Portfolio Management 2024: What are the top 10 challenges for capital raising and client management?

| By Romina López | 0 Comentarios

Portfolio management faces several complex challenges that require the constant attention of industry professionals. The 1st Annual Report of the Asset Securitization Sector, sponsored by FlexFunds, highlights the top 10 challenges facing portfolio managers when raising capital and acquiring clients.

Raising Capital and Acquiring Clients: A Competitive Battleground

Tightening regulations, which can increase costs and create barriers for new investors, is one of the first complications portfolio managers encounter. Intense competition to attract clients and capital adds to this challenge, especially when differentiation between financial products is minimal.

Lack of understanding on the part of investors and clients about investment strategies and financial products can generate fear and indecision, especially in environments of low returns or lack of liquidity.

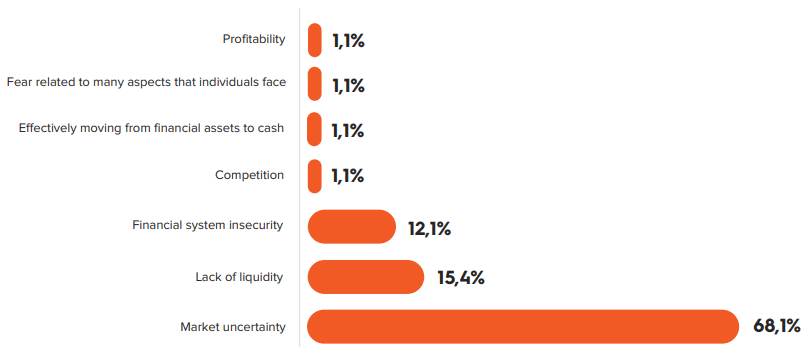

However, market uncertainty, arising from volatility or structural factors, stands out as the most problematic factor for acquisition.

FlexFunds’ report studies the main trends in asset management, which included the participation of more than 80 companies from 15 countries in LATAM, the United States, and Europe. This report reveals that 68.1% of participants consider uncertainty the most significant challenge, followed by lack of liquidity (15.4%) and financial system insecurity (12.1%). These factors accounted for 95.6% of the responses.

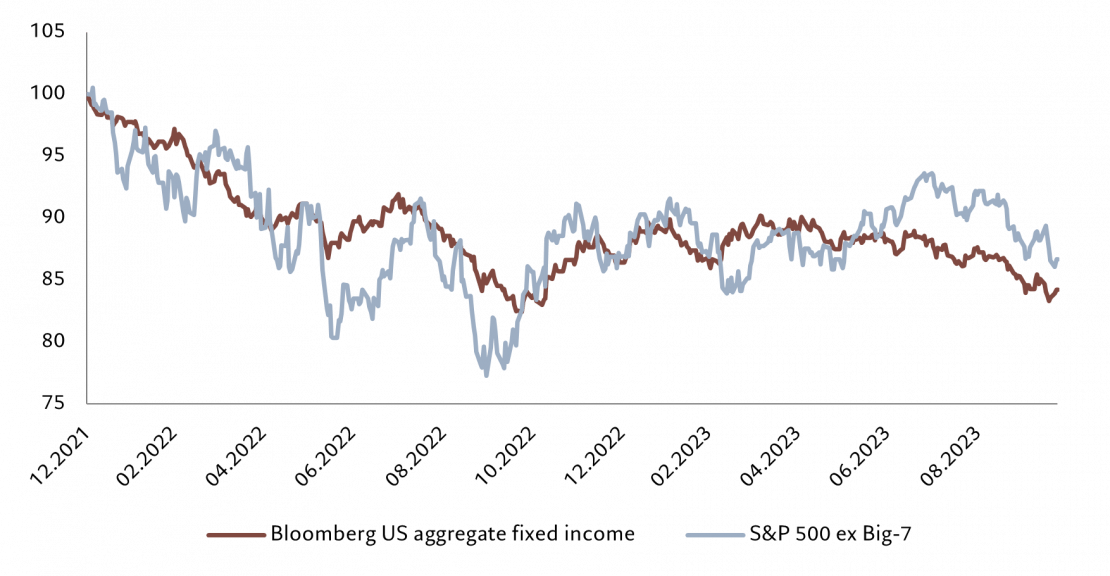

Market volatility undermines investor confidence and increases risk aversion, delaying investment decisions. Overcoming these challenges requires tactics that address uncertainty and improve client understanding of investment strategies.

Difficulties in Client Portfolio Management

According to the FlexFunds’ report, investment portfolio management faces several complex challenges, the top 10 of which stand out:

- Client risk tolerance: Each client has a different risk tolerance, requiring careful balance in portfolio composition.

