New twist in the U.S. presidential race. Finally, Joe Biden, the current president and Democratic candidate, has announced his withdrawal from re-election, stating in a social media release, “in the interest of my party, the country, and my personal interest.”

In the same statement, Biden added, “Although my intention was to seek re-election, I believe that the best course for my party, the country, and myself is to withdraw and focus solely on fulfilling my duties as president for the remainder of my term.” While Biden has committed to addressing the nation in the coming days to provide more details about his decision, the big question now is who from the Democratic Party will challenge Trump. So far, Kamala Harris has confirmed her candidacy for the presidency, already receiving Biden’s explicit support.

In recent days, the pressure for Biden to make this decision had been mounting, but the doubts about his candidacy began with his performance in the debate against Trump. After the debate, Libby Cantrill, Head of Public Policy at PIMCO, explained that the decision to stay in the race was solely his, not the Democratic Party’s or the donors’.

“Biden currently controls 99% of the delegates, and what happens with those delegates is his decision. Of course, no candidate has withdrawn this late in the race. The party has planned its entire campaign around his candidacy, and it’s important to note that presenting a new candidate is incredibly complicated; there is no clear consensus alternative,” Cantrill said earlier this month. At that time, the PIMCO expert saw Biden’s withdrawal as “unlikely,” though he acknowledged that the chances were higher than before the debate. “If that outcome occurs, we believe an announcement will be made in the next week or two,” he noted. In this sense, Cantrill’s predictions have come true.

Another prediction gaining strength is that Trump will win the election. Just hours later, polls already show that his candidacy has been reinforced, as was the case after the assassination attempt he survived last week. For example, in a poll conducted by Bendixen & Amandi Inc., Kamala Harris has a one-point lead over Trump, surpassing him 42%-41%. However, according to a CNN and SSRS poll, the Republican candidate has 47% of the vote, while Harris has 45%, “a result within the margin of error suggesting no clear winner in such a scenario,” they explain.

The next step is clear: Democratic delegates will select a new candidate for the nomination just a few weeks before the Democratic Convention, in a race against time to garner the necessary support for the November elections. “So far, the only sure bet is Kamala Harris. Biden has expressed his support for the vice president, and she has accepted to take his place. Harris finds herself in a delicate position at a time when a Trump victory is being discounted. On the Republican side, Trump has proclaimed Ohio Senator J.D. Vance as the party’s vice-presidential candidate. Additionally, he announced some of his proposals, such as reducing the maximum corporate tax rate, imposing more tariffs, and keeping Powell as Fed chairman until the end of his term,” Banca March experts point out.

What Would Change

A clear change is that the scenario of a victorious Trump, explained by managers in their semi-annual outlooks, is gaining strength. For example, when Paul Diggle, chief economist at abrdn, addressed these scenarios, he pointed to one where Biden would win and three variants of a Trump presidency depending on the combination of policies.

In this sense, Diggle analyzed and measured the impact of Trump returning to the White House. “First, a Trump focused on the trade war, with a 30% probability. A divided Congress could see him pursuing those aspects of his agenda through executive order, drastically increasing tariffs. This would put upward pressure on inflation, lower growth, and slow or halt monetary easing,” he explained.

Secondly, Diggle contemplated, with a 15% probability, a scenario marked by an “all-out” Trump, combining trade measures with tax cuts and increased spending under a unified Congress. In his opinion, this would likely cause significant market volatility. And thirdly, “a market-friendly Trump focused on tax cuts, deregulation, and the appointment of establishment figures, with a 10% probability. The economy and risk markets could perform well,” Diggle pointed out.

