Alternative Assets: Can Latin America Learn From European Experience?

| By Javiera Donoso | 0 Comentarios

This year, the Chilean market received the long-awaited news that the Central Bank has finally decided to raise the investment limits for Chilean pension fund managers (AFPs) investing in alternative assets. This decision is in line with the global trend of sustained growth and interest in this asset type, being an important contributor to both diversification and positive returns for fund managers worldwide, whether they are state entities, pension funds or private managers.

Given its variety of sub-assets and sectors, its relatively short existence compared to liquid assets, and its rapid growth and evolution, the growth of the alternative assets fund industry undoubtedly presents numerous difficulties, challenges and opportunities for all its stakeholders: managers, investors, companies, regulators, legal advisors, consultants, etc. One example is the range of topics we see discussed at various levels on a daily basis: valuation, reporting, liquidity, sustainability and ESG, secondary markets, government participation, distribution and democratization, to name a few.

US as key influence to date

However, in this article we want to focus on a longer-standing question, which cuts across this entire booming industry, both in Chile and the rest of Latin America, and relates to the ideological inspiration behind it. To put it simply: where should we look for references, solutions and innovations?

Readers will no doubt agree that the initial reflex response is: to the north, particularly to the US. Perhaps it is enough to look at Chile’s vigorous venture capital industry, with its recent explosion and growth, which seems to be the clearest example of this Anglo-Saxon inclination. Cliff, Vesting, Reverse Vesting, Safe, Convertible Notes, Preferred Shares, Pre-Money, Post-Money, Seeds, Flip and many others, are all terms that have made their way into our business and legal world. From California and Delaware, straight into our contracts and the structuring of our companies, passing through the not inconsiderable obstacles of our legal system, our language and – even – the scrutiny of our public bodies.

These regions have so far dictated, and in a very decisive way, the development of this industry. Is there anything wrong with that? Not at all. Chile and Latin America have merely looked where the whole world looks: where the investors, transaction volume, knowhow, specialists and latest trends are, and where (until now) legal and institutional certainty have been.

Today’s circumstances prompt fresh scrutiny

However, it is healthy for any industry, especially one that has been developing for several years and has reached a certain level of maturity, as the alternative assets industry has, to have certain moments of introspection. Raising capital and investing (or advising or overseeing) are not the same today as they were ten, five or even two years ago.

In addition to the back and forth of macroeconomic cycles, there is an ever-growing list of global factors to consider. To highlight just a few, these include:

- political and geopolitical risks (both totally contained until very recently but now constantly changing and unpredictable);

- socio-economic evolutions (or regressions);

- the digital revolution and artificial intelligence in their wide-ranging (and even incommensurable) manifestations;

- the diverse economic and social after-effects of the pandemic;

- citizen empowerment;

- accountability and criticism of public institutions; and

- various industry sector and regulatory trends in different fields.

In short, there is today a level of uncertainty and fragility that western economies have not experienced for several decades and that we probably believed had been consigned to history and the previous century.

For all these reasons, it is absolutely essential for a mature industry to constantly ask itself where it can find the material and intellectual resources to continue growing in a sustained manner.

Latin America’s close cultural and legal links with continental Europe

A truism to make the point: Latin America is a heterogeneous region, a mix of different influences and cultures, which is impossible to reduce to just a handful of common characteristics to indicate that we are or are not a certain way. However, it is equally evident that there are at least two elements that are largely present throughout the continent and that are by no means negligible.

First, language and market “culture”. Whether it is Spanish or Portuguese, English is clearly not the predominant language, indeed it is sometimes less widely spoken than it should be and than we would like in professional contexts. Also, markets like ours are usually more accustomed to developing sustainable businesses over time, rather than US exponential-growth type companies. Second, the legal system: with a few exceptions, Latin America adopts a continental Europe style (civil law) legal system and not the common law.

Given that we mostly share our cultural and legal base with continental Europe, it seems paradoxical that we do not give it enough weight when seeking institutions, concepts, models and useful references for Latin American legal, economic and business realities.