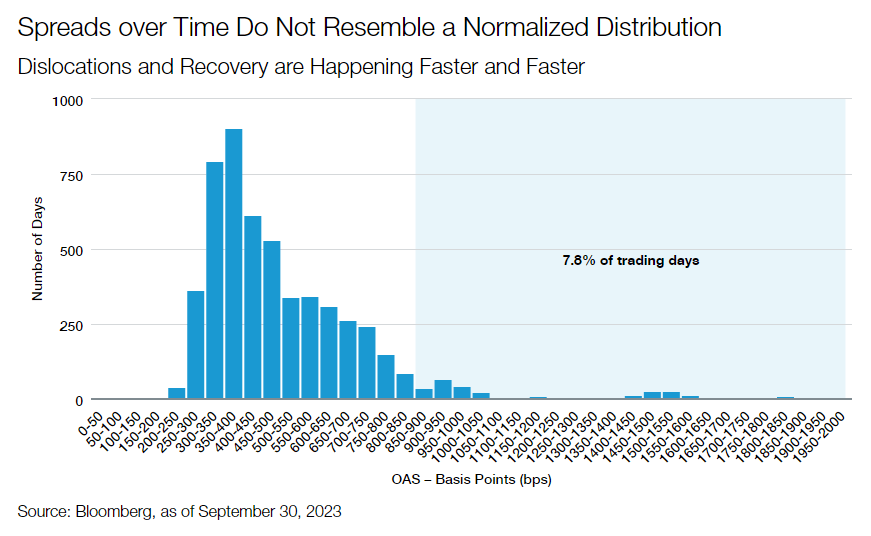

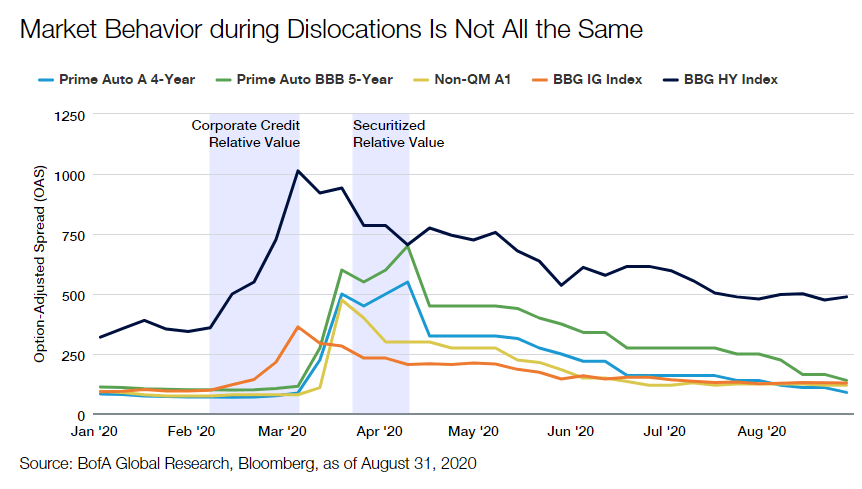

- Market volatility: Financial markets are inherently volatile, requiring frequent adjustments to maintain portfolio balance.

- Changes in economic conditions: Economic and market conditions impact asset returns, requiring adaptability in investment strategy.