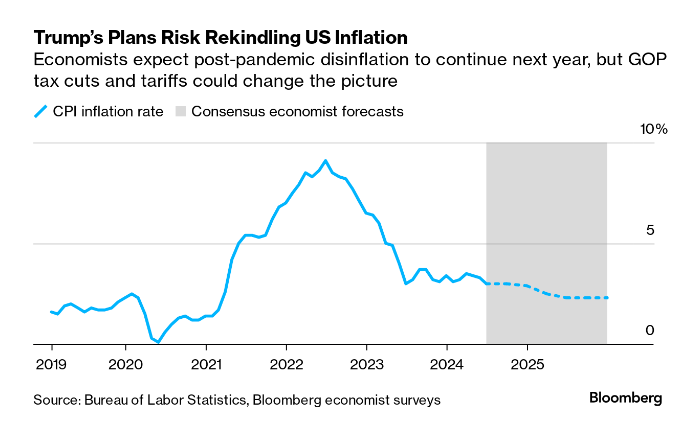

Another aspect currently under debate is whether a second Trump presidency would mean higher inflation now that it seems to be subsiding. “In our opinion, Trump’s policy mix would likely be more inflationary than a continuation of Biden’s policies, implying that in 2025 the Fed would apply fewer rate cuts in this case,” noted Claudio Wewel, currency strategist for J. Safra Sarasin Sustainable AM.

In the opinion of Michael Strobaek, Global CIO of Lombard Odier, a second Trump administration would be more inflationary. According to Strobaek, the U.S. currency might appreciate further as the dollar is likely to rise in anticipation of additional tax cuts in 2025, “America-first” import tariffs, and the possibility of stricter immigration policies restricting the labor market.

“These inflationary pressures would lead to higher long-term bond yields and a steeper U.S. yield curve. This is one of the reasons why we prefer German bunds to U.S. Treasury bonds while maintaining exposure to global fixed income at strategic levels. In equities, we continue to favor non-U.S. markets, where valuations and market concentration risks are lower. We maintain U.S. stocks at strategic levels,” adds Lombard Odier’s Global CIO.

As Bloomberg explained this Saturday, “while the Republican Party has been trying to blame Biden for residual inflation, it is Trump’s plans that could undo the hard-won progress of the Federal Reserve.” In this sense, they noted that “economists warn that his policies, another round of tax cuts that, according to Democrats, will go to the wealthy, widespread tariff hikes to trigger another trade war with China, and immigration restrictions that Republicans blocked earlier this year, will wreak havoc on global trade and reignite inflation.”

In fact, a group of 16 Nobel laureates signed a letter stating that Trump’s arrival would bring higher prices. “Many Americans are concerned about inflation, and there is a legitimate concern that Trump will reignite it due to his fiscally irresponsible budgets,” they said in the letter. Among the signatories are George A. Akerlof, Sir Angus Deaton, Claudia Goldin, Sir Oliver Hart, Eric S. Maskin, Daniel L. McFadden, Paul R. Milgrom, and Roger B. Myerson.

What Wouldn’t Change

While Biden’s decision gives the campaign a major twist, some macro aspects may remain unaffected, as one of the main theses experts have defended so far is that, in terms of monetary policy or public deficit, for example, the electoral outcome wouldn’t matter.

For example, Steve Ellis, Global CIO of Fixed Income at Fidelity International, recently explained that in the medium to long term, there are even greater problems for the Fed. “Regardless of whether Biden or Trump wins in the November elections, we will likely see more budget deficits added to an outstanding U.S. public debt that already hovers around $35 trillion. To continue financing this and attracting investors, either real interest rates remain relatively high, or real yields do. That will limit the interest rate easing the Fed can apply, and considering that around 40% of the notional volume of high-yield debt in circulation will have to be refinanced at significantly higher levels over the next three years, the pressure on the U.S. economy will increase.”

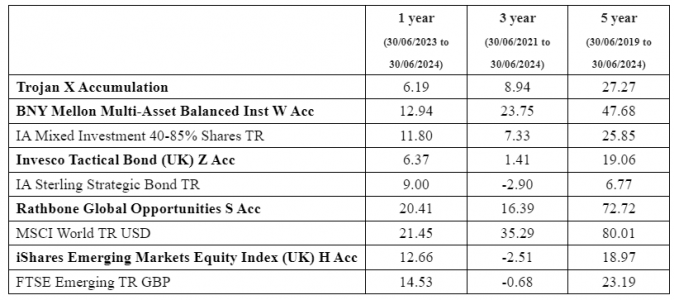

Experts have also focused heavily on analyzing market behavior during other election processes. “Equity markets tend to welcome a decisive victory for Republicans in the White House and Congress, but have generally reacted worse to Republican presidents without absolute majorities. While returns are usually positive in election years—albeit a bit weaker than usual—they can rebound strongly once the elections are over,” explained Erik L. Knutzen, Chief Investment Officer and Multi-Asset Director at Neuberger Berman, at the end of May.