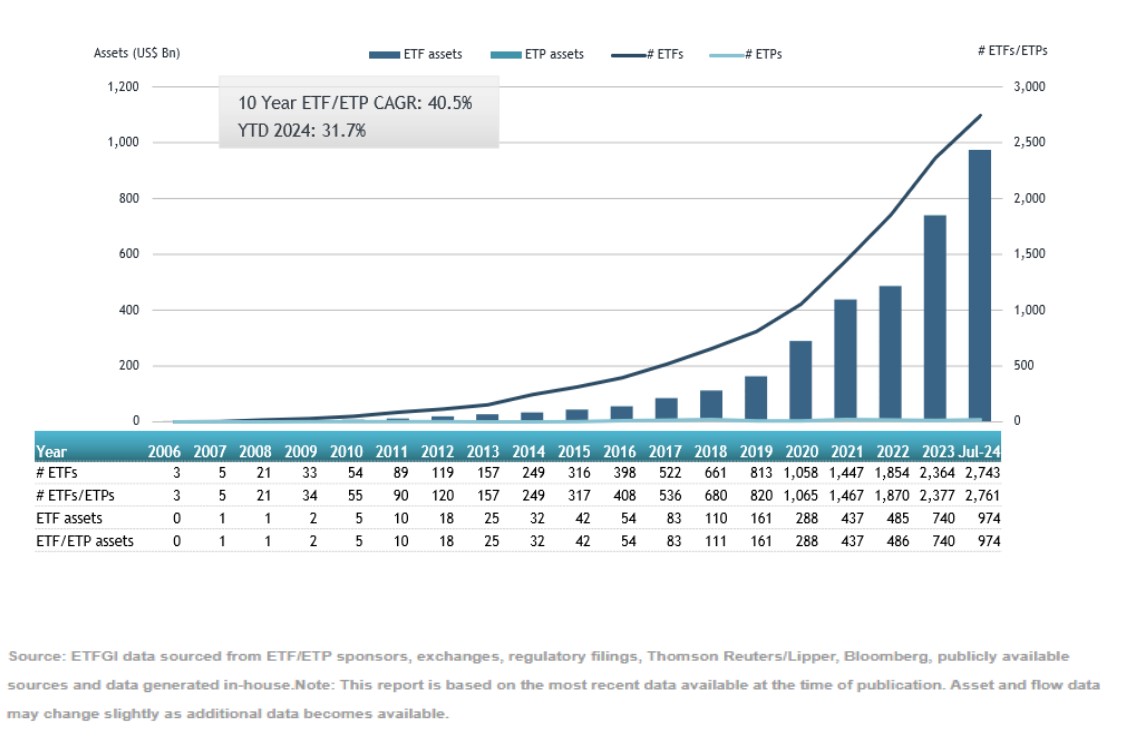

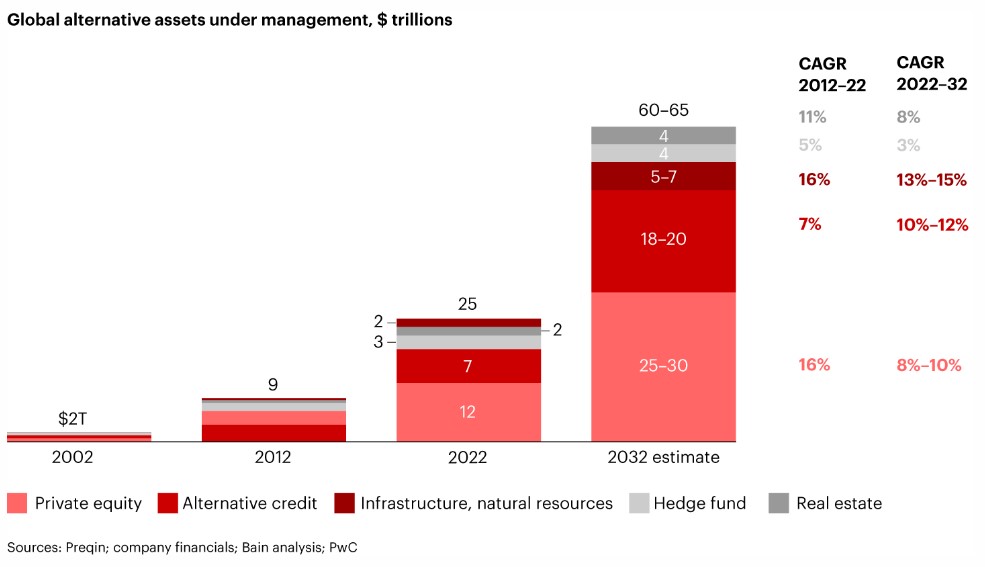

Many asset and wealth management firms have recently embraced private markets. Managers emphasizing the launch and distribution of alternative assets and products have been rewarded by investors with higher market capitalizations than most firms focusing on publicly traded assets (Chart 1). Although private markets are not the sole reason for the higher market capitalization, they play a significant role, according to a report by Bain & Company.

As highlighted by Preqin, one key aspect of Bain & Company’s report is that, following the surge in demand for these types of assets, the challenge now is not to “die from success.” “The stakes are high. The demand for alternatives is booming, and investors, particularly new