoring processes.

Advisors can now focus more on human relationships and strategy, leaving operational and analytical tasks to intelligent tools. In an increasingly competitive environment, this combination of efficiency and closeness makes the difference.

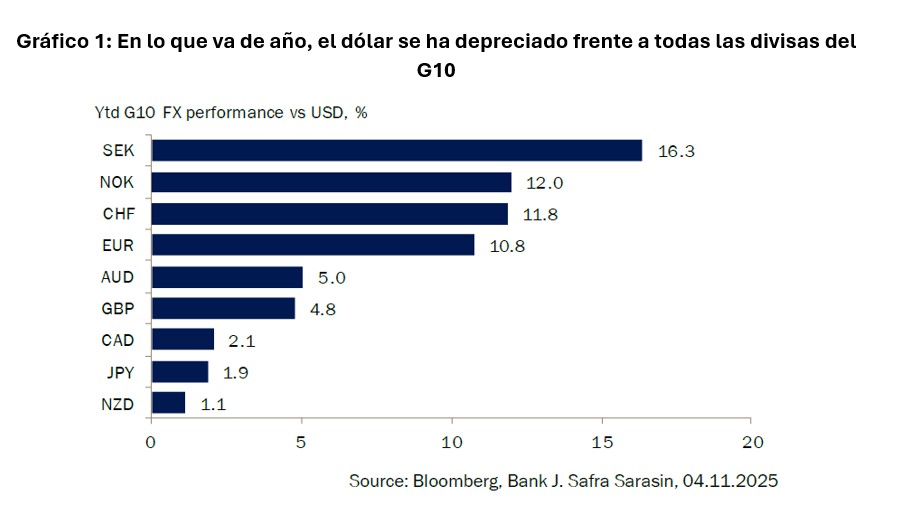

One of the recent challenges in the market has been the uncertainty caused by new tariff announcements and trade tensions, particularly between the United States and China, but also with Latin American and European countries.

In this context, many firms adopted protective strategies: rebalancing portfolios toward defensive assets, geographic diversification, use of derivatives, and ongoing communication with clients to avoid emotional decisions.

Proactive and personalized advice was key to navigating this period of volatility, reinforcing the advisor’s role as a guide beyond purely financial matters and above technological tools.

In Summary

The offshore wealth management market toward the United States is undergoing a deep transformation. Firms that integrate the key strategic elements mentioned—technology, diversity, multigenerational planning, and risk management—will be better positioned to lead the next cycle of growth in the offshore market.

FATCA (Foreign Account Tax Compliance Act) is U.S. legislation aimed at combating tax evasion. CRS (Common Reporting Standard) is the global, non-U.S. equivalent of FATCA.