The New Popular Front Surprises in the French Legislative Elections: The Deficit Remains a Focus for the Markets

| By Amaya Uriarte | 0 Comentarios

The left-wing coalition, New Popular Front, unexpectedly won the second round of the French legislative elections, and instead of clearing up the market uncertainties triggered by President Emmanuel Macron’s call for elections, it has refocused investors’ concerns on France’s fiscal deficit and its impact on financial markets.

Mark Haefele, Chief Investment Officer at UBS Global Wealth Management, sees three potential outcomes. Firstly, a technocratic government, composed of technical experts rather than politicians. However, he considers this scenario unlikely. The second scenario points to a government formed by moderate parties (Socialist Party and Together for the Republic, the coalition of President Emmanuel Macron’s allied parties). This option also seems to have limited prospects. Haefele notes that under Article 12 of the French Constitution, the President of the Republic can only dissolve the Assembly again within a 12-month period.

A third option could be Macron appointing a prime minister from the party with the most seats in the National Assembly, which, after Sunday’s elections, is the New Popular Front (NFP). While it is customary for the president to appoint a prime minister from the majority party, there is no legal obligation to do so. A confirmation vote in parliament is not required, but in practice, the prime minister needs the support of the majority due to the parliament’s power to overthrow the government with a vote of no confidence.

This option, however, will have economic consequences. In Haefele’s opinion, “an NFP government would likely attempt to roll back recent pension and unemployment reforms, increase the minimum wage, and not pursue fiscal consolidation. We believe that the NFP’s program, if implemented as proposed, could lead to a significant deterioration of the already high budget deficit.”

The election results will undoubtedly impact the markets. Haefele assures that “an indecisive parliament is probably the best scenario for European equities,” and given that European stock indices barely changed in early trading, “it suggests that the outcome was not surprising.”

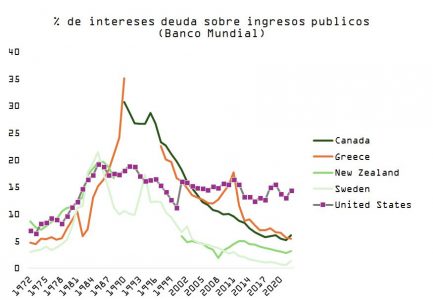

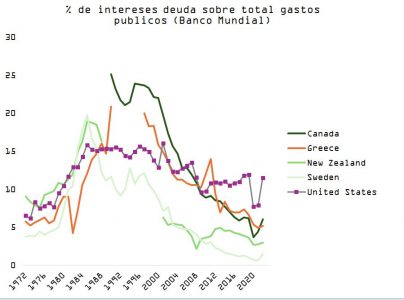

However, he considers this the best result of the second round, adding, “volatility may remain high”: political uncertainty remains elevated in France, and the elections have heightened focus on France’s precarious debt situation, with high levels of public debt and budget deficits, according to the expert. Therefore, he expects a certain political risk premium to persist compared to a month ago, and that the market rally will be limited to the very short term, “as foreign investors are likely to continue viewing Europe’s political backdrop as uncertain.”

In fixed income, UBS clarifies that due to possible political paralysis, limited visibility on political/regulatory decisions, and the potential for new negative ratings actions on French sovereign debt, “volatility in French assets will remain high.” Therefore, with limited upside potential in French bonds, the firm sees better opportunities in countries with more stable debt trajectories.