entrants, are forming new brand and product preferences. But it’s not just about profit and growth. As Bain titled its report, it’s also about ‘avoiding collapse,’” states Grant Murgatroyd, Head of News at Preqin.

Chart 1: Asset managers focused on private markets have experienced strong growth in their market capitalization

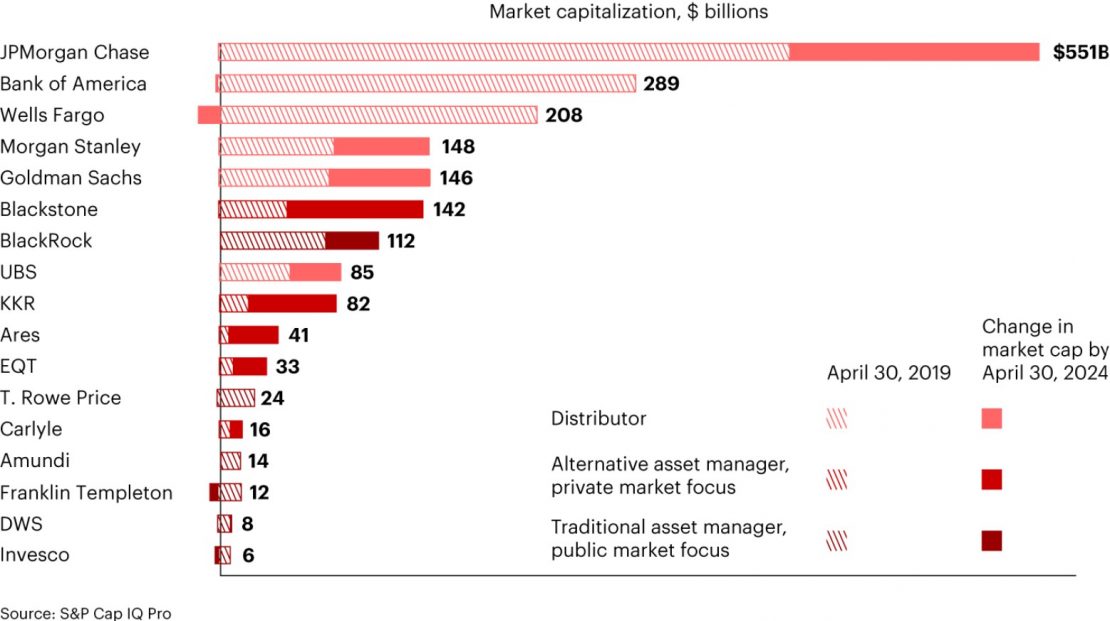

Private markets have gained popularity as the business models that have dominated asset management for years are nearly exhausted: margins have compressed, and average profit per assets under management (AUM) has dropped from 15 basis points in 2007 to eight basis points in 2022 (Chart 2). “Many firms have reduced management fees, leading to a 4% decline in average income from 2021 to 2022,” according to consulting firm Casey Quirk.