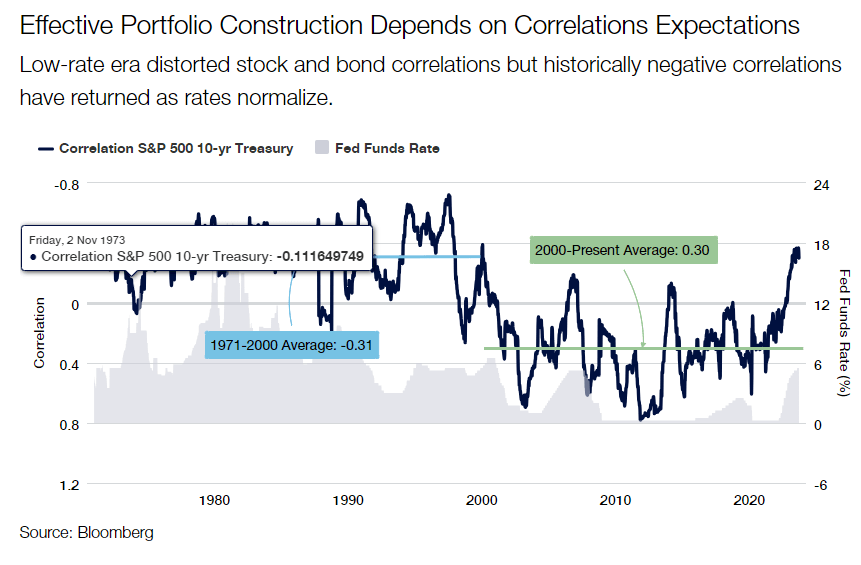

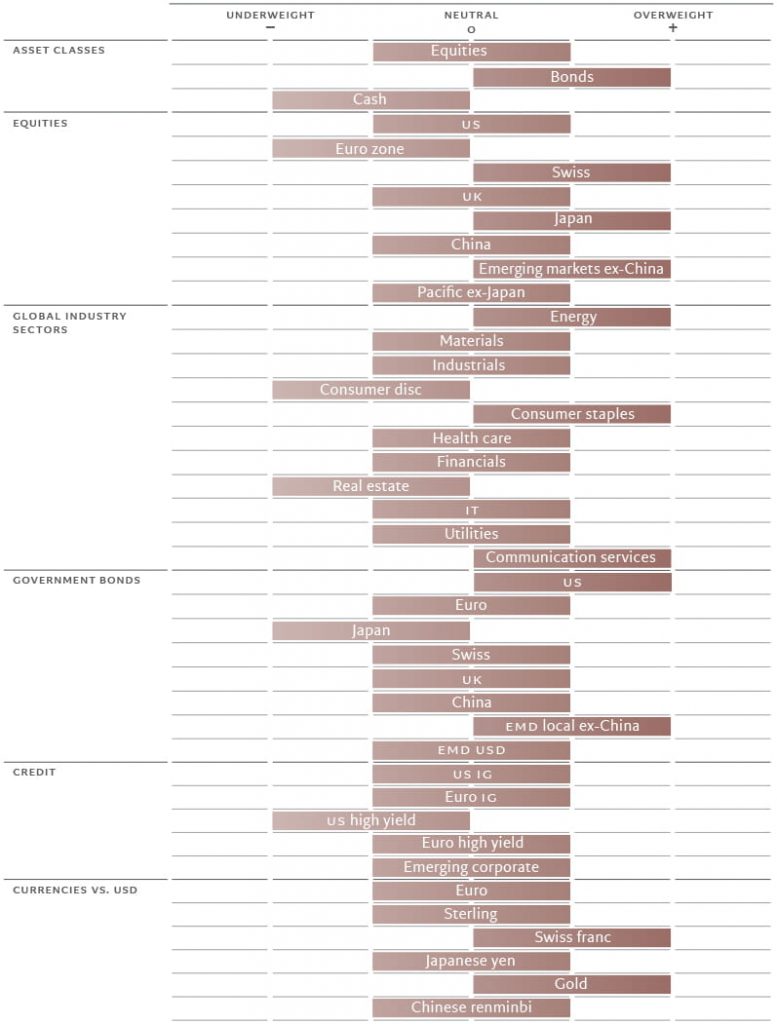

- Proper diversification: Achieving optimal diversification can be challenging, requiring in-depth analysis and specialized knowledge.

- Asset selection and active management: Identifying strong asset investment strategies and actively managing the portfolio involves constant monitoring and informed decision-making.

- Costs and fees: Balancing costs with the quality of services and results is essential to maintaining the client’s net return.

- Effective communication: Clear and effective communication is crucial to understanding the client’s changing needs and ensuring trust over time.

- Compliance and regulation: Keeping compliant with regulations and ethical standards is essential for asset managers.

- Managing client emotions: Handling client emotions during volatility is crucial to avoid impulsive decisions.

- Relative performance and expectations: Addressing client expectations and explaining relative performance is vital to maintaining trust.

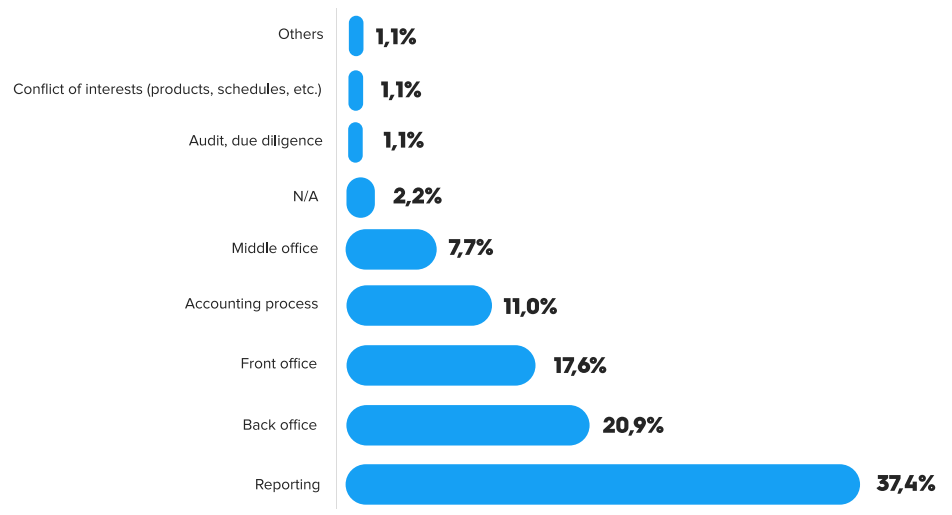

When industry professionals in more than 15 countries were asked, “What are the main difficulties you face in client portfolio management?” respondents identified reporting (37.4%), back-office (20.9%), front-office (17.6%), the accounting process (11%), and middle-office (7.7%) as the primary challenges in portfolio management.

Dive into a detailed analysis of the difficulties in portfolio management. From risk tolerance to emotional client management, FlexFunds’ 1st Annual Report of the Asset Securitization Sector reveals the daily complexities that portfolio managers face. Discover how industry leaders address market volatility, appropriate diversification, and regulatory challenges.

Download the full report to uncover innovative strategies, practical solutions, and exclusive insights on portfolio management in the competitive financial world 2024. Will the 60/40 model remain relevant? Which collective investment vehicles will be most utilized? What is the expected evolution of ETFs? What factors should be considered when building a portfolio? among others.