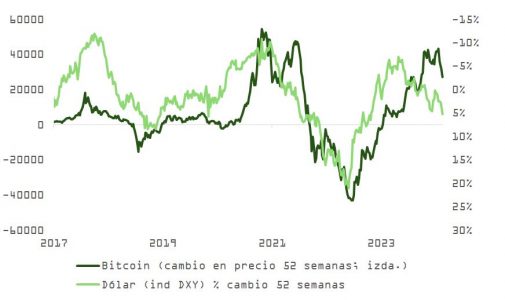

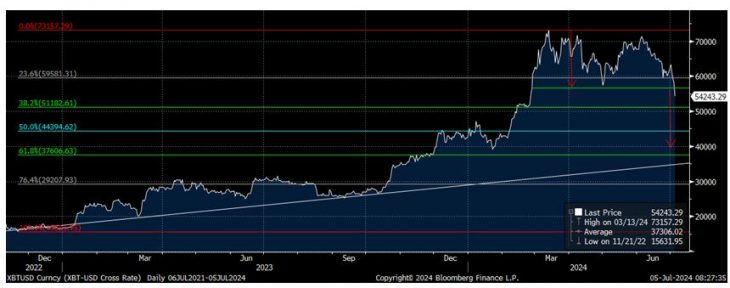

In currencies, Haefele notes that the impact on the euro is likely to be limited but also sees nuances. If the left forms a government and implements its strategy, “the euro/dollar exchange rate is likely to fall below 1.05, given the expansive fiscal implications of the party’s manifesto at a time when France is likely to face an Excessive Deficit Procedure.” If a government composed of moderate parties is formed, the euro should remain close to 1.08, in his opinion.

According to Alex Everett, Investment Manager at abrdn, the election result “has brought some relief in France” in the eyes of the markets, as Marine Le Pen’s National Rally “convincingly lost its coveted absolute majority,” but he notes that the surprising result of the left-wing coalition “leaves a complicated power struggle” in the country. “Now that a parliament without a majority seems very likely, markets can take comfort in this ‘less bad’ outcome. All things being equal, a significant increase in French debt is not expected. Compromise politics implies few changes from now on, smoothing the excesses of any party,” says Everett.

However, the expert acknowledges that “once the dust settles, the stalemate of a divided parliament will prove more damaging than initially thought.” At this point, he points to France’s budgetary problems, which have not disappeared: “The September 20 deadline to present a credible deficit reduction plan is approaching. Macron’s attempt to force unity has further fueled discord. We are skeptical about achieving significant budgetary progress and continue to underweight France compared to its European counterparts,” he asserts.

Peter Goves, Head of Developed Markets Sovereign Debt Analysis at MFS Investment Management, is clear about the French legislative election results: “Divided politics, less political visibility, and more mid-term uncertainties.” In the short term, “a ‘rainbow coalition’ or a ‘caretaker government’ are feasible. Certainly, it’s not the most politically acceptable outcome, but it’s also not the least favorable for the market,” he asserts, maintaining his short-term range of 70-90 basis points for the spreads between French and German bonds. Behind these market doubts are “relations with the EU, which may be far from benign, especially in an EDP context,” and he advises selling on the upticks in spreads.

For his part, Kaspar Koechli, Economist at Julius Baer, also observes that the absence of an absolute majority from the far right or far left in the National Assembly “keeps fears about the implementation of spending-driven fiscal policy changes limited and practically unchanged since the first round.” However, he is aware that the fixed income market may remain somewhat uneasy about a potential left-wing government, “which might lean more towards spending and question fiscal consolidation efforts in its next budget project for 2025, necessary for the resumption of the EU Stability and Growth Pact.”

With ongoing political uncertainty and an unclear timeline for forming a new government, “we are likely to see a breakdown of the recent tightening of spreads that occurred after the first round last Sunday, following the shock of the announcement of early elections that caused a spread rally,” according to Koechli. Moreover, he notes that while the euro has remained range-bound, “it is awaiting more clarity and is likely vulnerable to news from the French fiscal front.”

“In the long term, the events of recent weeks are problematic from an EU perspective. A strong EU needs a strong France almost as much as a strong Germany. With an increasingly unclear political situation in both countries, the EU project will need a new push. As a desk, the general opinion was to reduce exposure to French assets when President Macron announced his early elections, reflecting increased uncertainty. With the French elections nearing their end, the consensus is more inclined towards identifying investment opportunities. However, our bias towards globally relevant companies rather than those more focused on the domestic sphere will remain a feature of our thinking,” adds Jamie Ross, Portfolio Manager at Janus Henderson.

For now, the market reaction has been mixed, given the prevailing uncertainty. “The 10-year OAT-Bund spread is slightly narrower at 65 basis points. French and European equities opened the week positive (around +0.5% late morning); and the euro opened slightly lower but has already recovered those losses (EUR/USD at 1.0840),” highlights Vincent Chaigneau, Head of Research at Generali AM, part of the Generali Investments ecosystem.