Chart 2: Asset management profitability has halved

Differentiation has also diminished: Bain & Company points out that data provider eVestment estimates low dispersion in returns (1% to 2%) and fees (4 to 6 basis points) in public equity investments among top- and bottom-quartile management firms. This decline has driven managers to opt for low-cost beta followers, and the share of passive investments is expected to rise.

According to Preqin, Bain’s analysis shows how traditional firms focusing on public markets have either maintained their value (Amundi) or lost ground (T. Rowe Price, Franklin Templeton, DWS, Invesco). “Asset managers focused on private markets have seen significant growth. Blackstone, KKR, Ares, EQT, and Carlyle have more than doubled their value,” they note.

The appeal of private markets

In this context, a promising business model emphasizing alternative private markets is beginning to emerge, but asset management firms will need to develop a range of new capabilities to secure their position in this new landscape.

Private assets represent a much larger market than public assets, offering potentially higher returns, diversification, and, in cases like real estate, an inflation hedge. In recent years, fewer companies have gone public, and global initial public offerings (IPOs) will decrease by 45% between 2021 and 2023 due to increased regulation and costs.

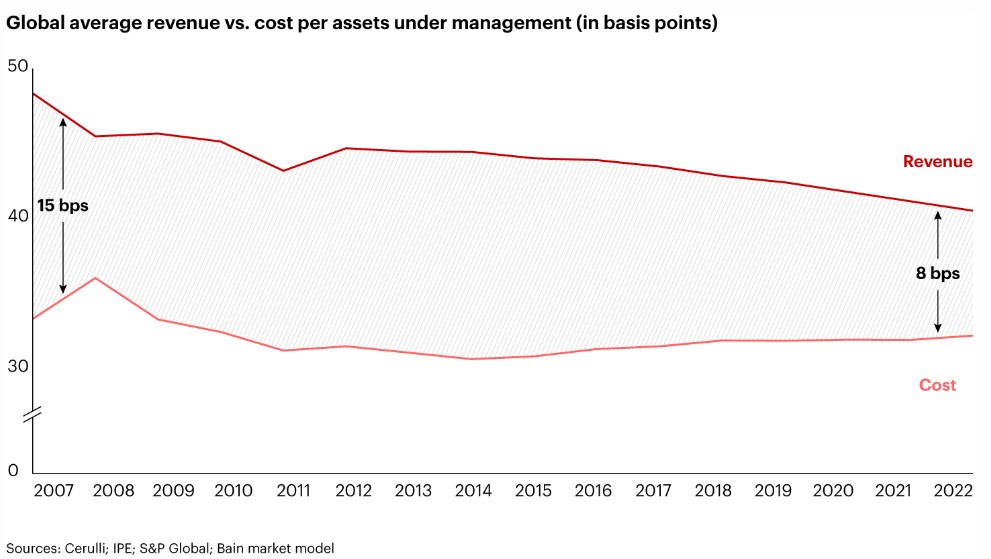

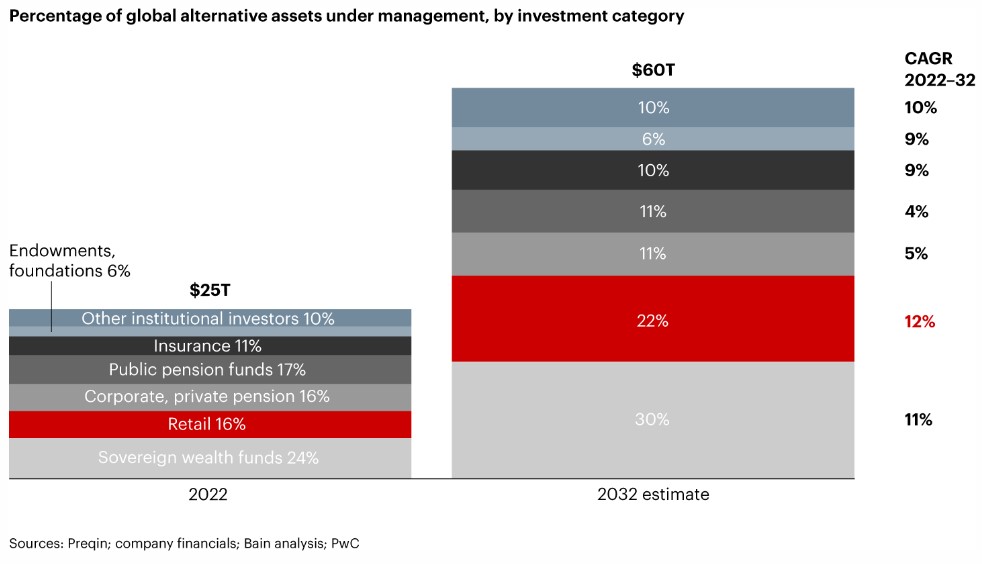

In contrast, “we estimate that private market AUM will grow at a compound annual growth rate (CAGR) of between 9% and 10%, bringing the value of these assets to between $60 trillion and $65 trillion by 2032, more than double the AUM of public markets (Chart 3). “By 2032, we expect private market assets to represent 30% of total AUM,” the firm states.

Chart 3: Alternative assets should continue to show strong growth

At the same time, fee income from private market investments, which reached $900 billion in 2022, is expected to double to $2 trillion by 2032. “Private equity and venture capital will remain the most important categories, while private credit and infrastructure investments will expand to the point of becoming significant asset classes.

Alternative credit has already grown at a 7% CAGR between 2012 and 2022, “and we expect it to grow at a 10%-12% CAGR by 2032,” Bain’s report states, noting that this accelerated pace “largely reflects the reduction in bank lending.”

