The Investment in Alternatives by AFOREs Is Growing in Amount, but the Percentage Remains Unchanged

| By Amaya Uriarte | 0 Comentarios

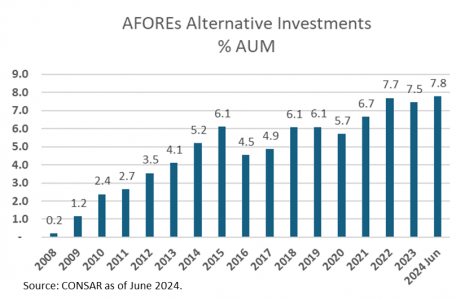

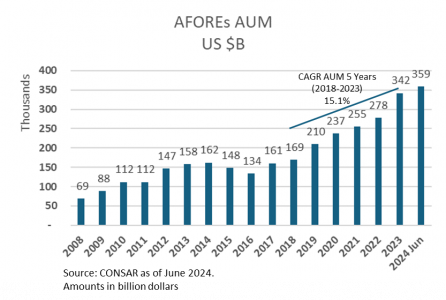

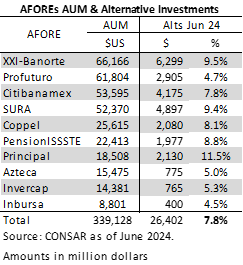

As the assets under management by AFOREs have increased, the resources allocated to alternative investments have also grown. However, the percentage these investments represent in the portfolio at market value remains low, not yet reaching double digits on average for all AFOREs, currently standing at just 7.8% of the $359 billion they manage (as of June 30). If commitments are considered, the percentage is higher, as only 58% of these commitments have been called.

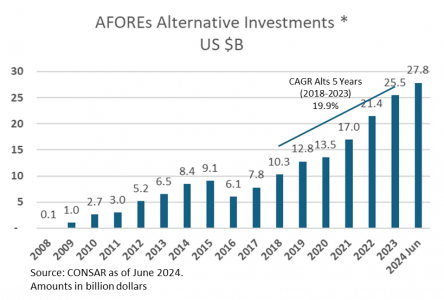

To reach this 7.8%, in nearly six years, there has only been a 1.7% increase relative to assets under management (from 6.1% in 2018 to 7.8% in June 2024) when comparing in dollars. This equates to an average annual increase of 0.28% over six years. However, when looking at the growth in assets and alternative investments, the amounts are significant.

Over the past three years, the weighted percentage of AFOREs’ investment in alternatives has stabilized between 7.5% and 7.8%, with some individual cases sometimes approaching or exceeding 10%, while others are slightly above 4%.

Investments in alternatives rose from $10.3 billion at the end of 2018 to $27.8 billion by June 2024, representing a 2.7 times increase relative to the percentage growth during this period.

The assets under management by the 10 AFOREs ended June at $359 billion. The compound annual growth rate (CAGR) over five years (2018-2023) is 15.1% in dollars, while alternative investments had a five-year CAGR of 19.9%, a slightly higher percentage than the growth in assets under management.

Investments in private equity funds have been channeled both into Mexico (56% at market value as of June 2024) and internationally (44%). Regarding investments in Mexico, according to information published by Dario Celis (El Heraldo de México on July 31), the AFOREs invested $805 million in 12 combined cycle plants and a wind farm that the government purchased from the Spanish company Iberdrola. This investment is close to the average growth rate over the past six years (0.22% investment in Iberdrola vs. 0.28% average growth over six years), representing a significant amount invested in Mexico.

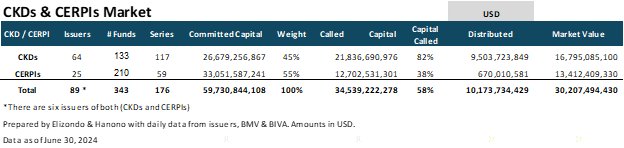

The market value of all alternative investments made in Mexico and internationally is $30.207 billion, according to public information from the 343 CKDs (133) and CERPIs (210) as of June 2024. Investments in Mexico made through CKDs represent 56%, while 44% is predominantly international since CERPIs invest at least 10% in Mexico.

The appetite for alternative investments by AFOREs is expected to increase as assets under management grow, and the percentage they represent is likely to approach the 9-10% range, which seems to be the level where AFOREs feel most comfortable.