Neither Recession, Nor Bear Market, Nor Hard Landing: It’s Just Volatility

| By Beatriz Zúñiga | 0 Comentarios

Markets are recovering. In this context of calm, investment firms insist that stock market volatility is normal, even though we had become accustomed to its absence.

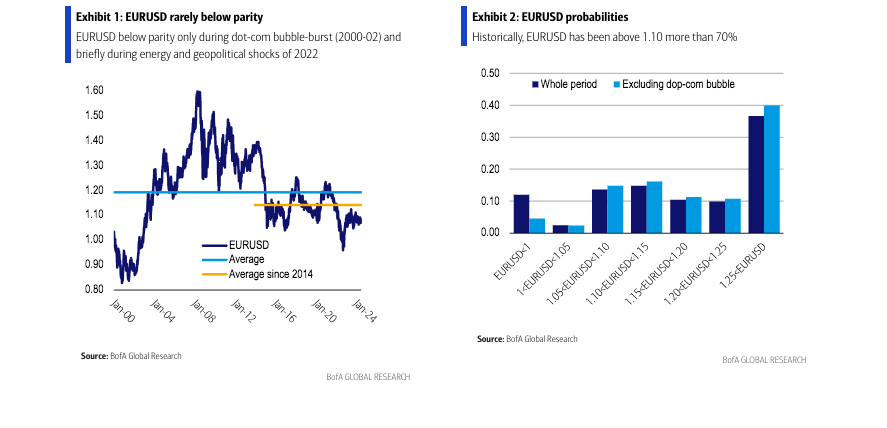

“The S&P 500 has retreated more than 8% since its peak on July 16, which is not unusual. In fact, we have seen 5% or more contractions occur on average three times per year since the 1930s. As for corrections of 10% or more, they have happened once a year, and indeed we are on schedule, as the last correction was in the fall of 2023,” Bank of America noted in its report yesterday.

According to the bank’s analysts, a full bear market (a drop of 20% or more), is unlikely: only 50% of the signals that historically preceded S&P 500 peaks have been triggered, compared to an average of 70% before previous market peaks. “Bear markets have historically occurred once every three to four years on average, and the last one was from January to October 2022. Despite growing recession concerns due to weaker economic data, our economists expect a soft landing, do not anticipate recession-sized rate cuts, and forecast the first cut in September,” they add.

Schroders echoes this message: sharp declines are not particularly unusual in equity markets. “In recent days, there has been a sharp sell-off in stocks, which has hit consensus and crowded trades hard. However, this should be seen in the context of exceptionally strong equity markets since October 2023 – by mid-July, the MSCI All-Country World Index had risen about 32% from its October lows – and a correction is perfectly healthy and normal,” reiterates Simon Webber, Head of Global Equities at Schroders.

Enguerrand Artaz, fund manager at La Financière de l’Echiquier (LFDE), shares this view, explaining that the correction occurred in the context of very bullish markets and large accumulations of speculative positions, including short positions on the yen. “The sudden liquidation of these positions, combined with traditionally more limited summer liquidity, likely amplified market movements,” he explains. And he adds: “The market capitulation of recent days seems particularly exacerbated, although some of the triggers should be taken seriously. Therefore, at this time, it seems important to adopt a cautious approach without overreacting to short-term movements.”

Moreover, for most asset managers, a soft landing in the U.S. remains the most plausible scenario. “Market anxiety is understandable, especially after the pace of economic growth slowed and price pressures experienced a widespread relaxation. We expect this trend to continue and its dynamics to moderate through the end of the year. This means that the risk of recession is increasing, but not to levels that concern us. It is unlikely that growth will plummet and economic fundamentals remain quite solid. Consumer and business finances appear quite healthy. Our working hypothesis remains a soft landing, with a 55% probability, and we manage a 30% probability of recession,” says Fidelity International’s Global Macroeconomics and Asset Allocation team.

“Looking at equity markets in general, we would say that investors have become more attentive to the condition of the U.S. economy and whether the Fed might be lagging in its interest rate strategy. In recent days, markets have adopted a risk-off mode, as investors worry about growth and employment. In such circumstances, areas of the market where investors’ funds are most concentrated tend to be the hardest hit,” conclude Shuntaro Takeuchi and Michael J. Oh, portfolio managers at Matthews Asia.

Central Banks’ Response

In this market event, we have seen old and new habits. Undoubtedly, “the old” is getting used to living with volatility again and “the new” is the strong intervention of central banks every time the market hiccups (a reality we have lived with for the past ten years). Evidence of the latter is that the tranquility of Asian markets has come from the Bank of Japan, whose deputy governor came out yesterday to announce that he will not raise interest rates further if markets are unstable.

According to Bloomberg, this reassured anxious investors. “The comments provided much-needed reassurance at a time when many are still worried that the yen carry trade reversal has further to go,” they note.

In the case of the Fed, the debate is whether it is taking too long to cut rates. “The problem is that in June the Fed only announced one rate cut this year. This was too aggressive and prevented it from acting quickly in July. The Fed could cut 50 basis points in September to make up for lost time. But the market is now pricing in five cuts in 2024, which is an overreaction,” explains George Brown, Senior U.S. Economist at Schroders.

Fidelity International experts expect the Fed to cut interest rates by 25 basis points in September and December. “In any case, we won’t know the severity of the risks emanating from financial markets until it’s too late, which could then justify a strong central bank response. That means we can’t rule out the possibility of more and bigger rate cuts (up to 50 bps) if financial conditions tighten further. The Fed could issue an official statement to quell the market’s most immediate concerns, stating that it is monitoring developments and ready to act if market turmoil begins to affect liquidity and monetary policy outlooks,” they argue.

According to the U.S. asset manager Muzinich & Co, it seems that the market is realizing two things. On the one hand, the Fed is behind in cutting interest rates, and the effects of its inaction this year are negatively impacting many sectors of the economy.

“Investors should expect a Fed reaction: at the time of writing, rate cut expectations stand at 50 basis points for September and November, and a 25 basis point cut in December,” they point out. Additionally, they note that “investor overexuberance and perhaps lack of attention to fundamental variables have led to excessive valuations in some sectors, especially in the stock market.”

Finally, Paolo Zanghieri, Senior Economist at Generali AM, part of the Generali Investments ecosystem, incorporates the eurozone scenario, as it was the first to publish its quarterly GDP. “Despite the persistent strength of inflation data, lower inflation expectations (based on the market) and fears of global growth have prompted a sharp revision of ECB rate cuts. At the time of writing, markets expect three more 25 basis point cuts this year (from the current 3.75%) and place the deposit rate at 2% by the end of 2025.

This pessimistic view implies a rapid return to the inflation target, something we only consider consistent with a recessionary evolution. We maintain our view of an official interest rate of 2.5% by the end of 2025,” he indicates.