The strong growth of infrastructure, with an average annual rate of 16% over the last decade, is expected to continue at a pace of 13%-15% over the next decade due to the shortage of public funds as the fiscal deficit grows.

Investor demand has also picked up, with institutional allocations to alternative assets expected to grow by 10% annually from 2022 to 2032, “pushing AUM to at least $60 trillion (Chart 4).”

Sovereign wealth funds, endowments, and insurance company funds are seeking higher returns due to the volatility of public markets and declining yields. Similarly, the increase in contributions from retail investors will push the proportion of AUM from these investors from 16% in 2022 to 22% by 2032, according to Bain’s report. “Individuals are drawn to the alternative asset market due to the prospects of diversification and higher returns, and they are willing to tolerate lower liquidity,” the study notes.

Chart 4: Retail investor participation in private assets is increasing

In response to this retail demand, some firms have launched innovative offerings, such as intermittent liquidity products characterized by periodic redemptions. Blackstone and KKR, for example, have launched private market funds with monthly or quarterly buyback frequencies, as noted in the study.

Recent moves in the chessboard

The share of traditional managers in alternative assets increased from 16% in 2018 to 22% in 2022, as firms sought diversification and better risk-adjusted returns. Some have made acquisitions to expand their product range, while others have expanded organically, like Fidelity, which launched 18 alternative products in 12 months. These firms are also extending their position in the wealth management value chain, such as BlackRock’s joint venture with Jio Financial Services in India to offer direct digital investment solutions through Jio’s local distribution network, according to Bain’s report.

Private banks and wealth managers have expanded to capitalize on client demand and generate higher fee income. Some firms are entering the retail market with their own products, while others have hired experienced advisors and wealth managers to target high-net-worth individuals.

Meanwhile, alternative asset managers and private equity firms have also expanded their portfolios of alternative assets. Others have attracted retail investors by offering evergreen products (with no fixed expiration date) following difficulties in raising funds from institutional clients and ensuring reliable fee income streams.

