State Street Ventures into the US Offshore Business

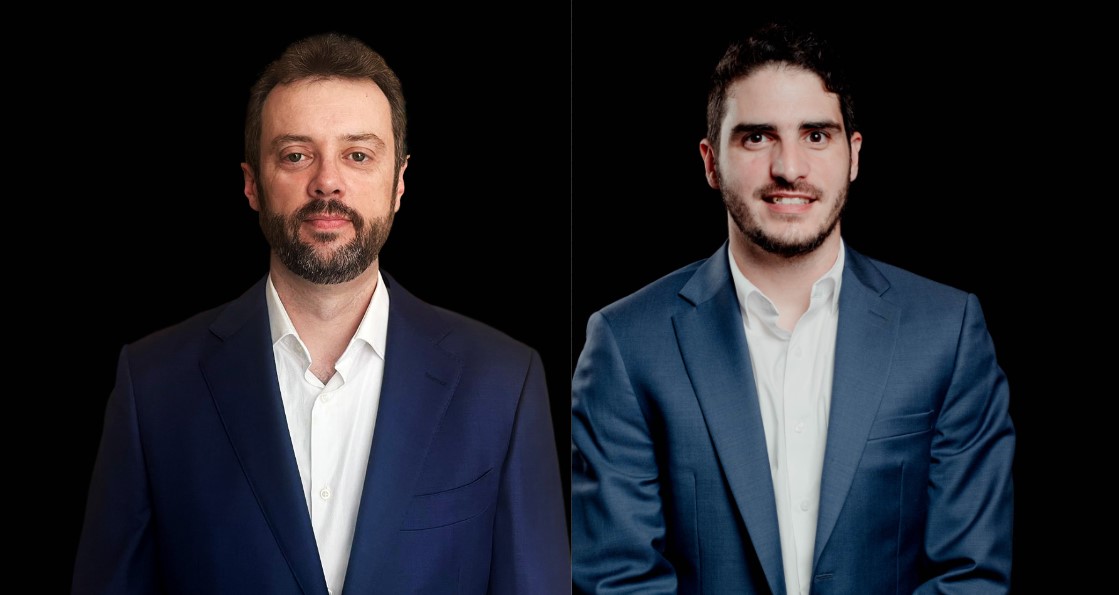

| By Marcelo Soba | 0 Comentarios

State Street has entered the US Offshore business after solidifying its position in Latin America. With approximately $10 billion in Mexico and a presence of $7 billion in the Andean region, through Credicorp Capital, the ETF-specialized manager meets a growing demand from banks, Heinz Volquarts, Managing Director, Head of Americas International (Canada and Latam) of the firm, told Funds Society.

Volquarts highlighted that US Offshore “is a really new business” for the firm and that it emerged as a response to major financial entities in the U.S., which were inquiring about products for non-residents.

State Street spent the year 2023 laying the groundwork for the business to start a “proactive” strategy from 2024 onwards. For this, they have promoted Diana Donk as the person in charge of ETF sales for the US Offshore business.

Latin America

The executive reviewed the importance of the Americas market (excluding the U.S.) in terms of assets, highlighting Canada as the largest, followed by Mexico with about $10 billion, and then Chile, Peru, and Colombia, which together are close to $7 billion dollars.

Volquarts talked about the work they do alongside Credicorp Capital as a distributor and highlighted a synergy in the “sales effort and leadership vision”. The State Street team works in conjunction with the distributor: “we travel with them probably five or six times a year,” he explained.

Mexico, on the other hand, has a team in which Ian López is responsible for the business. They have around 83 products listed in the U.S. market that trade on the SIC of the Latin American nation. In addition, a list of 35 UCITS funds in the same country.

Regarding investor preferences, both in Mexico and US Offshore, the expert said that accumulation classes are the most requested strategies, however, not all State Street products are of these characteristics.

Consequently, Volquarts emphasized that if there is demand, they “could launch a new accumulation class in Mexico” and commented that a very effective way to expose oneself to the S&P 500 with UCITS is through the SPYL (TER=3bps) with State Street’s accumulation classes.

Regarding Chile, he said that UCITS are no longer the market’s biggest concern. While it is a very new regulation, the new double taxation treaty with the U.S. allows “to use U.S. products,” thus opening up a “more attractive” proposal, he argued.

Meanwhile, in Colombia and Peru, the opportunity for UCITS is more latent. In the Caribbean country, about 80% of the assets are housed in sectorial ETFs. In an election year in many influential countries such as Mexico, the U.S., India, and Russia, to name a few, investors “look for ways to position themselves depending on the market.”

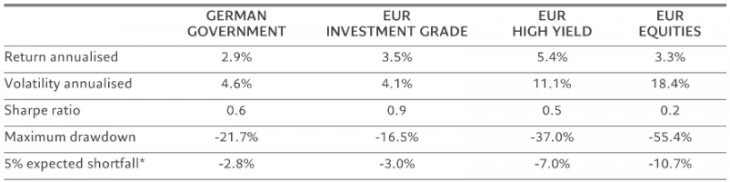

State Street is a manager heavily skewed towards equity ETFs given the enormous relevance of the SPDR ETF and all products related to the S&P500. Latin America follows the same pattern, and 90% of its assets are in equity ETFs, compared to 10% in fixed-income ETFs.

Finally, the Managing Director, Head of Americas International (Canada and Latam) of the firm highlighted “the success they have had with ESG strategies”. For example, one of their products, EFIV, has reached $1 billion in assets. Volquarts estimated that 70% has been sold to pension funds in Latin America, mainly in Chile, Colombia, and Mexico.