Luxembourg as an example

Without going into detail, it has been a pleasant surprise to observe, for example, that Luxembourg, the largest investment fund center in the world after the US, bases its very diverse investment vehicles on exactly the same legal and economic institutions as our own region. Corporations, limited liability companies and limited partnerships (sociedades en comandita) are cornerstones of a jurisdiction where pension funds, severance funds, insurance companies, banks, other institutional investors, sovereign wealth funds, mutual fund and alternative fund managers, family offices and HNWI from all over the world come together to invest, in turn, in the most diverse parts of the planet.

Indeed, a substantial part of the Luxembourg investment fund industry is based on commercial laws, codes, administrative practice and – perhaps most importantly – economic-legal principles essentially similar to those of Chile and the rest of Latin America. UCITS, UCI II, SIFs, SICARs, RAIF, SPF, etc., may sound like utterly foreign and complex concepts, but they are nothing more than the regulatory wrapping beneath which lie the same companies that we have in each of our countries.

Leveraging European expertise for Latin American growth

For these reasons, and this is valid for the investment funds and alternative assets industry and also for our overall legal and economic reality, the problems to be solved and the possible solutions to be explored from a European perspective will often coincide with those of our region. Likewise, it is not unreasonable to argue that it should be possible to “import” these solutions in a much easier, more fluid and natural way than those brought from the Anglo world.

Further, in matters where Europe diverges from Latin America, Europe should still be seen as an important source of knowhow. In our opinion, these matters are mainly due to the communitarian character of the EU economy and the powerful impulse provided by the aggregation and direction of budgetary, monetary, human and intellectual resources that – so considered – make up the second largest world economy and have generated a regulatory vanguard in practically all the issues that are of interest to Latin America.

EU knowhow on topical regulatory issues for the alternative assets industry

Thus, ESG, data protection, cybersecurity, AML, corporate governance, public-private collaboration, Fintech, “passporting” of services and promotion of private equity and venture capital, are all topics that affect the alternative assets industry in various ways. For these topics and many more, there are EU Regulations, Directives, soft law, Guidelines, recommendations and – even more relevant – several years of implementation and development.

Practical lessons for Latin America

In particular, so much could easily be learned from the other side of the Atlantic regarding, for example:

- fund structuring (co-investments, parallel vehicles, feeders, masters, continuation funds, warehousing);

- strategies (private equity, debt, real estate, infrastructure, venture capital, crypto, etc.);

- relationships with investors (institutional, HNWI, retails);

- distribution, redemptions, liquidity and incentives for managers (carry);

- governance of the various vehicles (boards and intermediate committees);

- relationships with regulators and state agencies (impossible not to think of the CORFO programs in Chile and how the European Investment Fund, the European Investment Bank and the various national agencies do it);

- relationships with investee companies (transactions and financing at different levels and in different jurisdictions);

- distribution/marketing, investment and outreach at regional and global levels;

- impact funds;

- sustainability; and

- reporting.

Time to look more into Europe

In conclusion, if we add the last component (technical, regulatory and practical vanguard) to our first point (legal and cultural proximity), then looking more closely at Europe seems practically an imperative, rather than merely a suggestion. Is everything that is done and legislated in Europe good and a model to follow? Of course not, but even in matters that have not been handled in the best way there, the opportunity to “learn from trial and error” is available. The resources are there, we just have to take the time to use them.

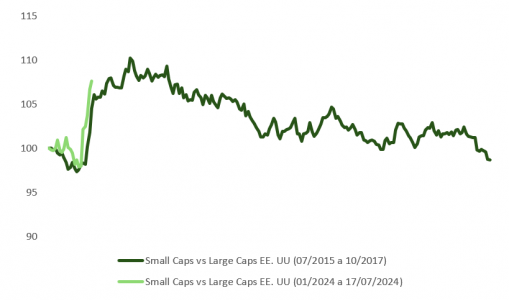

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.