“In retrospect, we observe a convergence of strategies between traditional and alternative asset managers, with many preparing to become full-service providers across all asset classes, investor types, and positions in the value chain,” the report states, adding that this situation “will intensify competition in the market,” and it is likely that dominant firms will resort to two strategies:

1. Offering niche products that generate alpha, such as environmentally sustainable infrastructure products for ultra-high-net-worth individuals.

2. Developing large-scale alternative products, including vehicle creation and testing, distribution—including reach and conversion—or operational efficiency—including risk management and regulatory compliance.

The study reveals that many companies of all types have already started to follow one of these approaches, and some are using both to maximize their results.

What it takes to adapt

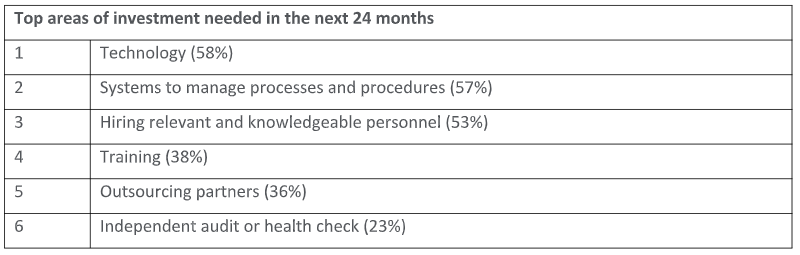

The transition of managers to private markets “poses significant challenges,” Bain notes, given the differences between retail and institutional investors. Companies will need to add or develop new capabilities around their technology systems, sales and marketing approaches, and investor education.

To fill gaps, some firms may turn to acquisitions, but many of them do not deliver the expected benefits due to cultural differences or ineffective integrations. And with a shortage of talent in certain areas, such as data science, recruiting and hiring enough people with the necessary skills can be difficult.

As companies consider how to expand into alternative assets, Bain believes firms should anticipate changes in the following areas:

1. Define where to play and how to win. It may seem obvious, but before making any moves, firms must know their starting point and ultimate ambition in private markets.

2. Develop new front-to-back-office capabilities. This can be achieved by training sales staff, incorporating product specialists, and redesigning operations, technology, risk, and legal processes. These activities will help bridge the gaps between, for example, a system for valuing private assets and one for public assets. A global insurance asset manager, for example, wanted to improve the performance of its private equity portfolio, which had been outsourced. After conducting a detailed portfolio review and competitive strategy study, the company developed new capabilities, carefully limiting changes to team structure and size. The new internal fund selection capability resulted in a 400 basis point improvement in its internal rate of return.

3. Educate investors on the risks and liquidity of alternative assets. Management firms will need to communicate how investors can have sufficient liquidity and the ability to collateralize private assets, that minimum investments and onboarding are more accessible than commonly perceived, and that reporting and tax filing processes have become more streamlined.

4. Adapt sales and marketing. New digital platforms and other distribution channels will be needed to raise brand awareness, attract funds, and offer a broader range of assets. Companies will need to hire and train sales representatives skilled at building relationships with wealth managers and explaining complex products to retail clients. A financial services company was experiencing a decline in revenue, AUM, and client numbers due to stagnant sales team productivity. A new training program and performance metrics for advisors doubled client acquisition and increased new AUM per advisor by 70%.

5. Improve merger and acquisition integration skills to combine talent, culture, and operations. Private market activity has accelerated since 2020, with more than 40 transactions in each of the past three years. More recently, traditional investment firms have announced some notable acquisitions and partnerships, such as BlackRock’s purchase of Global Infrastructure Partners.

According to Bain’s report, during this period of transition in which demand for private market assets is rising, retail investors are still forming their preferences for brands and products. “Regardless of their current market position, companies have the opportunity to shift their focus and expand their offerings if they

can develop the right capabilities, systems, and talent mix to capture that demand,” the study concludes.